The case for the EU to seize even the 207 bn euros is a very shaky one, which is likely to be the final nail in the coffin for the project which keeps the war going.

Join us on Telegram![]() , Twitter

, Twitter![]() , and VK

, and VK![]() .

.

Contact us: info@strategic-culture.su

There is an EU document in which it is stated there “is a problem with the financing of Ukraine”. No shit. The real problem actually comes with a new lack of confidence from EU member states in this “financing” following recent unconfirmed reports that Donald Trump has told the EU in blunt terms that they can’t dip into the supposed 300 bn USD in Russian “frozen” assets held by the West.

When the war started, Russia’s central bank held around $207 billion in euro assets, $67 billion in U.S. dollar assets and $37 billion in British pound assets.

It also had holdings comprising $36 billion of Japanese yen, $19 billion in Canadian dollars, $6 billion in Australian dollars and $1.8 billion in Singapore dollars. Its Swiss franc holdings were about $1 billion.

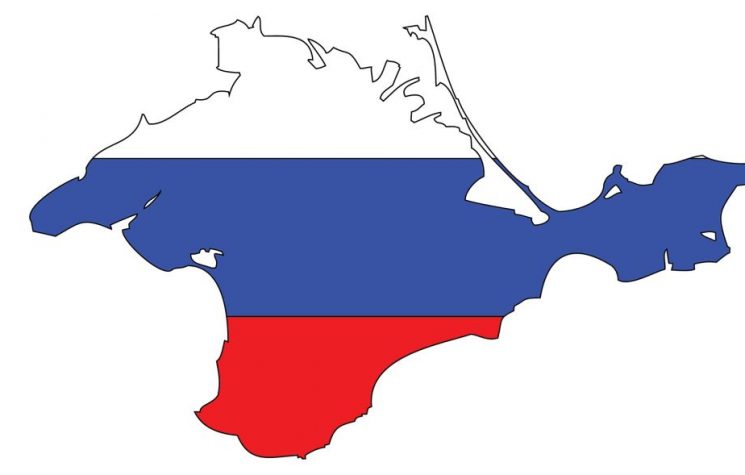

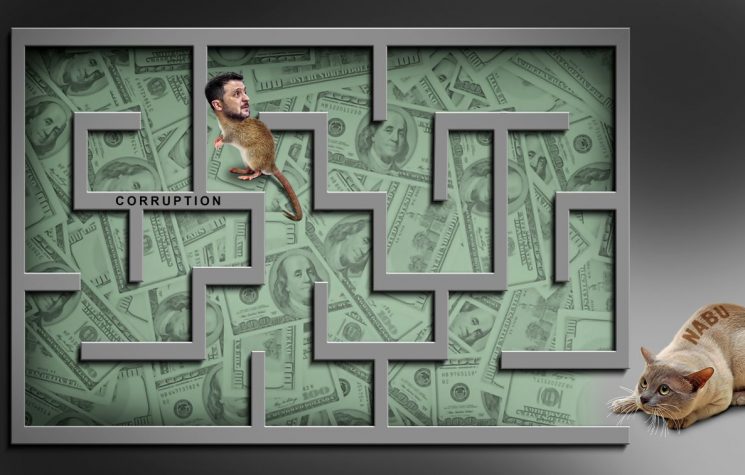

And so out of 355 bn USD of so-called “frozen” Russian money around the world, the EU only holds a little over a half of it, despite the EU talking as though they have it all. Yet despite this, much hope was placed on the EU to use this cash to continue to fund the Ukraine war. But even if Trump hadn’t have told the EU to keep their hands off the cash, under international law the case for the EU to seize even the 207 bn euros is a very shaky one, which is likely to be the final nail in the coffin for the project which keeps the war going. On December 18th in Brussels EU leaders will meet and will have to be forced to recognise a reality: if this cash cannot be used, then it will be EU member states themselves which will have to scrape together a rescue package to underwrite Ukraine’s 80bn USD 2026 budget. Recently, the EU announced another 2 billion “loan” but such payments aren’t going to sustain any kind of normality faced with the enormous black hole which needs to be filled. The real problem that the EU has is that it doesn’t put its mouth where its Russian money is. Faced with an ultimatum by ECB figures like Christine Lagarde, EU member states won’t offer their own cash as a guarantee when things go wrong with the cash, if it were to be used to fund the war. This lack of confidence might prove to be detrimental to the West’s support for Zelensky who is currently dealing with his own political demise in Kiev following corruption scandals and key allies resigning and even in some cases fleeing the country.

And with a 28 point peace plan, which most experts agree was “dead on arrival”, the popular narrative now from western commentators is that his time is up. He can’t himself offer a peace deal as it is feared that the moment he signs such a paper he will be assassinated and then a ceasefire is broken and both sides return to fighting. The only hope for the West is to invest their political and financial capital in a new leader who is familiar and respected by the Russians, whose signature will come with real guaranties – but this will have to come with assurances that their own troops won’t pile into Ukraine when the deal is signed. EU leaders can’t get this idea in their heads straightened out, that the whole war started because Ukraine was ushered towards EU and NATO membership and its troops have been equipped and trained by the West, in particular under Trump in 2017 during his first term in office.

Another idea which is unpalatable for all EU leaders – including the UK – is that these countries’ economies are on their knees. The Belgian primes minister recently hinted at a press conference that while he was against using Russian cash to fund the war, for a whole host of reasons he pointed out, it was preferable that if the EU were to go ahead into this unchartered legal area, it would be advisable that the EU had a non-EU partner to join it. He was hinting that this could be London. But someone needs to tell him that the British economy is about to collapse under its own debt interest of 120 billion pounds a year, based on reckless decisions after years of borrowing to resolve problems of its own making. It is inconceivable that the UK could be a partner in underwriting or providing guaranties to using Russian frozen assets to continue the war racket. But in the La-la land of the EU, such BS makes good press fodder for the following day’s copy.

Trump’s orders to lay off the Russian cash comes with a sobering wake-up call to EU leaders that they have run out of cash to throw into the black hole of the Ukraine war, which in private, they know is funding Zelensky’s own network of money-grabbing cronies whose only real occupation is looking at how to syphon off international money and stay in office. The resignation of his chief of staff recently, which followed his own business partner and friend fleeing the country after investigators were about to arrest him for his part in a 100m USD energy firm embezzlement, is the clearest indicator to date what the business model is in Kiev. It’s getting harder and harder for western leaders to close their eyes to the sheer level of corruption, how far it goes, and what figures are when such scandals obviously only represent the tip of the iceberg.

And now for EU leaders to meet on the 18th of December, in many ways, their decision is not to keep on finding more and more ingenious ways to scam their own taxpayers out of hard earned money, but whether they can continue to back Zelensky and his formula. With a corruption scandal now in Brussels with top EU officials making headlines, to add to the graft allegations hanging over the head of Ursula von der Leyen, it seems inconceivable that EU leaders will not be sensitive to the cries of disbelief back home from ordinary people whose main worry is that they will freeze to death in their own homes this Christmas. The priority of the summit will be political survival. Theirs, not Zelensky’s.