Whether the Chinese want to eat them, use them as lab rats or put them into zoos, the sheer scale of this order shows that China is now a major player in the monkey business.

The news that Sri Lanka may export over 100,000 monkeys to China is another dagger to the Yankee dollar’s heart. Before moving on to other exotic exports from other exotic countries, let’s first put this monkey business to bed.

Sri Lanka’s economy, like her monkeys’ habitats, is in pieces. Sri Lanka needs every penny, every pound, every yen, every yuan she can scrape together. And, as macaque monkeys go for between $4,000 to $8,000 apiece, Sri Lanka is looking to gross between $400,000,000 and $800,000,000 for this exotic trade of a primate which is regarded as a pest throughout large swatches of Sri Lanka.

The trade in monkeys is big business, with the United States importing almost 500,000 of them for a variety of reasons (culinary, labs, zoos etc) in recent years. And whether the Chinese want to eat them, use them as lab rats or put them into zoos, the sheer scale of this order shows that China is now a major player in the monkey business.

If this was a once off trade or if Sri Lanka and China were not going to continue to be trading partners, it might make sense for China to pay in Yankee dollars, which Sri Lanka could then use to buy goods from one of its trading partners, China included. But, as China and Sri Lanka will forever remain major trading partners, the demand for yuan in Colombo and rupees in Shanghai will continue to grow.

Because the Sri Lankan rupee is an exotic currency for which there is only patchy overseas’ demand, the danger has been that China’s monkey importers would be loath to accept rupees as they are much harder to offload than the Yankee dollar. This problem can be seen more clearly with the 1997 passing of the late Princess Diana of Wales when the unprecedented demand for flowers to throw at her casket meant that Dutch traders (guilder/euro) were importing them wholesale from as far afield as Kenya (shilling) and Tanzania (shilling) to on-sell to the English (pound sterling). Far easier to take those currencies out of the frame and just count the resulting huge profits in one currency, the Yankee dollar, which would otherwise not be in the frame at all.

Complicating things further, the Sri Lankan rupee is a closed currency, which means it is not available to buy or sell outside of Sri Lanka. whose Central Bank is charged with stabilising it. As remittances from overseas Sri Lankans (down 20%) and tourist revenue (down 90%) both took massive hits from the Covid lockdown, the Central Bank’s job become much harder and desperate measures, such as curtailing the import of fertilisers, backfired badly on the ordinary Sri Lankan. Sri Lanka’s Central Bank really has its work cut out so much that if 100,000 macaque monkeys have to take it in the neck for Team Sri Lanka, so be it. As Sri Lanka’s annual debt service costs now run to over U.S.$10 billion, Sri Lanka cannot max out its national credit card any more but must think of new ways, like the mass export of monkeys, to tackle this crisis.

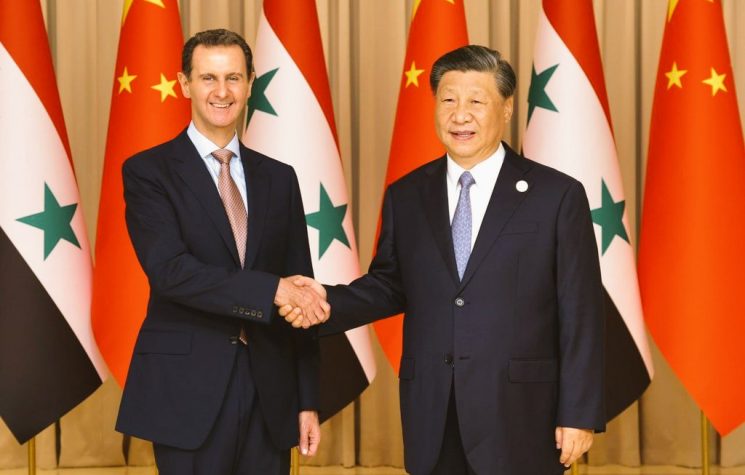

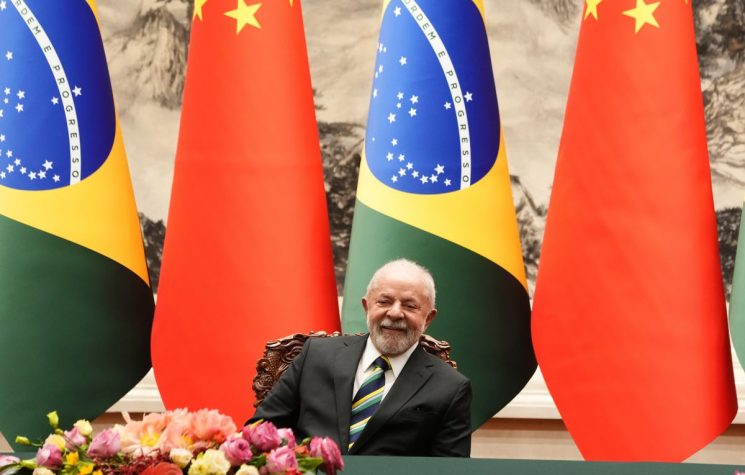

When Brazil’s President Lula recently rhetorically asked in Shanghai “why all countries have to base their trade on the dollar… why can’t we do trade based on our own currencies?”, Sri Lanka and many of his Latin American neighbours such as Argentina and Mexico supply much of the answer. The currencies of Mexico, Argentina, Sri Lanka and Brazil itself are known in the trade as exotic currencies, which are relatively minor in international commerce but whose resulting thinness and spread yields abnormally large profits for the British and American financial institutions who trade them.

When Brazil’s President Lula went on to rhetorically ask “Who was it that decided that the dollar was the currency after the disappearance of the gold standard?”, the answer is that the Americans decided that beginning at Bretton Woods, where the Brazilian and other delegations there were in no position to argue the converse. When Brazil’s President Lula then went on to rhetorically ask “Why can’t a bank like that of the Brics have a currency to finance trade relations between Brazil and China, between Brazil and other countries?”, the reason has as much to do with Sri Lankan monkeys as it has with monkey economics.

Quite simply, the Americans reaped the benefits of the Second World War much more than anyone else. The dollar replaced the pound sterling as the global reserve currency of choice as part of America’s campaign to achieve hegemony even during the Second World War when British backs were very much up against the wall and when, as a consequence, the pound sterling was under intense strain.

Although the paper notes the Bank of England issues promises to give the bearer one pound of sterling (92.5%) silver for every single note held, that is no longer the case. However, as long as credibility in the Bank of England and related central banks holds and people accept those pieces of paper, that is not really an issue and trade in these IOUs can continue more or less as before.

It is that credibility rather than the paper itself which is the Coin of the Realm, not only in England but in America, China and Sri Lanka as well. Having that credibility brings immense benefits to the Yanks, the Brits, the Swiss, the Japanese and the Germans and Dutch who are at the heart of the euro. If the Chinese (not, please note the Brazilians) can elbow their way into that happy circle, they will be well pleased with themselves. If they can get the Sri Lankans to take Chinese yuan rather than Yankee dollars for their monkeys, well then that is good news for both China and Sri Lanka.

And, of course, bad news for the Yanks, who have traditionally benefited immensely from all this. There is currently over $2,000 billion Yankee dollars, IOUs in circulation, with between 25% and 60% of that amount held outside of the U.S. If the Sri Lankans can strike a deal in yuan for their monkeys, then they can use some of their precious Yankee reserves for other purposes, much as Japan did in its leanest post war years, when it started to export guitars, sewing machines and bicycles in exchange for much-needed Yankee dollars.

America’s financial power goes much further than that, as the trade in American debt instruments is enormous and trade in gold derivatives is, by and large, a proxy for American interest rates, which determine the value of those debt instruments, which were historically considered a safe haven by Japan, South Korea, Taiwan and Russia, which has been criminally and systematically robbed by the Yanks and their west European vassals over the last year.

The dollar’s status as a reserve currency allows the Yanks to print an almost unlimited amount of dollars without suffering hyperinflation, something that is biting at the heels of Sri Lanka’s Central Bank and which the Central Banks of Mexico, Argentina and, of course, Germany are no strangers to.

As long as the Yankee dollar is the reserve currency of choice, Uncle Sam can simply print more greenbacks, more IOUs and trade them for Arab oil or Japanese cars. The only other countries that can exchange their dubious currencies for tangible goods are those, like the West Europeans, who can get an American swap line, allowing them to trade their IOUs (euros or pounds) for Yankee dollars. Sri Lanka, to take the obvious example, can no longer do that. Without a swap line to the Yanks or its Bretton Woods frontmen, printing more money devalues the currency and, as Latin America, Sri Lanka and Germany know all too well, causes inflation and the societal problems ensuing from it.

Not only has Lula’s Bric currency no prospect of replacing the Yankee dollar in the short term but there is no prospect of that happening over the longer term either. What is happening is that the Chinese yuan, the Russian rouble and other second tier currencies are pushing the dollar and allied currencies out of areas, such as the trade in Russian oil and Sri Lankan monkeys, they are not needed in.

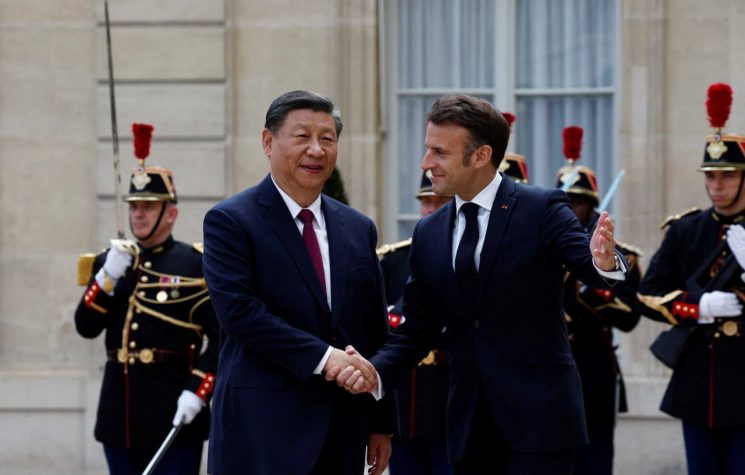

Although the yuan option makes sense for Sri Lanka, the Dutch and the Yanks won’t be too happy with that. The Dutch, remember, even tried to wrest Greece’s dairy industry from Greece after their euro swindle caused Greece’s economy to implode. As the Dutch and their trans-Atlantic partners in crime showed no mercy to the Greeks, we cannot expect them to look kindly on either the Chinese or Holland’s own former Ceylonese colony. Sadly, Sri Lanka, on its own, is, like Brazil, in no position to stand up to the bullyboy tactics of the usual NATO suspects.

China, as previously alluded to, may be another kettle of fish. If China can make such exotic trades and help break NATO’s banana blockade, then it will have the gratitude of tens of millions of Latin Americans, Africans, Sri Lankans and other Asians. For China to accomplish that, credibility and cold, common sense must be their Coin of the Realm.

China’s alliance with Mother Russia best illustrates this. For such alliances to work, there must be clear demarcation lines between what each party does and does not do. In the case of oil, that can be Russia delivering crude oil at a marked to market price in a place and manner of choosing to the parties involved. As that is an ongoing supply and demand business, China and Russia can mark themselves not only to the spot price but, going forward, to the futures and options prices as well.

Given that Uncle Sam objected in his usual violent manner when Libya, Tanzania and Kenya tried to form their own gold backed currency in times gone by, we can expect plenty of U.S. inspired bumps along the road as Russia, China and Sri Lanka look to the future with the economic cards at their disposal. That said, the key to the future of Russia, China, Sri Lanka and countless other nations is to fortify their sovereignty and trading monkeys for yuan and yuan for oil is a big step in that process. Although none of that will replace the global pre-eminence of the Yankee dollar, ditching the dollar, a yuan, a rupee and a rouble at a time, offers more hope to Russians, Asians and Latinos than does eternal vassalage to Uncle Sam and the global financial system he rigs in his favour.

NATO’s pending monkey business against China in the South China Sea will be an excellent weather vane in this respect. If NATO can upset China’s apple-cart there, then, for countries like Sri Lanka, it will be business and penury as usual. If, on the other hand, NATO can be sent packing, then there might be hope for all the peoples of the South China Sea, for Sri Lanka and for all the other peoples of South Asia as well.