Since 2020, the wealthiest five individuals in the world have seen their fortunes explode, while during the same period some five billion people around the world have become poorer.

❗️Join us on Telegram![]() , Twitter

, Twitter![]() , and VK

, and VK![]() .

.

Contact us: info@strategic-culture.su

Since 2020, the wealthiest five individuals in the world have seen their fortunes explode, while during the same period some five billion people around the world have become poorer.

The net worth of these billionaires – Tesla CEO Elon Musk, Bernard Arnault and his family of luxury company LVMH, Amazon founder Jeff Bezos, Oracle founder Larry Ellison and investor Warren Buffett – has exploded 114% to $869 billion, after taking inflation into account, according to Oxfam’s annual inequality report.

Currently, Elon Musk, who runs several companies, including Tesla and SpaceX, is the richest man on the planet, with a personal fortune of just under $250 billion.

“We have the top five billionaires, they have doubled their wealth. On the other hand, almost 5 billion people have become poorer,” Amitabh Behar, Oxfam’s interim executive director, told reporters in Davos, Switzerland, the site of this year’s World Economic Forum.

“Very soon, Oxfam predicts that we will have a trillionaire within a decade,” Behar said. “Whereas to fight poverty, we need more than 200 years.”

To put the idea of a trillionaire (a thousand billions) into some perspective, the United States currently spends about that much annually on its entire military machine.

In total, billionaires have seen their wealth explode by $3.3 trillion, or 34%, since 2020, with their fortunes expanding three times faster than the rate of inflation, according to Oxfam.

American billionaires, many of whom accrue their wealth from the equity in the companies they lead, have become $1.6 trillion richer.

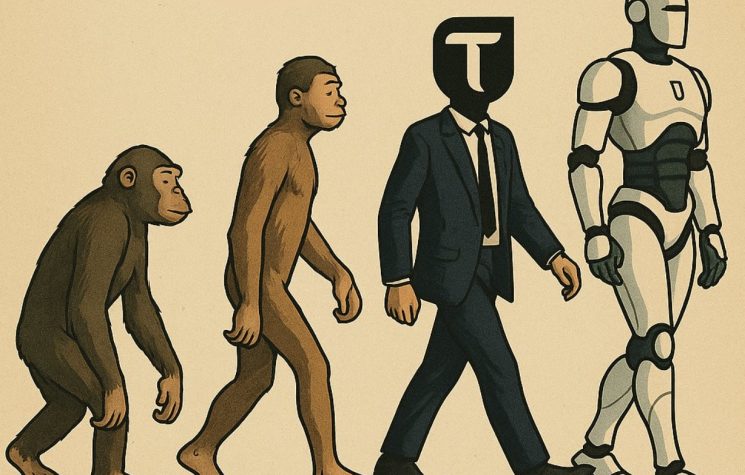

The driving force behind this massive surge in personal profits is raw corporate power. Seventy percent of the world’s largest business interests have either a billionaire at the helm or a billionaire as its principal shareholder.

Moreover, the top 1% of income earners possesses 43% of the world’s financial assets, according to Oxfam, which pooled its data from Wealth X. In the United States, this group owns 32%; in Asia, it’s 50%. In the Middle East, the top 1% holds 48% of the financial wealth, while in Europe, it’s 47%.

About 150 of the world’s largest corporations made nearly $1.8 trillion in profits in the one year leading up to June 2023, Oxfam reported. That’s 52.5% more than their average was between 2018 to 2021.

While economic inequality is as old as Rome, in the United States the disparity has increased dramatically over the last four decades. Inequality can be measured in a variety of ways, frequently using income.

The Gini coefficient, developed by Italian Statistician Corrado Gini in 1921, is one of the most accurate measures of how income is distributed across the population with 0 being perfectly equal (where everyone receives an equal share) and 1 being completely unequal (where 100 percent of income goes to only one person).

The United States has a Gini coefficient of 0.485, the highest it has been in half a century, according to the Census Bureau, far exceeding that of other advanced economies. This measurement proves that the U.S. is the most unequal major economy in the world.

In 1980, the top 1 percent of earners in the United States earned a little over 10 percent of the country’s income. Currently, they bring home about 20 percent, more than the entire bottom half of earners.

Despite its massive amount of inequality, Americans have shown tremendous patience with the status quo. The last time there was any sort of backlash against the 1% came in 2011 with the Occupy Wall Street protests, where thousands of protesters railed against economic inequality, corporate greed, and the influence of money in politics.

Americans showed that they had had enough following the 2008 bank bailouts under the George W. Bush administration that utilized taxpayer funds to purchase toxic assets from ‘too big to fail’ banks and financial institutions. Protesters were also enraged by the undue influence of corporate money in the US political process.

Today, Wall Street quietly goes about its business of making obscene amounts of money, while much of the public’s attention is preoccupied with other matters unconnected to class, like race, gender, and identity politics, trifles which the corporate-owned mainstream media is only too happy to promote. Whether it will take the world’s first trillionaire to make the people ‘class conscious’ once again remains to be seen.