What emerges is rather a Roman friendship; adversaries bound by overlapping interests, mutual restraint, and shared enemies.

Join us on Telegram![]() , Twitter

, Twitter![]() , and VK

, and VK![]() .

.

Contact us: info@strategic-culture.su

Despite having a strong narrative opportunity regarding Guyana, which Trump is silent about, the U.S. President neither pursues regime change, nor major kinetic action, in Venezuela for numerous reasons. Significantly these are not to provoke a rise in energy costs, and also with respect to Russia-Venezuela relations, which are good. The renewed positive relationship between Russia and the U.S. figures prominently in understanding the nature of the great game at work.

Military action and confrontation are foolish and do not need to begin when they provide no long-term advantage to the would-be aggressor. Venezuela holds the largest proven reserves in the world and exports around 700k–800k barrels per day, with approximately 303 billion barrels as of 2024, ahead of Saudi Arabia. Conflict-historical precedence strongly suggests such a conflict could push Brent crude up by $10–20 per barrel almost immediately, and this figure would either sustain or increase based upon the duration or unpredictability of such a conflict in Venezuela.

Critically, Trump’s approach with Russia reverses the trajectory taken by the Biden administration, and this relates significantly to the U.S. policy under Trump on Venezuela: eliminating the material foundation for future conflict by managing, guaranteeing, and incorporating the long-term interests of ExxonMobil and Chevron, masked by an optical theatre of “taking out drug cartels,” while also improving the overall position of Venezuela regarding PDVSA. This raises the question: are Trump and Maduro, in the Roman sense, “friends”?

FIGURE 1 – CPC route

A World Without Harris – Who? We have already forgotten her

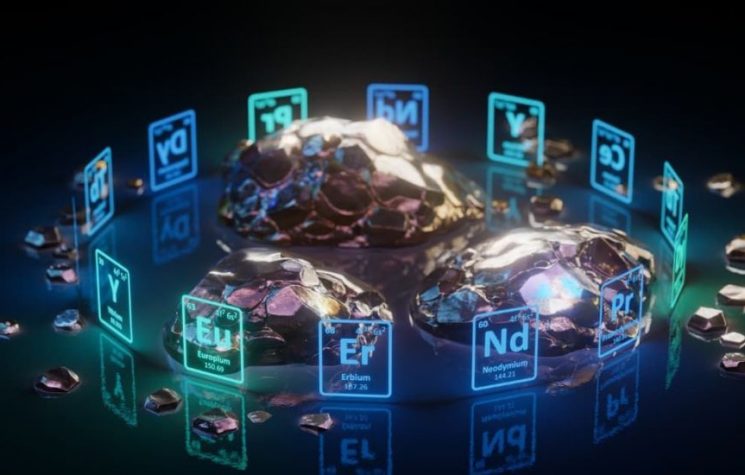

A Harris administration that would have pushed for open war and further sanctions on Russia would have forced Chevron to abandon its 15% stake in the Caspian Pipeline Consortium (CPC).

Lopsided support for Harris against Trump from both big-oil companies seems to suggest that their in-house analysts were reading the situation very wrong. In this, they would have believed the Biden administration and false intelligence suggesting that Biden’s position of signaling too-high-a-cost for Russia in Ukraine, through gradual escalation, would yield a Biden-desired result: after a period of withdrawal from the CPC, Chevron would have gone back in as perhaps an even larger shareholder. That is, a Russian withdrawal from Ukraine, a ceasefire/peace favoring “Ukraine” (NATO), and perhaps even leading to the removal of Putin. After this, the U.S. would have returned to the CPC and any assortment of other new projects in Russia, under either a new Russian administration or significant pressure on the present Russian administration, but in either event under terms favorable to Chevron and ExxonMobil.

As noted, team Biden was operating under zero-sum game ideations, consistent with defection/forced agreement models arising from primitive and aggression-rewarding von Neumann-Morgenstern game theory.

However, after several failed offensives by the AFU, the U.S. running out of ammunition, and increasing Western conventional awareness of the eventual Russian success in its SMO, the metric and final position of big-oil shifted, leading to an orientation toward Trump and prospects for rapprochement with Russia.

With ExxonMobil, Trump appears unmoved to defend it against Venezuelan claims on Guyana; in fact, Trump has not raised this crucial point in his “anti-drug cartel” optics against Venezuela.

Last March, Trump implemented a Treasury Department OFAC waiver, GL 41B, to allow Chevron to continue to some degree in Venezuela, replacing 41A that had forced a wind-down period. It is unclear to what extent 41B is interpreted, but to date, Chevron continues to operate in Venezuela under a combination of known OFAC waivers containing restrictions, in a profitable manner. While it is difficult to arrive at consistent answers from official representatives on details and framing (we are winding down still vs. we are going on but limited), it is clear that business continues.

As we find now so often to be the case, surface-level optics and rhetoric are designed to draw superficial conclusions to the contrary. This report outlines some features of the very complex reality, involving sophisticated counterparties, which justify our conclusion.

The following is far from complete but demonstrates a number of critical research avenues for further development by larger teams.

Outline of Key Points:

1. Trump does not seek regime change in Venezuela, and instead uses Axelrod model game theory (multiple moves) to pursue a course for cooperation, not conflict.

- Trump’s relationships with Chevron and ExxonMobil are understood as both personal and political, but also through tit-for-tat in the Axelrod model, which does not permanently punish ExxonMobil but instead gives them reasons for adapting to Trump foreign policy.

Politically, before the next stages of the game commence:

- Trump is closer to Chevron

- Trump is farther from ExxonMobilYet policy-wise, Trump balances reciprocating loyalty (Chevron) against incentivizing permanent opposition (ExxonMobil) as Axelrod moves continue.

- Hence, Trump does not alienate ExxonMobil or unnecessarily push them to oppose him later – rather, he provides them fair opportunities negotiated with Putin, including re-entry into the Sakhalin-1 project.

- But Trump ties those opportunities for ExxonMobil to his rapprochement with Russia. Therefore, he creates opportunities for Exxon in ways that tie them to his policy and against Russophobic Atlanticism. Trump guarantees Chevron’s role in the Caspian CPC and further joint Russian projects after the SMO.

- Trump’s anti-Maduro rhetoric satiates certain “Floridian” demographics in the U.S. and aligns with narrative formation internally, not real policy internationally. The same is true on Maduro’s end.

- The entire narrative conceals the U.S. push against Colombian drug cartels, FARC, and Colombia’s support for Ukraine through sending old-guard CIA assets (cartel members), ex-Colombian military personnel as mercenaries, all under the optics of this being about “Venezuelan cartels.”

- The profound absence of a real casus belli that the U.S. could pursue against Venezuela surrounds Venezuela’s claim on the ExxonMobil operating base in the form of Guyana but is ignored. This point is tremendously significant.

- Hence, Trump does not support regime change in Venezuela, even though it would allow Exxon to hold on to Guyana without potential conflict and deliver them favorable terms in a return to Venezuela.

- The specter that Trump “may move militarily against Venezuela” in a serious way is used to signal to Europe and Israel that energy prices may rise further and that U.S. military resources cannot be overly shared.

- Other bonuses include, especially if some kinetic activity arises, joint Trump-Maduro elimination of Colombian mercenaries/cartel paramilitaries before they reach Ukraine.

- Russia’s Rosneft partners with PDVSA in projects like Petromonagas, Petrovictoria, Petromiranda, Boquerón, and Junín-6 in the Orinoco Belt.

These gave Moscow both equity oil and leverage over Caracas, while helping PDVSA access capital and technology when U.S. sanctions locked it out.

- Maduro previously openly called for the possibility of friendship between himself and Trump.

Strategic Analysis:

Events in Venezuela and apparent U.S. bellicosity reveal a distinctive feature of Washington’s recent foreign policy under Trump: a war-like posture that, when interpreted through game-theoretic models, can appear to encourage reciprocal cooperation. Using non-zero-sum reasoning, rational choice, and repeated-interaction logic as analytical tools helps illuminate patterns that might otherwise seem contradictory or opaque.

Energy is a central driver in this dynamic. By signaling what can appear as unilateral generosity, the U.S. creates incentives for rational responses from the counterparty, producing cooperation in a pattern reminiscent of Axelrod’s iterated tit-for-tat model. In this sense, stability can emerge without formal agreements or enforceable bargains. This contrasts with the post-Cold War dominance of zero-sum strategic thinking, which emphasized conflict and binding arrangements. While von Neumann-Morgenstern game theory provides technical tools for both zero-sum and cooperative scenarios, the historical focus was often on adversarial logic rather than repeated strategic signaling.

What distinguishes the current period is a reversal of traditional approaches. Rather than claiming peace to justify war, the U.S. appears to be posturing for conflict as a mechanism to secure strategic stability: a form of peace through strength. This pattern can be observed in Trump’s policy toward Iran over the summer and now in Venezuela, where carefully calculated moves and anticipated responses create a stable equilibrium in a complex strategic environment.

The Post-Cold War U.S. was a Bad Faith Actor

The old model made the U.S. non-agreement-capable, built on imperial hubris inherited from the victories of a bygone era. A hubristic and undiplomatic culture arose on the shoulders of past generational success; a culture that was not the one that originally produced that success. This is a Spenglerian/Toynbeean paradox.

As popular culture puts it: “Hard times create strong men, strong men create good times, good times create weak men, and weak men create hard times.” G. Michael Hopf laid this out in his 2016 novel Those Who Remain, though clearly influenced by Ibn Khaldun’s Al-Muqaddimah from 1377.

In the moribund post-Cold War model, hostility was disguised as civility through human rights imperialism and so-called “nation-building.” Today, as the U.S. under Trump attempts to become “agreement-capable,” it is necessary to build trust for cooperation within the rubric of game theory. At the same time, both the military-industrial complex and key vectors of the right-wing American populace require performative politics and symbolic appeasement. To maintain their support, no one can appear more hawkish or hardline in rhetoric than Trump.

So rhetoric is received, and it operates along a cost-benefit metric. Statements that appear kinetic might actually serve to temporarily enhance the stock value of MIC firms, a game that can be played similar to insider trading.

It was perhaps an error for the U.S. not to recognize the facts of the changing world at an institutional level until eight years ago. Even then, four of those years under Biden were wasted resisting this reality, rolling back Trump’s efforts, and holding on to a model of conflict with Russia and the absurd notion of building a “Pacific response” militarily to contain China. As a consequence, the conflict in Ukraine began in 2022.

Meanwhile, BRICS and the multipolar world proceeded along their own developmental course. At a certain point, Washington and Wall Street had to rationalize themselves with the emergent and the inevitable: the U.S. empire in steady decline, the petro-dollar far from what it once was, and the role of the dollar as a stand-alone reserve currency increasingly diminished.

From a functionalist, systemic perspective, this represents a recalibration. How it was experienced by oligarchic players on the ground, each pursuing their own interests and being welded into the old ways of business, is better understood through a conflict-theory lens. It was, in many ways, a fight to the death. This explains the internal political conflict in the U.S.: contested elections like 2020, the culture war as both distraction and reality, accusations against Trump over the alleged and since-debunked “Russia collusion,” several assassination attempts on Trump, lawfare to prevent his second presidency in 2024, realignment in the Middle East, a direct economic contest against the EU, defunding of the Ukraine war, and even threats to annex Canada and “liberate” Greenland from the King of Denmark.

Neo-Realist Trump on Venezuela: Bellicose Rhetoric to Arrive at Win-Win

Mainstream U.S. commentary on Venezuela often distorts the basic alignments at play. Liberal and progressive outlets like The Hill, The New York Times, and Washington Post describe Trump as a hardliner against Maduro and yet appear to cheer this on while criticizing his vacillations. At the same time, conservative Cuban and Venezuelan exiles in Florida often assume Trump shared John Bolton’s obsession with regime change. Both frames are misleading.

Bolton’s use of Juan Guaidó as an asset was a continuation of the Clinton-era “deep state” toolkit, and in both structure and form went against Trump’s strategic posture. Trump, for his part, described Maduro as “strong” and preferred him over Guaidó, whom he described as a “skinny kid” and “wet behind the ears.”

If Trump were serious about “taking out” Maduro and doing more than a little optical sword-rattling to conceal the real Axelrod-type rational-choice deal-making behind the scenes, he would have made a larger-than-life issue of Maduro’s claim of legal annexation of a large part of Guyana. Instead, on this subject, we heard only crickets.

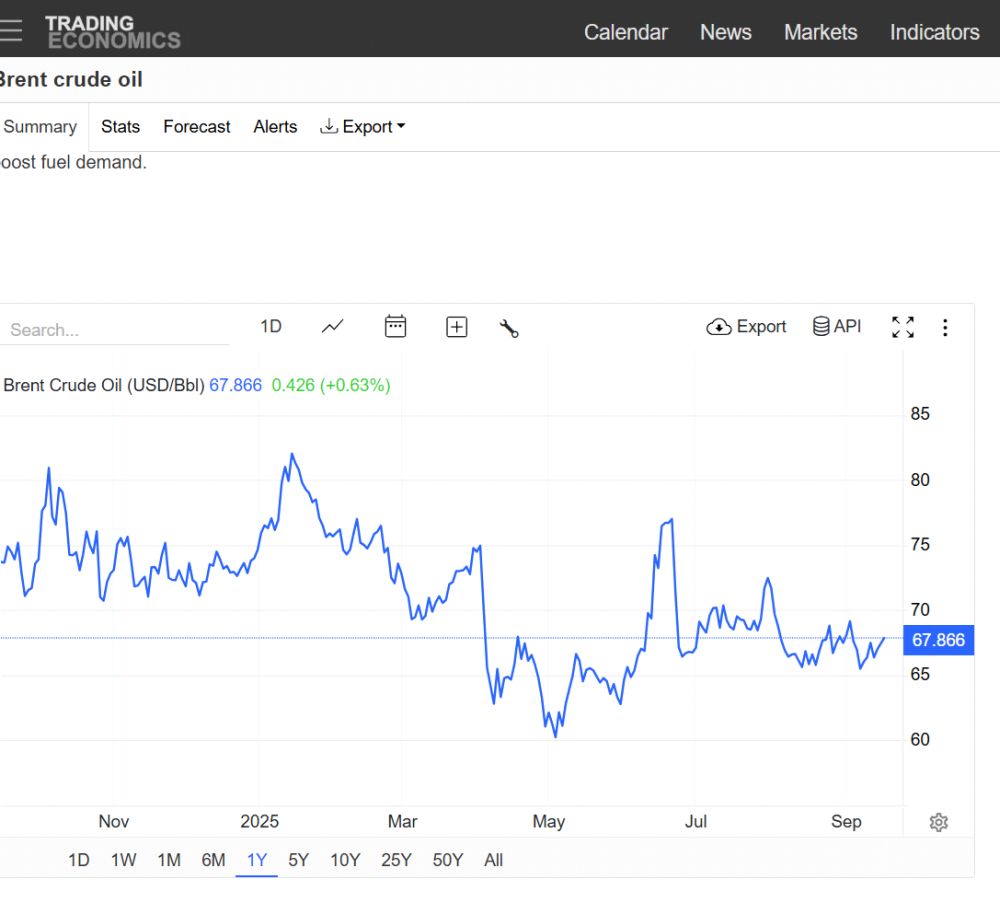

In addition, sophisticated actors within the oil industry itself seem to read Trump very well. Typically, realistic signs of approaching bellicosity with the world’s largest holder of oil reserves would see a notable spike in Brent crude per barrel. Instead, ‘everyone’ who needs to know that events are proceeding smoothly is acting accordingly.

FIG 2 – No anticipatory panic in Brent crude

Although Venezuela produces heavy crude like Merey 16 rather than Brent, disruptions to its output still affect Brent prices globally. Brent serves as the main international benchmark, so any sudden Venezuelan supply shock changes refinery planning, trade flows, and market expectations. Even if Merey itself isn’t traded as Brent, traders adjust Brent and other global benchmarks in response, which is why any Venezuelan conflict can drive spikes in Brent prices indirectly.

To understand why Trump ignored Venezuela’s annexation of western Guyana while talking instead about drug trafficking, the answer lies less in foreign policy orthodoxy of the old guard and more in what we may term a Nash-Axelrod logic approach. By “Nash-Axelrod logic,” we mean the combination of Nash’s non-cooperative equilibrium reasoning with Axelrod’s insight that repeated interactions can sustain cooperation through reciprocal strategies like tit-for-tat.

Zero-sum framing: the von Neumann–Morgenstern model

Von Neumann and Morgenstern’s classic game theory assumes zero-sum outcomes: one player’s gain is automatically the other’s loss. Applied to geopolitics, this model underpins Cold War logic: the U.S. must overthrow Maduro because every barrel of oil Venezuela sells to Russia or China diminishes U.S. power. Bolton, Clinton, and the intelligence bureaucracy going back to the early 90s acted from this template. For them, Venezuela is a front line in a binary contest where regime change equals victory.

But this framework does not explain Trump’s behavior. Trump did not escalate over Venezuela’s declared annexation of western Guyana in 2024, nor did he take Maduro’s alignment with Russia as a direct defeat. Instead, he redirected discourse toward drugs and transnational crime. Trump views these conflicts through a different lens, closer to Nash-Axelrod than von Neumann.

Nash equilibrium: multiple players, overlapping payoffs

Nash reframed game theory by focusing on equilibrium rather than zero-sum outcomes. In a Nash equilibrium, players choose strategies such that no one can improve their position by changing strategy alone. This framework allows for situations where adversaries cooperate tactically, not out of friendship, but because destabilization would worsen outcomes for both. A classic “Roman friendship.”

Trump and Maduro illustrate this. Trump’s focus on drug interdiction, especially against old-guard CIA-linked rogue networks out of Colombia, creates space for Maduro to act against FARC on the Colombian border. Maduro gains by weakening insurgents that threaten Venezuelan sovereignty. Trump gains by choking off a channel of illicit narcotics that undermines his domestic political project, and can signal to Russia some aid in reducing the number of potential foreign mercenaries from Colombia in the AFU ranks. Neither “wins” in the zero-sum sense, but both stabilize their positions against rogue actors within their own systems toward win-win.

Politics: Russia, Venezuela, Chevron, ExxonMobil, and the Deeper Equilibrium

Energy explains why Trump emphasizes drugs over Guyana. Hugo Chávez came to power in February 1999 and soon reshaped Venezuela’s oil sector under stronger state control. By 2007–2008, PDVSA required all foreign companies to cede majority ownership (51%) of their Venezuelan operations. ExxonMobil resisted, leading to a gradual exit, while Chevron agreed to continue operations under PDVSA joint ventures. In 2015, Exxon shifted focus to Guyana’s offshore Stabroek Block, while Chevron remained in Venezuela.

Chevron’s operations persisted through Trump-era sanctions (2017–2020) and into the Biden era, sustained by limited licenses and tacit U.S.-Venezuelan accommodation. These constraints made the 2007–2008 PDVSA terms workable but under strict oversight. Maduro’s annexation of Essequibo in 2024–2025 primarily threatened Exxon’s Guyana operations, not Chevron’s Venezuela-based assets. Trump’s strategic preference for Chevron is reflected in campaign and administration alignment: Chevron contributed significantly to Trump’s inaugural fund and adhered to his policy framework, creating a mutually beneficial alignment.

FIG 3 – Russia’s Sakhalin-1 project (source www.itochuoil.co.jp/e/project/001_sakhalin.html )

Trump’s policy is heavily shaped by rapprochement with Russia, which stabilizes Venezuelan operations and global energy flows. In September 2025, the U.S. facilitated ExxonMobil’s re-entry into Russia’s Sakhalin-1 project, providing a major concession to Exxon while maintaining Chevron’s privileged position in Venezuela. Chevron, in addition, is now positioned to keep their CPC shares, and whatever other future joint projects can come with further warming between the U.S. and the Russian Federation.

Kpler.com notes on July 29th, 2025, ( https://www.kpler.com/blog/chevrons-venezuela-comeback-will-spark-heavy-crude-price-correction ) that Trump’s reversal on Venezuela sanctions allows Chevron to prosper in-country. They also see rather than hostility leading to a price-increase, that a downdward price correction is already being seen, with more expected.

“The potential resumption of U.S. purchases of Venezuelan crude is expected to trigger a downward correction in Canadian oil prices, both in the U.S. and in Asia. Western Canadian Select (WCS) crude is currently priced near record highs at around -$2.50/bbl against WTI at Cushing, while WCS at Hardisty recently saw its discount widen to approximately -$11/bbl — down from around -$9/bbl in June, but still markedly stronger than the -$14/bbl level seen in July last year, according to Argus Media assessments. As a result, landed prices for high-TAN Canadian crude in China rose to around -$1.50/bbl versus ICE Brent, a sharp increase from -$2.50/bbl last month, despite expectations that crude loadings from the TMX system on Canada’s West Coast would increase in August and September.”

This snapshot explains the larger move which integrates Russia, the U.S., Venezuela, and their respective oil interests into a single strategic framework. Russia gains partnerships, while Maduro ensures survival and revenue. Chevron maintains access on two continents, Exxon gains a valuable asset, and Trump centralizes influence while avoiding destabilizing shocks politically and to the price of oil. This forms a Nash-style equilibrium, where overlapping payoffs allow cooperation without formal alliance.

Trump’s focus on narcotics serves as a flexible populist smokescreen for Floridians and others moe ‘hyped up’ on kinetic action (like a whole generation of low-brow but otherwise patriotic Americans), while also permitting attacks on real-existing rogue CIA factions and cartel-linked actors still loyal to the old-guard (Obama/Clinton, etc.) and Trans-Atlantic vectors domestically, while also hiding the deeper energy diplomacy that underpins this multi-actor equilibrium. Maduro benefits from Russian backing, American support, which provides leverage and stability, forming the “secret friendship”: public bellicosity between Trump and Maduro paired with behind-the-scenes actual coordination.

Russia, for its part, has energy partnership with Venezuela dates back two decades, centered on Rosneft-PDVSA joint ventures in the Orinoco Belt, including Petromonagas, Petrovictoria, Petromiranda, Boquerón, and Junín-6. The Russian Federation also extended more than $17 billion in loans since 2006, often collateralized with oil shipments, and Rosneft regularly lifted Venezuelan crude as repayment.

Although Rosneft formally exited some ventures in 2020 to avoid U.S. sanctions, assets were reportedly shifted to the state firm Roszarubezhneft, keeping Russian stakes alive. Since 2022, under Western pressure over Ukraine, cooperation has deepened. By 2025, these projects remain intact, having providing both economic survival and geopolitical leverage against Washington during the Biden regime years, but now figure in to the rapprochement.

Trump Silence on Venezuela’s Guyana Claim

The Essequibo territorial dispute illustrates the symbolic dimension of Venezuelan claims. Venezuela created legal and political structures for a new state, Guayana Esequiba, and staged votes in 2023–2025, but Guyana continues to administer the territory. ICJ rulings in 2023 and 2025 reinforced Guyana’s sovereignty. The stakes are defined by oil interests: ExxonMobil holds 45% of the Stabroek Block, Hess 30%, and CNOOC 25%. Chevron’s planned acquisition of Hess would consolidate U.S. stakes. Venezuela frames Guyana’s development as theft, while the U.S. is incentivized to protect its corporate investments in several ways, yet none really push it to make this the public issue. The silence speaks loudly.

Maduro’s Continuously Positive Public Signals to Trump

Maduro has continuously, and positively, signaled to Trump quite openly his complex understanding of the situation just earlier this month, September, 2025. ( https://t.me/NewResistance/39889 )

Here, Maduro says that Trump is intelligent and bold

In those statements, Maduro does not blame Trump for the gunboat diplomacy at work against Venezuela – but rather lays responsibility on Marco Rubio.

Maduro explained that Marco Rubio effectively wants to entrap Trump, bloody Trump’s otherwise clean hands, and push him towards making a grave error that will cause war across the region, which people will remember for centuries – ruining the potential for actual Pan-American cooperation.

Maduro concludes, expressing confidence, that Trump knows what to do and will handle this the correct way.

This connects to a previous pattern :

In July, 2024, Maduro said in the linked video that he believes he and Trump can be friends (https://t.me/NewResistance/30338).

“If we had met, Trump and I would have understood each other — we could even have become friends… [Bolton and Pompeo] led Trump to a failure. False advisors!”

Again, Maduro understands the difference between Bolton (or Pompeo) and Trump. The Iranians, though more quietly, also certainly understand the difference.

Final Summary

Trump’s Venezuela policy is not the blunt-force regime change operation many geopolitical trainspotters still imagine. Instead, it represents a recalibrated, game-theoretic strategy that trades in optics of hostility for the substance of equilibrium. Trump signals bellicosity while avoiding kinetic escalation, using a Nash-Axelrod style of repeated interactions that allow cooperation with adversaries under the veil of rivalry.

By privileging Chevron’s long-term stake in Venezuela while still offering Exxon avenues of re-entry via Russia, Trump ties U.S. corporate energy interests directly to his broader rapprochement with the Russian Federation. This not only manages oil price stability but also reshapes strategic alignment away from zero-sum imperatives of the past. His silence on Venezuela’s claim over Guyana, his OFAC waivers, and his drug-war optics are all parts of a calibrated theatre, designed to pacify domestic hawks while pursuing stability abroad.

Maduro, for his part, understands the distinction between Trump’s performative hostility and his actual posture, repeatedly signaling openness to cooperation and even “friendship.” Russia, for its part, ensures PDVSA’s success and integrates Venezuelan crude into its own geopolitical strategy, now under conditions far more favorable to Trump’s multipolar rapprochement than to Biden’s zero-sum escalations.

What emerges is not a story of “secret friendship” in the sentimental sense, but rather a Roman friendship; adversaries bound by overlapping interests, mutual restraint, and shared enemies. Trump and Maduro may spar in rhetoric, but in practice, both sides navigate toward a win-win equilibrium that secures survival for Venezuela, profits for U.S. energy majors, leverage for Russia, and stability for Trump’s foreign policy framework.

Follow Joaquin on Telegram @NewResistance