An array of Russian, Iranian and even Chinese drones should serve as a reminder that the stock market, like the wars it feeds off, can be a very expensive place to gamble.

❗️Join us on Telegram![]() , Twitter

, Twitter![]() , and VK

, and VK![]() .

.

Contact us: info@strategic-culture.su

Though a recent SCF Infographics depicted how Americans view the world, Wall St tends to see the markets in the starker, heuristical terms of buy, hold, sell or get the hell out of Dodge before the market collapses. One buys on the rumour and sells on the fact. When, for example, Nancy Pelosi hears rumours or rumblings of future events, her husband will buy low on the rumour and sell high after the event occurs.

Although that is one insider trading heuristic Wall St lives by, a much more basic one is that money is a coward and will flee turbulent areas quicker than Dracula will flee from a cross. You don’t want to be Scarlett O’Hara’s father holding Confederate bonds when General Lee has raised the white flag. You want to have sold the Confederate losers and bought the Yankee winners long before that.

Yet another heuristic is if you don’t know who you are, the markets are a very expensive place to discover yourself. The markets are like a jungle where, acting on information, the big players the Pelosis are in hock to generally hoover up all the profits and they take no prisoners. Guess wrong, put your money on the wrong horse and you can lose a lot more than your shirt.

All of that being so, Israel but especially Ukraine leave us in a pickle. Why did Big Money not get out of Dodge sooner? Who in their right minds wants to be investing in Zelensky’s Ukraine or Netanyahu’s Israel when both countries are on fire? Why has Big Money not got out of Dodge and is our traditional, tried and trusted analysis missing something in all of this?

This article contends that we have missed nothing but that it is the game itself that has changed. We will plod our way through the traditional analysis and then, with cursory nods to the relevant academic literature, 9-11, the Second Gulf War and the Soviet invasion of Afghanistan, conclude by explaining why we cannot concur with the traditional buy and hold strategies.

As the first part of any financial time series analysis is to graph and then stabilise the data, let’s go to these sites, which graph currencies (those of Ukraine and Israel included), as well as oil, gold and U.S. bond prices. Although the Ukrainian hryvnia has taken a mauling over the last six months, just like the Israeli shekel, it does not, as yet, seem fatal, certainly when compared to the currencies of Syria or Lebanon, both of which are very much in Uncle Sam’s bad books.

Israel, by all accounts, is still enjoying (modest) economic growth and Ukraine, our friends at Russia Today explain, are expanding their drone production even though the country is bankrupt a hundred times over. If it is market turbulence you are looking for, the exotic currencies of Ukraine and Israel are not the places to make a quick killing.

This is because the Israeli and Ukrainian markets must be seen by today’s market maxims and not yesterday’s where singularites like 9-11 and the 1979 Soviet invasion of Afghanistan caused markets to freak out. Not only are those events now only historical footnotes but oil markets, once one of the world’s major barometers of turbulence, seem to be largely indifferent to what Israel and Ukraine are up to.

Although gold was the other historical barometer, as gold prices are generally a proxy for American bond prices, not too much attention should be given to their volatility. Not so the bond markets, where turbulent countries like Israel and Ukraine run the risk of running out of short term, rather than long term liquidity.

And therein is the key because the United States, helped by her loyal EU, Japanese and British lapdogs, seems ready to pick up any tab either Ukraine or Israel run up. Because NATO is prepared, to coin JFK, to pay any price to keep the Kiev and Tel Aviv regimes in power, corruption must be off the charts, especially in Ukraine, where there are no checks and balances to counter its long-established systematic corruption. As NATO has a history of facilitating similar corruption in Iraq and in rebel-held Syria, the fact that Ukraine, even leaving its own traditional seediness to one side, is corrupt from top to bottom should not surprise us.

But what should surprise us is that the markets are prepared to play along with this folly. If football is a game of 90 minutes after which Germany wins, then the markets are a game of turbulence, after which BlackRock, Vanguard and the Bidens, Pelosis, Obamas and Clintons in hock to them always win.

But such characters are not into small bets. They prefer the big wager that would break even Las Vegas. Their bet is that they cannot only isolate Russia which, with Iran, has effectively been elided from international trade but cause them to implode, after which they can buy up those countries at cents to the dollar. If causing famine in Russia and Iran seems immoral, just look at Gaza to see NATO’s morality in action.

The fact that Iran and Russia have produce the poor of the world badly need does not faze these gluttons, who now effectively own the bankrupted state of Ukraine. As regards the pygmy state of Israel, don’t let this Atlantic Council puff piece about its Central Bank fool you. Not only do the same cast of characters own, and have always owned Israel but tiny Israel’s expertise in exporting spy systems and weapons of mass destruction show that it is very much a team player with those same dark forces.

So, how does all this end? What is the exit strategy? That is an easy one. NATO will either eventually sign a peace deal with Russia, perhaps ceding much of its Ukrainian colony to Russia or it will push the envelope too far and give us a nuclear high noon by the Dnieper. Whatever about excluded Russia, the deeds of the rump Ukrainian Reich and much of the European Union will be in the hands of BlackRock, Vanguard and their political vassals who will use the mass media to explain to their impoverished masses that better days are ahead, once Dixie, in the form of demographically denuded Ukraine, rises again.

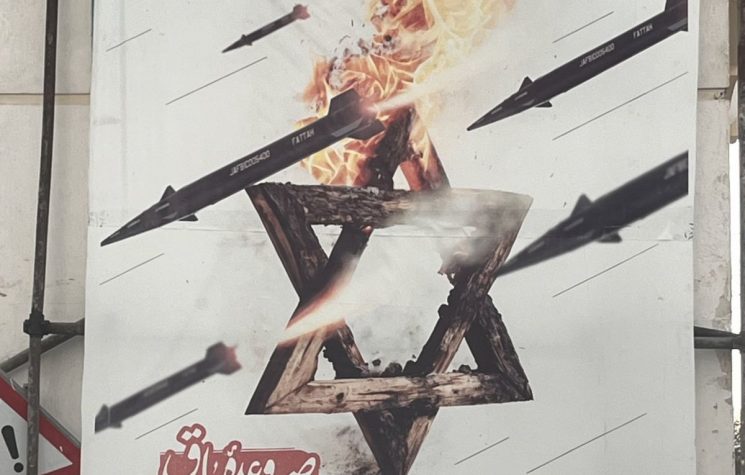

As regards Israel, it is fulfilling its mission of making the Middle East a nightmare for its indigenous peoples. And though space precludes me from going on about how that might turn out, BlackRock, Vanguard and the Bidens, Pelosis, Obamas and Clintons in hock to them are betting that, as with Syria, Iraq and Libya, they can profit by turning that land of milk and honey into a wasteland as they build their New Jerusalem on the skulls of Palestinian babies.

Perhaps all that will be so. But, if you are thinking of gambling your savings on that outcome, an array of Russian, Iranian and even Chinese drones should serve as a reminder that the stock market, like the wars it feeds off, can be a very expensive place to gamble and, as with the ordinary Ukrainians and Palestinians, you might lose your short and much else besides. Caveat emptor!