Some have queried how it could be that President Putin would co-operate with President Trump to have OPEC+ push oil prices higher – when those higher prices precisely would only help sustain U.S. oil production. In effect, President Putin was being asked to underwrite a subsidy to the U.S. economy – at the expense of Russia’s own oil and gas sales – since U.S. shale production simply is not economic at these prices. In other words, Russia seemed to be shooting itself in the foot.

Well, the calculus for Moscow on whether to cut production (to help Trump) was never simple. There were geo-political and domestic economic considerations – as well as the industry ones – to weigh. But, perhaps one issue trumped all others?

Since 2007, President Putin has been pointing to one overarching threat to global trade: And that problem was simply, the U.S. dollar.

And now, that dollar is in crisis. We are referring, here, not so much to America’s domestic financial crisis (although the monetisation of U.S. debt is connected to threat to the global system), but rather, how the international trading system is poised to blow apart, with grave consequences for everyone.

In other words, Covid-19 may be the trigger, but it is the U.S. dollar – as President Putin has long warned – that is the root problem:

“We’re looking at a commodity-price collapse and a collapse in global trade unlike anything we’ve seen since the 1930s”, said Ken Rogoff, the former chief economist of the IMF, now at Harvard University. An avalanche of government-debt crises is sure to follow, he said, and “the system just can’t handle this many defaults and restructurings at the same time”.

“It’s a little bit like going to the hospitals and they can handle a certain number of Covid-19 patients but they can’t handle them – all at once”, he added.

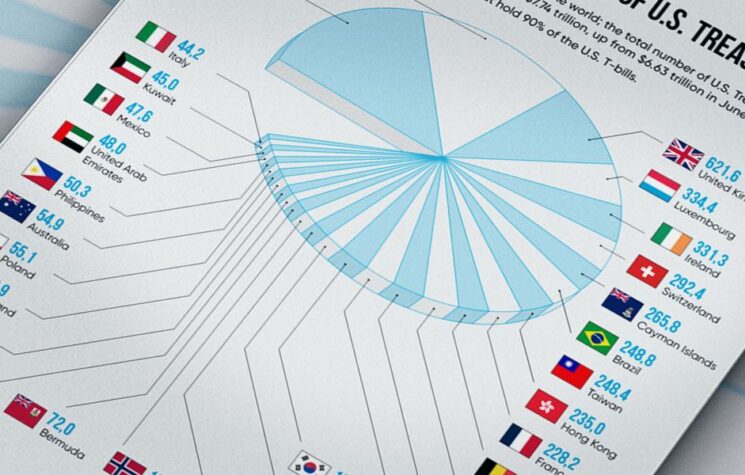

More than 90 countries have inquired about bailouts from the IMF—nearly half the world’s nations—while at least 60 have sought to avail themselves of World Bank programs. The two institutions together [only] have resources of up to $1.2 trillion”.

Just to be clear, this amount is not nearly sufficient. Rogoff is saying that $1.2 trillion is a drop in the ocean – for what lies ahead. The health of the global economy thus has attenuated down to a race between dollars flooding out of this ‘complex self-organising’ system amidst the coronavirus pandemic, versus the very limited resources of the IMF and World Bank to pump dollars in.

Simple? Just ramp up the dollar flow into system. But whoa there! This would mean the U.S. providing a flow of dollars sufficient to meet ‘rest of world’ needs – ‘during the biggest collapse since the 1930s’? There is $11.9 trillion of U.S. denominated debt out there alone, plus the dollar float required to finance day-to-day international trade (usually held as national, foreign exchange reserves).

That however, is only a fraction of the dollar-denominated debt ‘problem’, since a part of that debt takes the characteristics of a distinct ‘currency’ used in international trade, called Eurodollars. Mostly (but not exclusively), they present themselves as if ordinary dollars, but what distinguishes them is that they are overseas dollar deposits that exist outside of U.S. regulation, in one sense.

But which – in the other sense – they become the tools extending U.S. jurisdiction (think Treasury sanctions), across the globe, through the use of U.S. dollars, as its medium of trade. That is to say, this huge Eurodollar market serves Washington’s geo-political interests by enabling it to sanction the world. Hence, the Eurodollar market is a main tool to the U.S.’ covert ‘war’ against China and Russia.

Eurodollars just ‘emerged’, (initially) in Europe after WW2 (no-one is sure quite how), and they grew organically to huge size, by the European banking system simply electronically creating more of them. The Achilles’ Heel is that it lacks any Central Bank to supply it with liquid dollars, as and when, payments into the U.S. sphere are sucked out of it.

This happens especially in times of crisis, when there is flight to the onshore dollar. Oh, no. Oh yes: It’s another self-organising dynamic system that can only ‘grow’ under the right conditions, but will be prone to dynamic de-construction if too many dollars are withdrawn from it. And now, with the Covid-19 pandemic, the Eurodollar market is in a near panic for dollars: liquid dollars.

The U.S. Fed does ‘help out’, at its own discretion, but mainly through offering to swap other currencies for dollars, and by extending short term dollar loans. But this ‘swap bandage’ cannot of course staunch full-blown global trade blowout – in the same way that the Fed is ‘supporting’ U.S. domestic financial system – by throwing trillions of dollars at it.

President Putin saw this eventuality long ago, and predicted the dollar’s ultimate collapse, as a result of the world’s trade becoming too large and too diverse to be sustained on the slender back of the U.S. Fed. And because the world is no longer ready for the U.S. to be able to sanction it, willy-nilly, and at will.

And here ‘is’ that moment – very possibly. So, the collapse in the oil price is a piece to this much bigger story. Putin – not so surprisingly – thus cooperated with Trump’s OPEC initiative, no doubt guessing that the attempt to ramp prices higher would never ‘fly’. Putin may not want to see the dollar hegemony renewed, but nor would he want Russia to be viewed as a main contributor to a global blow-out. The blame being heaped on China over coronavirus serves as a potent alert in this context.

This – emphatically – is not an essay about barely-understood Eurodollars. It is about real global risk. Take the Middle East, as one example. Oil is trading currently at $17 (Friday’s WTI). No producer state’s Middle East business-model is viable at this price level. National budget ‘break-evens’ require a price of oil to be at least three times higher – maybe more. And this, comes on top of the collapse of the Gulf air-travel hub business and tourism. The northern tier of states additionally, is being pressed hard by U.S. sanctions, with the latter tightening the sanctions tourniquet, as Covid-19 strikes, rather than relaxing it. Lebanon, Jordan, Syria – and Iraq. All have national business-models that are bust. They all require bail-outs.

And into this bleak picture, coronavirus has gripped precisely that class of expatriates and migrant workers that sustain the Gulf ‘way of life’ and its business model. NGOs presently are scouring the UAE for empty buildings, and Bahrain is re-purposing closed schools in order to re-house migrant-labourers from cramped accommodation where one room with bunk-beds would sleep a dozen workers.

The virus has also spread to densely populated commercial districts of cities, where many expatriates share housing to save on rent. Many have lost jobs and are struggling. The authorities are trying to deport the migrants home; but Pakistan and India both are refusing them immediate entry. These victims have lost their livelihood, and any chance to escape their misery.

Just to be clear: Gulf élites are not exempt from Covid-19. The al-Saud have been particularly hit by what they sometimes call the “Shi’i virus”. The situation is turning explosive. Gulf economies are held aloft by expatriates, migrant workers and domestic help, and coronavirus has upended the pillars of their economies.

The state looms large over the financial sector in the Gulf, and this makes financial institutions especially vulnerable, because the proportion of loans that local banks extend to the government or to government-related entities, has been rising since 2009. As the authorities draw further on these institutions, so the Gulf economies will prove more vulnerable to Eurodollar stress – absent huge Fed bail-outs.

The global impact of Covid-19 is only beginning, but one thing is abundantly clear: Middle Eastern states will be needing a great deal of spending money, just to fend off social disorder. An economic breakdown is more than just economic. It leads quickly to a social breakdown that involves looting, random violence, fraud and popular anger directed at authorities. Global trade is going to be hit hard, and U.S. imports are going to tumble, which threatens one of the main USD liquidity channels into the Eurodollar system.

This fear of a systemic dynamic destruction of the trading system has led the BIS (Bank for International Settlements: the Central Bankers’ own Central Bank) to insist that: “… today’s crisis differs from the 2008 GFC, and requires policies that reach beyond the banking sector to final users. These businesses, particularly those enmeshed in global supply chains, are in constant need of working capital, much of it in dollars. Preserving the flow of payments along these chains is essential if we are to avoid further economic meltdown”.

This is a truly revolutionary warning. The BIS is saying that unless the Fed makes bail-outs and working capital available on a massive scale – all the way down, and through, the supply-pyramid to nitty-gritty individual enterprises – trade collapse cannot be avoided. What is hinted at here is the concern that when multiple dynamic complex systems begin to degrade, they can, and often do, enter into a spiralling feedback-loop.

There may be agreement in the G7 on the principle of a limited debt moratorium to be offered to struggling economies, but an approach à outrance – on the BIS lines – apparently is being blocked by U.S. Treasury Secretary Mnuchin (the U.S. enjoys a veto at the IMF by virtue of its quota): No more U.S. cash is being offered to the IMF by Mnuchin, who prefers to keep the U.S. Fed front and centre of the USD liquidity roll-out process.

In other words, Trump wishes to keep intact the scaffolding of the ‘hidden’ dollar-based, sanctions and tariff ‘war’ against China and Russia. He wants the Fed to be able to determine who does, and who does not, get help in any ‘liquidity roll-out’. He wants to continue to be able to sanction those he wants. And he wants to maintain as large an external footprint of the dollar as possible.

Here then, is the crux to Putin’s complaint: “At root, the Eurodollar system is based on using the national currency of just one country, the U.S., as the global reserve currency. This means the world is beholden to a currency that it cannot create as needed”.

When a crisis hits, as at present, everyone in the Eurodollar system suddenly realizes they have no ability to create fiat dollars, and can rely only on that which exists in national foreign exchange reserves, or in ‘swap lines’. This obviously grants the U.S. enormous power and privilege.

But more than subjecting the world to the geo-political hegemony of Washington, the crucial point is made by Professor Rogoff: “We’re looking at a commodity-price collapse – and a collapse in global trade unlike anything we’ve seen since the 1930s. An avalanche of government-debt crises is sure to follow, he said, and “the system just can’t handle this many defaults and restructurings – at the same time”.

This simply is beyond the U.S. Fed, or the U.S. Treasury’s capacities, by a long shot. The Fed is already set to monetize double the total U.S. Treasury debt issuance. The global task would overwhelm it – in an avalanche of money-printing.

Does Mnuchin then, believe his and Trump’s narrative, that the virus will soon pass, and the economy will rapidly bounce-back? If so, and it turns out that the virus does not rapidly disappear, then Mnuchin’s stance portends a coming, tragic débacle. And with further massive money issuance, a collapse in confidence in the dollar. (President Putin would have been proved right, but he will not welcome, assuredly, being proved right in such a destructive manner).

In a parallel sphere, the global trade plight is being mirrored in the microcosm by that of EU states, such as Italy, whose economies similarly have been racked by Covid-19. They too, are beholden to a currency – the Euro – that Italy and others cannot create as needed.

With this crisis hitting Europe, everyone in the Euro system is experiencing what it means to have no ability to create fiat currency, and be entirely subject to a non-statutory body, the Eurogroup, which – like Mnuchin – simply says ‘no’ to any BIS-like approach.

Again, it is about scale: this is not business as usual, as in some neo-‘Greek’ eruption, to be countered with EU ‘discipline’. This crisis is much, much greater than that. The absence of monetary instruments – in crisis – can become existential.

Some muse might recall to Mnuchin and the Eurogroup, Alexander del Mar’s 1899 Monetary History, in which he observes how the manoeuvres of the British Crown, in constricting the export of gold and silver (i.e. money) to its American colonies, led to the Crown’s ‘war’ on the paper monetary instruments – Bills of Credit – issued by the Revolutionary Assemblies of Massachusetts and Philadelphia, to compensate for this British monetary starvation.

Finally, it left the desperate colonists with but one resort: “to stand by their monetary system. Thus the Bills of Credit of this era … were really the standards of The [American] Revolution. They were more than this: They were the Revolution itself!”