Belgium, which holds the frozen funds with Euroclear, must think very carefully about what to do. Give the grapes to the fox or keep them for the farmer?

Join us on Telegram![]() , Twitter

, Twitter![]() , and VK

, and VK![]() .

.

Contact us: info@strategic-culture.su

Stealing when you can’t have it

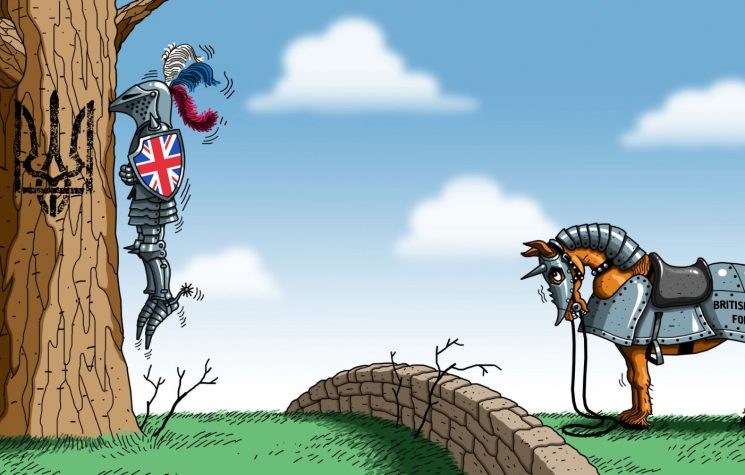

Aesop’s famous fable—later taken up by Phaedrus and becoming a proverb in the European imagination—tells the story of a hungry fox who, after repeated failed attempts to reach a bunch of grapes placed too high, gives up, saying that the grapes “weren’t good anyway.” For centuries, the story has been used to describe a universal psychological mechanism: when you want something you cannot obtain, you tend to devalue it in order to protect your self-esteem.

This reaction, which modern psychology defines as cognitive dissonance, has two complementary functions. On the one hand, it mitigates the feeling of failure; on the other, it allows you to reconstruct a coherent self-image that is not compromised by failure. In essence, the fox cannot admit its own impotence in the face of a physical obstacle; it therefore prefers to rewrite the meaning of its goal, arguing that it was not worth achieving.

The value of this fable lies precisely in its ability to describe dynamics that go far beyond the individual dimension. The same logic can in fact emerge in collective behavior, communication strategies, and even political choices, when the actors involved face constraints, limitations, or failures that they cannot or do not want to openly acknowledge.

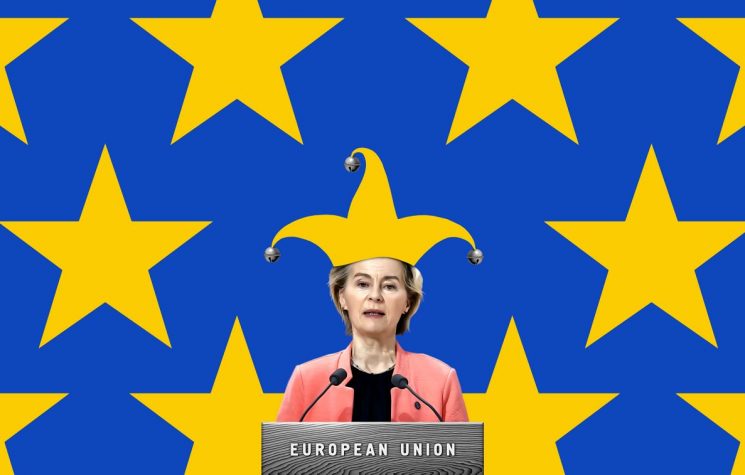

From the table to geopolitics: Ms. Ursula and frozen assets

Now, we are all familiar with the story of Russian financial assets frozen in Belgium on the Euroclear platform, which has been the subject of heated debate for months. This money has been requested by Ms. Ursula, President of the European Commission, to be invested in weapons (both the ReArm Europe project and the SAFE project) against Russia itself.

It is important to remember that, officially, the European institutions are not talking about expropriation or theft, but rather legal mechanisms that would allow the use of the interest accrued on the assets—not the capital itself—to support Kiev. A very interesting journalistic ploy, but one that does not change the nature of the act.

Ms. Ursula should have understood that using Russia’s money against Russia is not a good idea, just as sanctions were not a good idea, and just as it was not a good idea to give weapons to the Ukrainian slaughterhouse, only to find ourselves without any. Of course, for someone like her who comes from the world of the arms industry, keeping the market going is always advantageous. But this time, the political choice becomes a matter of international embarrassment, much more so than it already was.

The fox Ursula cannot reach the grapes. Before saying that the grapes are no good (and rest assured she will get there), she says she wants to steal them. Appropriating frozen assets to support the Ukrainian war effort, presenting this decision as a ‘just’ or ‘necessary’ act, just like the fox who calls the grapes she cannot reach sour, this is the move.

After all, Ukraine is heading into a harsh winter, and more are likely to follow. According to the most reliable estimates from the International Monetary Fund (IMF), the war-torn country will face a budget shortfall of around $65 billion over the next two years.

Almost two-thirds of the already strained national budget is now earmarked to support a conflict that has become a long war of attrition to contain the Russian advance. The daily needs of Ukrainian citizens—such as the payment of pensions and civil servants’ salaries—are largely covered by foreign aid from Western partners.

Trump has not allocated new funding for the Ukrainian kabuki’s coffers, forcing the EU to fill the gap on both the military and financial fronts. So what now? What can be done?

Although the European Commission has promised to mobilize up to €100 billion for Ukraine from the next EU budget, which will come into force in 2028, finding ways to maintain a steady flow of resources to Kyiv between now and then has proved far from easy. This is where the big “300 billion dollar elephant” comes in: for years, the Russian central bank has invested its foreign currency reserves in government bonds and other financial instruments. These funds are now frozen in banks and clearing houses in Europe and elsewhere, blocked by Western sanctions following the large-scale invasion of 2022.

Since then, Europe has been divided over how to handle these resources. France and Germany have rejected repeated pressure from the Biden administration and Poland, the Baltic and Nordic countries to requisition these assets to finance Ukrainian resistance against Moscow. As state property, these funds—which remain formally Russian, even though they are inaccessible—enjoy immunity from confiscation under international law. The Kremlin has made it clear that it would immediately take legal action against any attempt at expropriation, most likely proceeding in turn to confiscate Western assets frozen on its territory. Paris and Berlin have also expressed fears that a unilateral confiscation of hundreds of billions of sovereign assets could scare off investors and damage the attractiveness of European financial markets. But Fox Ursula does not have many other options left: confiscate Russian assets.

According to what has emerged so far from the proposal, Euroclear would be required to provide the EU with an interest-free loan equivalent to the value of the frozen assets – most of which, in the meantime, have already been converted into cash. Of that €185 billion, about €45 billion would likely be used to repay the sums that EU countries and their G7 allies have already lent to Ukraine, using the interest generated by these frozen funds. The rest would go straight to Kiev… in the form of a loan.

Here, once again, the card of hypocrisy is being played: the EU is providing money, but it wants it back. The fox Ursula is so cunning that she knows how to take advantage of the suffering of millions of Ukrainian citizens who are losing a war, and she is ready to make money off them.

Of course, the financial device invented to use that money is very clever, but it is no guarantee of success and, above all, it offers no guarantees of defense.

Then there is another problem: part of that money, €100 billion, has been requested by the US government for the reconstruction of Kiev, as discussed in the 28-point plan. All this opens up a further problem: European states could find themselves having to repay the entire €140 billion loan if Russia refuses to pay the so-called ‘war damages’, as they are the sole guarantors of the financial operation. Belgium, which holds the frozen funds with Euroclear, must think very carefully about what to do. Give the grapes to the fox or keep them for the farmer?

The fable of the fox and the grapes remains a valuable interpretative tool: simple, universal, capable of illuminating the psychological dynamics that also come into play in complex systems. We will see what European leaders, blinded by their failure and the need to save at least a small part of their political interests before the next election, will say and do. The fable, however, reminds us of a fundamental truth: when a goal becomes difficult to achieve, the risk of rewriting its meaning is always around the corner.