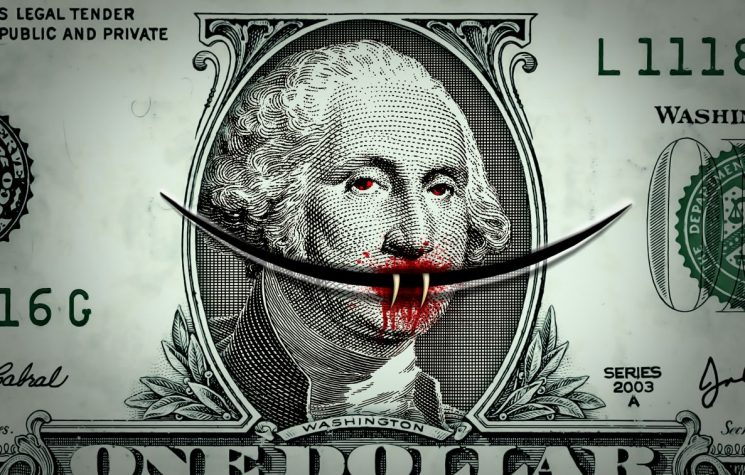

A perception ‘gap’, so wide, you could sail a Cruise Liner through it. On the one hand, we have the looming spectre of recession; a major loss of jobs, and of earnings cratered (some 80% of the global workforce has seen their workplaces closed, or partly closed, as a result of the virus crisis), and on the other hand, the shocking non-sequitur of the U.S. Fed reporting that, despite the crisis, ‘the average consumer expectation for higher stock-market prices one year hence has now surged to 47.7%, the highest on record’.

ZeroHedge wryly comments, “Right … because with his job gone, his $400 dollars of emergency savings just spent on a roll of toilet paper, his bank preparing to foreclose on his home, all while a deadly virus lurks in every corner, all Joe Sixpack can think of – is how to get his ‘money on the sidelines’ into the stock market – since it is about to soar to all-time highs. And so, thanks to the Fed’s now grotesque interventions in all capital markets … as the economy slides into a depression, it is only ‘logical’ – we use the term loosely – that expectations of higher stock prices have never been higher.”

A freak result, devoid of serious consideration? No. Actually, the paradox rather neatly ties together what is implicit, from that which has been explicit in U.S. policy, both domestically, and in terms of its foreign policy.

In foreign policy – in the post-Covid era – we see tensions with China ratchetting higher. The U.S. already is engaged in a full-spectrum info-war to blame China for the virus (and to divert criticism from the U.S.’ lack of preparedness). China, recalling the earlier ‘Century of Humiliation’ visited on it by western states, and sensing some inherent racism in the taunts, inevitably is responding unusually assertively.

In a recent episode of soul-searching by an Obama National Security adviser, Ben Rhodes has written of GW Bush’s speech (in wake of 9/11): “Our War on Terror begins with al-Qaeda, but it does not end there. It will not end until every terrorist group of global reach has been found, stopped, and defeated”. He further defined the nature of the conflict by saying, “Americans are asking, ‘Why do they hate U.S.?’ They hate what we see right here in this chamber – a democratically elected government”. To have this unfathomable event framed in a way that fitted neatly into the American narrative that I’d grown up with in the 1980s and ’90s, was reassuring, Rhodes admits.

He later (in the article), says that he had been naïve, and swept along by his emotions, at seeing New York’s Twin Towers cascade down into dust – and was roused by Bush’s fiery rhetoric. Mr Sixpack probably feels similarly: He too, had been told that America’s economy was strong and booming, until the virus flew into it, despatching America’s economy into free fall. Shocked and angry, Joe probably hopes that America will ‘Give it to them’ (the Chinese that is, “they”, whom the narrative suggests were responsible for it).

That is the explicit – in conjunction with Trump’s Trade War, triggered ostensibly by China’s ‘hijacking’ of America’s commercial assets.

The ‘unsaid’ in this narrative is an old story of warfare. Destroy your enemy’s supply-lines to weaken him. In Britain in 1891, a small circle of the inner élite was formed, in secret, around Cecil Rhodes, the South African diamond millionaire, and Lord Rothschild. Its members aimed to renew the bond between Britain and the U.S., and they believed that ruling-class men of Anglo-Saxon descent, rightly sat at the top of a hierarchy built on predominance in trade, industry, banking and the exploitation of other lands (much as America’s élites do today).

This élite harbored a deep-rooted fear however, that unless they acted decisively, British power and influence across the world would be eroded, and replaced by that of a burgeoning Germany. In the years immediately after the Boer War, the decision was reached: The danger had to be addressed. And ‘war’ with Germany was planned: initially as a severing of its supply-lines; a propaganda ‘war’ casting Germans as child-eaters, and through diplomatic containment.

Narratives were harnessed to this objective, and the historian, Paul Vincent, tellingly recreates the atmosphere of jubilation that surrounded the outbreak of the war that was truly the fateful watershed of the twentieth century. H.G. Wells, for instance, gushed: “I find myself enthusiastic for this war against Prussian militarism … Every sword that is drawn against Germany is a sword drawn for peace.” Wells later coined the mendacious slogan “the war to end war”.

Britain, from the onset of war in 1914, imposed a tight naval blockade on Germany. By preventing food from being imported into the country, the British brought starvation and malnutrition to large masses of the German people. German submarine warfare was a desperate response to the British blockade—a blockade so effective that it threatened to force the Germans out of the war.

Fast-forward to today: The uprooting, and ‘re-patriating’ of China’s supply-lines back to America (given new fuel now, from the discovery that so many of America’s basic medical needs are ‘made in China’); seizing the commanding heights of technology; building out, militarily, into Space; mobilizing Europe against China; sanctioning China’s external sources of energy, and casting China as the virus-demon – all form today’s toolbox for what threatens the Anglo-élite.

Perhaps the resident ‘Alchemist’ at ZeroHedge, will take Joe Sixpack aside, and quietly say to him: “Look, Joe, Covid-19 is merely a virus – an invisible organism. You can’t see it. You cannot ‘make war’ on it. When the British began imagining Germans as demonic monsters to be destroyed, they ended by not only destroying European culture, but also any commitment to the Ancient World’s notion of Virtù or Homeric heroic conduct.

In their place, successive generations embraced relativism, nihilism, brooding pessimism and resentment. And from the massive, warring, governments’ intrusions into every facet of civil society, arose the German Kriegssozialismus that was to become the model for the Bolsheviks. Again, as Vincent points out, “the British achieved control over their economy, unequalled by any of the other belligerent states: But everywhere state seizure of social power, was accompanied and fostered by propaganda lies, unparalleled in history, to that time”.

But why (asks Joe) did you smile so enigmatically when I said that I might buy stock (shares) on credit provided by my broker, to try to recoup my loss of earnings, as a result of the Coronavirus?

“Well”, says the Alchemist, “I was thinking of the ‘hidden ‘war’, and how a virus ‘out of nowhere’ has changed its course, for good”.

“What do you mean?”, queries Joe.

“You recall how you said that the U.S. economy was fundamentally the strongest in the world? Well that’s not quite true. Sometime ago, U.S. growth began to falter, and the Authorities opted for a debt-driven, consumer-led economy. Money was printed (as credit), and – normally – a lot of new money or debt in circulation, would have created inflation (such as we had during the Reagan Administration).

“How we managed this difficulty (apart from regularly re-jigging the price index), was by the so-called ‘China Trade’. China was then in the midst of its Industrial Revolution: they sent cheap products to Walmart. They effectively subsidised the middle classes, by giving U.S. a standard of living – access to cheap consumer-goods – which otherwise, we could not have afforded. And better still, they recirculated the monetary proceeds back to Wall Street, through buying U.S. Treasury bonds.

“The point here, was that in so doing (buying our debt), the Chinese allowed U.S. to shrink our created, new-money ‘footprint’, by exporting U.S. dollar debt out of harm’s way – to Emerging Markets. We have lent out $13 trillion in this way, thus repressing the domestic money footprint.

“These little ‘tricks’ were necessary to avoid inflation. But the inflation threat was mitigated also, in another way. All this new money was used to ‘financialise’ and leverage ‘everything’, from healthcare to education. They blew ‘bubbles’.

“This gave U.S. a simulacrum of ‘growth’ – but money-printing did not make the dollars available to you, I’m afraid, Joe. They got stuck in the financial system and were hoarded. You may have noticed that times were getting less rosy. But that was also a result of the U.S. business model, which has always prioritised capital formation and allowed labour costs to take the strain, or be eased-down by off-shoring labour costs to overseas.

“Ah, but what of the ‘hidden war’ that you spoke about. How does that fit in?”, asks Joe.

“You recall what I said earlier about Britain fearing that it could not stay at the pinnacle of international power forever? And seeing Germany somehow coming together, and building-out towards the East, in order in order to rival Britain? Well, China some years ago, stopped re-circulating the proceeds from the China Trade back to Wall Street, and instead started building-out towards Central Asia. It began spending the proceeds of the ‘China Trade’ building the Belt and Road, instead. As Germany had threatened to rival Britain, China was on a path to rival America.

“This posed a problem for the U.S.: firstly, how now to finance that China Trade; and secondly – not least – how to let the middle classes’ down gently, from the loss of their ‘China Trade’ ‘subsidy’, and avoid a ‘revolt’ inside the U.S. The blowing of the housing ‘bubble’ was intended – at least partly – as the offset.

“Equally problematic for U.S. was that the Chinese-Russian Eurasian project, was intended to channel trade – in a hugely important sphere, including energy and raw materials – not via our channel – the dollar – but rather, away from it. The dollar has been ‘squeezed’ by the de-dollarisation crowd since at least 2007.

“Hence all the ‘tricks’ in the toolbox that I outlined earlier. But it got worse: We have tried to keep all the oil sales in the world going through the dollar (sanctioning non-compliant producers, creating instability of supply etc.), but scattergun of sanctions just brought everybody into our jurisdiction, and made their financial systems subject to arbitrary U.S. Treasury threat. The world doesn’t want to do that anymore. The revolt grew.

“This, in essence, was the ‘hidden war’. And it was not going so well: The U.S. Treasury – simply – was running out of further bubbles to blow. Finally, it had resorted to blowing the ‘everything bubble’ to maintain the appearance of a strong economy; but as this structure became ever bigger, more leveraged, more complex and thus opaque – so it became less stable. The Coronavirus ‘pin’ popped the bubble – forcing Washington to deploy unlimited money-printing, and to bailout simply, ‘everything’ (which is the inevitable ‘logical’ response to an ‘everything bubble’, I would imagine)”, said the Alchemist.

“Then, what happens now” blurts out Joe, alarmed: “Will it end in war, like in the 19th Century?”

“Possibly, but probably, not”, responds the Alchemist calmly. “China is too powerful, but its economy inevitably will have been weakened too. More likely, America will continue the struggle against China (and Russia) through proxies, such as in Venezuela, or in the Middle East. (Iran though is a special case, on account of Israel).”

“At the end of WW1, European economies had been partly shut down by the war – and there were huge dollar debts owing to the U.S. Today, western economies are in partial lockdown due to Covid-19. And national debts today are similarly, more or less, at levels associated with (real) wartimes. And there is the $13 trillion – owed by emerging markets, and for which repayment in full, now must be viewed as problematic.

“After WWI, there was no debt forgiveness (no debt jubilee), just a pass-the-parcel practiced by the European states, as they tried to off-load their debts onto others. To find an exit, some hoped that austerity could fix the problem. But others did resort to ‘helicopter money’ (much as the U.S. is so doing, in its response to the Covid-19 lockdown). The gold-backed German Reichsmark became the unbacked Papermark. Initially, the Reich financed its war outlays, in large part, through issuing debt. But From May 1923, the quantity of Papermark started spinning out of control. Wholesale prices skyrocketed. By 1918, you could have bought 500 billion eggs for the same money you would have to spend, five years later, for just one egg. The Papermark was scrap value.

“With the collapse of the currency, unemployment was on the rise. Hyperinflation had impoverished the great majority of the German population, especially the middle class. People suffered from food shortages and cold. And political extremism was on the rise. This is a real risk, since all the earlier Treasury gigs to suppress inflation are no longer available.

“So what might Washington do – especially about the $13 trillion debt owed by EMs?”, pleaded Joe. “Why don’t they reform the system?”

“We don’t know what they will do”, sighed the Alchemist, “but the signals suggest that the Central Bankers are toying with a new global, reserve digital crypto-currency – against which EMs (and the U.S.) might devalue their currencies. (The former governor of the Bank of England has hinted at something like this). It might never happen. The type of ‘crypto’ the Central Bankers have in mind is one giving the authorities complete control: no real money, just a credit at the central bank with ATMs spitting out only what the central banks determine. And no, there will be no real reform – only ‘mumbleswerve’. But that – dirty money, lots and lots of it – is another story. Transparency is not an option.

“So, you would advise me not to buy stocks?”, asks Joe.

“No, I wouldn’t Joe. It seems that Trump now wants to bail out the American Middle Class in a different way. I know you, like many others, like to check out daily their 401K (stocks held as a future pension provision). And if it’s up, they are happy; if not they are gloomy. So Trump is trying to blast-up markets, with a wall of freshly printed money – and bailouts unlimited.

“The President has taken full control of the (nuclear) button that controls the global supply of money, in dollars. He has control of the Treasury which has completed its take-over and merger with the Fed. How things work is that Congress authorises $450 billion in a CARES bailout. The Treasury gives it to the Fed as its stake – and then instructs the Fed to multiply that stake, by a factor of ten (through printing fresh money). The $450 billion becomes $4.5 trillion and is handed over to a friendly Hedge Fund – Blackrock – to distribute. And the details of the distribution are all tied up in confidentiality clauses and opacity. Trump becomes a secular Croesus: he can ‘print’ as much as he wishes. Nothing to stop him. Will be able to contain himself?

Joe sighs.

“So, the question then, Joe, is – is it really feasible for the market to soar when maybe half the economy is semi-furloughed, and inherentvalue is plunging?

“As I mentioned earlier, money ‘printing’ does not always make dollars available. Liquidity is being provided to the U.S. banks: yes, but the problem is not so much liquidity; but one of potential default – especially on the $13 trillion owed overseas. So there is a massive scramble by those overseas debtors for dollars, with which to pay interest, and capital repayments, as they become due – and that means the dollar will soar (for now). It is the dollar strength that brings to world to its nadir (just like the 1930s). It is the dollar system that is the really big problem. This virus will either prick the dollar bubble and collapse it in an inflationary spiral downwards – or, the CBs will be forced to find some other solution (though God knows what!)

Joe sighs again.

“I’m afraid Joe, that I may not have been much help to you – sorry”.