The international monetary system has already passed its point of no return to an international monetary order centered on a single national reference currency.

Join us on Telegram![]() , Twitter

, Twitter![]() , and VK

, and VK![]() .

.

Contact us: info@strategic-culture.su

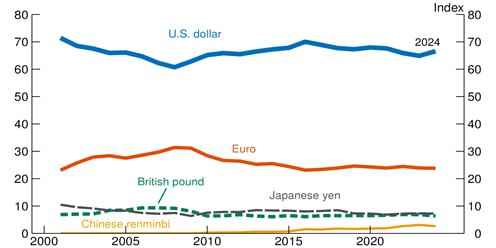

The July 2025 FEDS Notes document, entitled The International Role of the Dollar – 2025 Edition, prepared by the Federal Reserve, released updated data on the usage index of the essential convertible national currencies. It considers the following components: disclosed foreign exchange reserves (25% of the value), the volume of foreign exchange transactions (25%), foreign currency debt issuance (25%), international loans (12.5%), and international deposits (12.5%).

According to this index, shown in the chart below, the dollar has remained relatively stable throughout the period from 2000 to 2024, varying between 60 and 70. The euro has also fluctuated little, from 20 to 30, as have the Japanese yen and the British pound, 5 to 10. The Chinese renminbi (RMB), on the other hand, ranks only fifth in the international currency hierarchy, with growth from 0 to 3 over the last 15 years. Moreover, the value of the dollar usage index is higher than the sum of the other currencies for any year in the period under review.

Index of international currency usage

Source: FED, The International Role of the Dollar – 2025 Edition, FEDS Notes, July 2025.

Also, according to the Federal Reserve document about participation in central bank portfolios, in 2024, the dollar accounted for 58% of disclosed reserves, surpassing other convertible currencies, namely: the euro (20%), the Japanese yen (6%), the British pound (5%), and the Chinese renminbi (2%). The document noted a significant increase in the share of gold in official reserves, which has more than doubled over the past decade. However, it considers that this was mainly due to a rise in the market value of the metal, which increased by more than 200% during the period, while its physical quantity in central bank vaults rose by only 10%.

It is therefore striking to note the isolation and stability of the dollar’s position at the top of the international monetary hierarchy, especially when one recalls that, throughout this period, the US incurred structural deficits in its current account of the balance of payments, produced steady growth in its public debt as a percentage of GDP, and subjected the world to severe financial crises, such as the internet crisis in 2001 and the Great Recession of 2008, whose epicenters were its own national economy. Despite this, there has been no flight from dollar positions over the years. On the contrary, US public debt securities have remained the safe-haven asset of the system, especially during times of significant uncertainty and crisis.

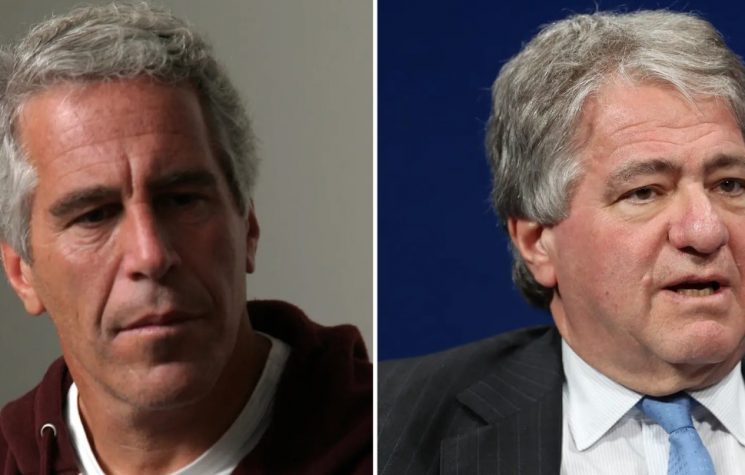

It is not surprising, based on these data and facts, that the Federal Reserve document concluded there are no significant threats to the dollar as an international reference currency in the current situation. Not even the widespread use of the dollar as a weapon of war via economic and financial sanctions on different countries, companies, and individuals targeted by its foreign policy has compromised the dollar’s position, according to the document.

Digital currencies are also not a concern for US monetary authorities, as in practice, they end up reinforcing the use of the dollar, given that, for example, 99% of stablecoin capitalizations occur in dollars.

As for China’s significant economic growth, this is also not identified as a threat. According to FEDS Notes, “the renminbi is not freely exchangeable, the Chinese capital account is not open, and investor confidence in Chinese institutions is relatively low. These factors all make the Chinese renminbi relatively unattractive for international investors.” (FED, 2025: 15).

Therefore, as a general conclusion, the document states that: “In sum, absent any large-scale, lasting disruptions which damage the value of the U.S. dollar as a store of value or medium of exchange and simultaneously bolster the attractiveness of dollar alternatives, the dollar will likely remain the world’s dominant international currency for the foreseeable future.” (FED, 2025: 15).

It is interesting to note that, in July 2025, the People’s Bank of China also published a technical document on the international monetary hierarchy, entitled White Paper on RMB Internationalization of Bank of China, whose main objective is to assess the process of renminbi (RMB) projection based on: the evolution of cross-border flows between China and foreign markets; the development of offshore markets in RMB; and the role of the Chinese currency in multilateral international institutions.

According to the document, in 2024, China’s total cross-border settlements in RMB increased by 22.5% over the previous year. Among them, settlements in RMB in the current account grew by 15.7%, and in the capital account, by 24.9%. The global use of the RMB in 2024 reached 4.2% of international payments, 5.5% of trade finance, 5% of foreign exchange trading, and 2.2% of foreign exchange reserves. According to the document, in comparative terms, the RMB was the third most widely used currency in trade finance, the fourth most commonly used for payments, the fifth most widely used in foreign exchange trading, and only the seventh most commonly used as a reserve currency.

The report also highlights that Chinese companies have increasingly used the RMB as a vehicle currency for foreign direct investment (FDI). For 27.1% of companies, the RMB accounted for at least 50% of their FDI in 2024, representing an increase of 2.2 percentage points compared to 2023. For 22.3% of them, the RMB accounted for at least 20% of their FDI, representing a 3.1 percentage point increase from the previous year.

Therefore, similar to Washington’s FEDS Notes, Beijing’s White Paper ultimately shows that the Chinese currency has not yet achieved a significant position in the current international hierarchy. However, it has achieved substantial growth rates in its use in certain activities, partly due to a small initial calculation base. In any case, the document points to greater internationalization of the renminbi in the near future.

Therefore, while the Federal Reserve report reinforces the centrality of the dollar in the global economy and points to the absence of concrete and potential threats, the People’s Bank of China report, while not contradicting these conclusions, prefers to highlight the recent growth in the internationalization of the renminbi, without, however, showing a more significant change in the position of its national currency in the international monetary hierarchy.

Given such data and analysis, it is not easy to draw a different conclusion. However, there are reasons to believe that neither report gave due attention to the most essential pillars for determining the international monetary hierarchy.

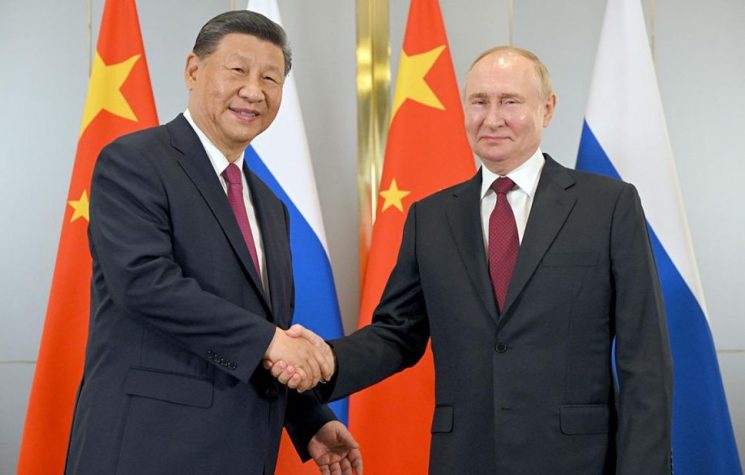

As a first observation, the reconfigurations of international monetary hierarchy are not, and never have been, market processes, as is generally assumed. Economic agents and most nation-states have little capacity for strategic initiative in this field. It is, in effect, a dispute between major powers.

Perhaps because they focus on market data and the logic of economic agents above all else, the reports from Washington and Beijing did not give due attention to the geopolitical transformations the world is undergoing. Various initiatives to circumvent the dollar system, through the construction of a monetary and financial infrastructure at points sensitive to the hierarchy of the system, are in full swing, such as: the creation of spaces for pricing strategic commodities outside the dollar (especially oil); the establishment of multilateral financing organizations outside Washington’s veto power, thus providing space to operate with other national currencies; and the construction of international payment and interbank communication systems that bypass the SWIFT system. These are therefore processes whose dynamics the market forces don’t capture immediately, but are strong enough to exert structural pressure on the pillars of the dollar in the contemporary international system.

Regarding the pricing of strategic goods, since 2018, the Shanghai Futures Exchange has been trading oil and other commodity futures contracts in yuan, thereby creating a space outside the US dollar territory. For example, as China is the world’s largest consumer of industrial metals, but much of this trade occurs in dollars, the Shanghai Futures Exchange, in May this year, undertook a greater opening to promote the placement of the renminbi at the center of these contracts to the detriment of the dollar. On the other hand, Beijing is already preparing to open its domestic bond market to major Russian energy companies Gazprom, Gazprom Neft, and Rosatom. For these companies, “The placement of bonds in China will allow raising money at more affordable rates in yuan, which is important against the background of the high cost of loans in Russia and the ban on foreign loans.”

Regarding interbank communication systems outside the dollar territory, there are at least three in operation, at varying stages of development. There is Russia’s financial messaging system (SPFS), which manages to bypass the SWIFT system. Its recent success has led France and Germany to push for even tougher new sanctions against foreign banks that maintain commercial relations with Moscow through the Russian system.

Similarly, India has already developed its structured financial messaging system (SFMS), as have the Chinese, who have created their own international payment network, the Cross-Border Interbank Payment System (CIPS). To give you an idea, “Annual volumes through the Cross-Border Interbank Payment System (CIPS) reached around 175 trillion yuan ($24 billion) in 2024, a more than 40% year-on-year growth rate, according to its own data.”

In a recent article dated July 27, 2025, CNBC analyzed the interface between oil and non-dollar payment systems. “For years, China has been buying Iranian oil at a discount in bulk, and U.S. sanctions on Tehran have had little effect on this trade, according to analysts, thanks to a parallel transshipment supply chain and a yuan-denominated payment system that bypasses the U.S. dollar.” Thus, such initiatives have weakened the dollar’s power as an instrument of sanctions, while laying the foundations for a monetary and financial infrastructure that bypasses the dollar territory.

In the realm of international financial institutions, this year’s big news was the decision by the Shanghai Cooperation Organization (SCO) at its summit in Tianjin, China, to move forward with the creation of its own development bank. In addition to creating a new source of international financing in currencies other than the dollar, the new bank’s goal will be to bypass Euroclear and Clearstream in the settlement guarantee (final transfer of assets and money) and custody (safekeeping of assets) processes for securities in the region and worldwide. In other words, the intention is to create a financial infrastructure for settlement, custody, and asset management in cases of cross-border and domestic transactions involving securities, stocks, derivatives, and funds outside the dollar territory. This new bank will enable Russian corporations and banks, for example, to invest in foreign assets again without the risk of confiscation and freezing, and allow foreigners to invest in Russia without facing threats.

Therefore, it is not difficult to see that initiatives are already underway and at various stages of consolidation to reconfigure the international monetary geography. These focus on sensitive points within the system’s hierarchy. They are concrete facts from the most recent situation regarding the creation of a monetary-financial infrastructure, with the primary purpose of circumventing the dollar territory, implemented by states with the capacity to defend themselves against vetoes and retaliation.

Keep in mind that these are reactions to the dollar’s dominance, linked to the advantages enjoyed by the US over the last three decades in terms of: a disproportionate ability to sustain a global military structure and a history of uninterrupted wars, on the one hand; and widespread use of economic sanctions against the targets of its foreign policy, on the other.

It is not difficult to see that this reaction to the violence of the dollar goes hand in hand with tensions and competitive pressure among the major powers of the international system, marked by intensified rivalries in all strategic fields of the broader geopolitical dispute. Therefore, in the short term, as there is nothing to indicate a slowdown or deceleration of these rivalries between the major powers, nor is there any indication that one side will be able to impose itself unilaterally, there will continue to be a willingness to confront the violence of the dollar by building a less hierarchical international monetary geography. In this sense, it argues that the world has already passed the point of no return in transitioning to a unilateral dollar-centered order, moving toward other configurations, most likely the formation of monetary blocs, as has occurred at different times in history.

Regarding the speed of these transformations, it notes that when pressures that strain the international monetary hierarchy are triggered, they do not necessarily involve protracted processes full of inertial forces, as is commonly assumed.

After World War II, for example, both the victors settled their conflicts in dollars, through the lend-lease mechanism (1941-45), and the defeated, through the war reparations established in the peace treaties. Added to this were the Bretton Woods Agreements of 1944, which established the dollar as the center of the new system under construction. At the time, although little commented on in the specialized literature, the imposition of the dollar occurred directly and without constraints. According to the British representative at Bretton Woods, the famous economist John Maynard Keynes, “We, all of us, had to sign, of course, before we had had a chance to read through a clean and consecutive copy of the document (…). All we had seen of it was the dotted line. Our only excuse is the knowledge that our hosts had made final arrangements to throw us out of the hotel, unhoused, disappointed, unaneled, within a few hours.”*

However, within just two years, with the outbreak of the Cold War in 1947, a monetary geography marked by global bipolarity was established, with the dollar territory on one side and the ruble territory on the other. This monetary geography closely mirrored the features of the emerging new military, political, and ideological world order. The monetary bipolarity that characterized the early decades of the Cold War only changed in 1971, as a result of the triangular diplomacy of 1969, when, within two years, China and the USSR rejoined the dollar territory, establishing, only then, the effective globalization of the US currency**.

Therefore, concluding the argument in suggestion, unlike the conclusions of the Federal Reserve report, it is understood that the international monetary system has already passed its point of no return to an international monetary order centered on a single national reference currency. The process for a new redesign of monetary geography will not necessarily be as slow as economic analysts generally assume and market data suggest. As has been the case throughout history, the dispute between the great powers will determine both the direction and speed of events in the monetary field. As the former president of Argentina, Cristina Kirchner (2007-15), once said, accurately, succinctly, and somewhat bluntly: “It’s geopolitics, stupid.”

* Steil, Benn. The Battle of Bretton Woods: John Maynard Keynes, Harry Dexter White, and the Making of a New World Order. Princeton University Press. New Jersey, 2013. (p. 251).

** Metri, M. História e Diplomacia Monetária. Editora Dialética. Rio de Janeiro, 2023. (Cap 8 e 9).