Since the very onset of the Coronavirus Pandemic, economists and the media have been warning the public about the damaging effects that quarantine would and is having on the financial world. The yearly “growth” that we would normally expect was negative for many nations, especially in the West. However, the most interesting tale of economic survival in 2020 would have to be Saudi Arabia. Logically and statistically their country should look like North Korea in the 90’s and yet all things are quiet on the Arab front. How could this possibly be? Let’s take a look at this peculiar paradox and see what is in store for this oil giant.

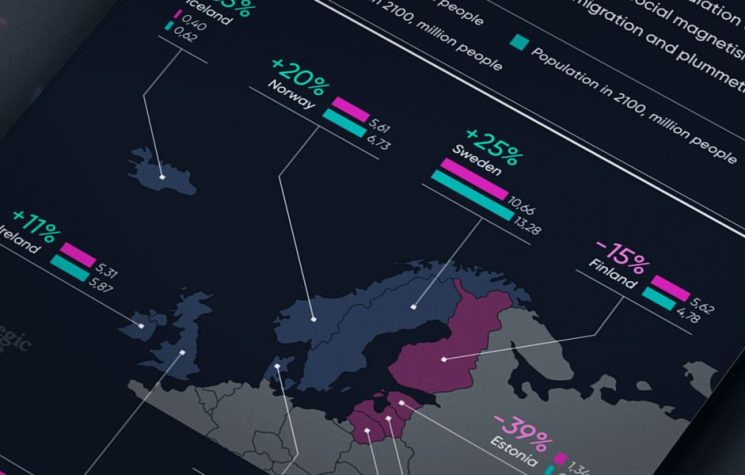

Just taking a peek at the first quarter of 2020 we can see that with the stark exception of Ireland the entire EU is deep into the red GDP wise. This measurement is coming from official European statistics, which means the situation may actually be far worse. When individual humans count pennies in a jar, this yields a concrete quantity. But when groups of experts try to estimate the value of a nation’s economy there is a lot more room for intellectual flexibility. This is why GDP and other lovely metrics tell us something, but are certainly not hard science, which is very relevant in the case of 2020 Saudi Arabia.

The World Bank in their paper “The Potential Impact of COVID-19 on GDP and Trade” laid out four main causes for economic downturn. This was focused on “shocks” that Europe was facing, but this logic can be applied globally. Their list explaining the specific reasons of how an international quarantine can ruin GDP growth is as follows…

- A drop in employment

- A rise in the international trade costs of imports and exports by 25%

- A sharp drop in international tourism

- A demand switch by households who purchase fewer services requiring close human interaction

Now if we add a few of our own factors specific to Saudi Arabia then the picture looks even more grim.

- A dependence on foreign labour

- An economy that has oil at its center, while oil prices are way down, with Covid pushing demand even lower

- An involvement in a traditional war that has been going on since 2015 with no end in sight

Saudi Arabia is very famous for its oil reserves which make up the largest segment of its economy and if the CIA factbook is to be believed then it is the absolute keystone of the nation’s prosperity. It is their golden goose and nothing else that happens in the nation is a distant second. They state…

“The petroleum sector accounts for roughly 80% of budget revenues, 45% of GDP, and 90% of export earnings”

If this is true then the double impact of pre-outbreak low oil prices along with the reduced demand during the pandemic must have had a devastating impact. Furthermore…

“Roughly 6.4 million foreign workers play an important role in the Saudi economy, particularly in the oil and service sectors”

This dependence on foreign workers coming in and out when travel is restricted probably doesn’t help either. The Covid-19 Pandemic has stuck many people on one side of a border they would normally be able to cross with ease. Why the Saudis after all these decades have been unable to raise their own oilmen is one of the many mysteries of how their economy still survives, but even in their most key industry they are still dependent on foreigners.

In early 2020 the cost of crude oil dropped to historic lows not seen since 1998 which even at that time were considered unusually low. This year we’ve seen a $20 dollar per barrel price range which is still hard to believe actually happened. The prices have “doubled” since then returning to a value that is better but still not very good for Saudi Arabia at a little over $40.

As mentioned above import costs are up and when a nation has a very monolithic oil based economy that means that the majority of things on store shelves just got way more expensive for the common man.

Image: Someone had to pay this Saudi soldier and others like him to fight in Yemen. Could it really be only American resources at play?

We also shouldn’t forget that Saudi Arabia has been involved in a “good ole fashioned” type of conflict in Yemen since 2015. Although this is technically a civil war the New York Times aptly referred to it as “Saudi Arabia’s War”. Sadly, that publication still turns a blind eye to American instigated regime changes. But acknowledging the House of Saud’s ambitions is a nice first step, maybe one day they will grow up.

Unless you’re the United States, war is very expensive and after half a decade of drain one would think that the green flagged nation would have pulled out like the Soviets in the 80’s or the Americans in the 70’s, but somehow they’re still going forward with this project albeit at a snail’s pace.

Image: Pilgrimage/Religious Tourism has been good to Saudi Arabia, but has collapsed under Covid-19 conditions.

Getting away from oil and war, Saudi Arabia has the geographical luck to contain many sites significant to Islam. When Muslims are expected to do the Hajj to Mecca once in their lives you are going to get a very large number of de facto tourists. This logic held true until the Coronavirus panic which has made global tourism plummet and has forced the nation to turn many away. This unusual “natural resource” that this desert nation has should prove to be even more stable than oil going into the future, but as soon as borders close and flights get canceled all that sweet religious tourism money vanishes instantly.

A Land of Miracles?

After all this, one would expect Saudi Arabia to be absolutely battered and broken economically but the evidence points to the contrary. Perhaps this ancient realm really is a land of miracles, because according to the CEIC…

“The Gross Domestic Product (GDP) in Saudi Arabia contracted 1.0 % YoY in Mar 2020, following a negative growth of 0.3 % in the previous quarter. Real GDP Growth YoY data in Saudi Arabia is updated quarterly, available from Mar 2011 to Mar 2020, with an average rate of 2.4 %.”

This occurring at the height of the oil price drop and the peak of Coronavirus panic is a very mild drop to say the least. The Saudis themselves and various other sources confirm this very small drop as well.

France and Germany experienced far worse GDP suffering due to the pandemic, yet they have large amounts of production and exports as well as get a big boost from the cheap oil they don’t have in their nations. The CEIC says that by the exact same metrics the United States is down -9.1% (YoY) which makes Saudi Arabia’s “successes” seem like they must have involved some fancy accounting tricks or divine providence.

This is what is so fascinating, the country that should be the most affected by the pandemic seems to be only mildly inconvenienced. Statistically this shot that hit them point blank, directly in the chest, was labelled a “glancing blow” and we are expected to believe it.

This situation could represent a classic case of “if it wasn’t in the news then it didn’t happen”. If an economic collapse isn’t reported then no one will believe it is happening and life and sort of go on as usual. Furthermore, certain Middle-eastern nations are known for buying nice advertising packages in the Mainstream Media to get the coverage/version of reality that they like.

Saudi Arabia has either triumphed over the economic hurdles thrown in its path by Covid-19, attained true mastery of the art of hiding one’s gaping wounds under a thick red tunic of disinformation, or is being propped up by Washington to unparalleled levels that even Israel would be jealous of. Something doesn’t add up.