If India really is considering dumping Russia oil, this only harms U.S. interests and drives the BRICS model forwards at even a greater speed making Americans the biggest losers.

Join us on Telegram![]() , Twitter

, Twitter![]() , and VK

, and VK![]() .

.

Contact us: info@strategic-culture.su

If India really is considering dumping Russia oil, this only harms U.S. interests and drives the BRICS model forwards at even a greater speed making Americans the biggest losers.

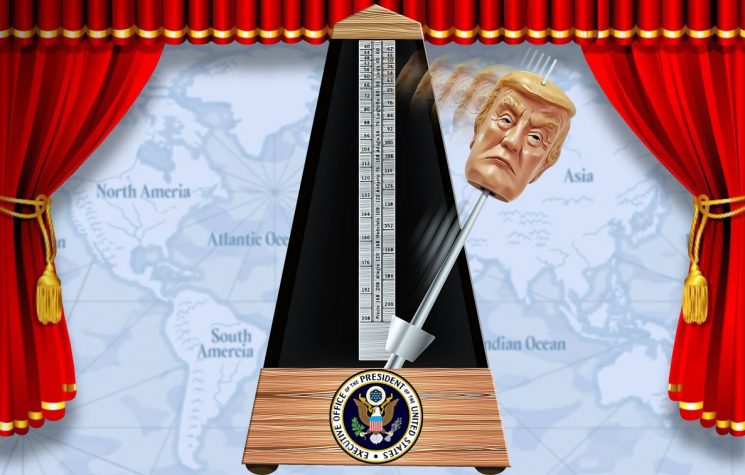

The announcement at a press conference with the British prime minister by Donald Trump that he was about to increase sanctions to Russia as well as roll out ‘secondary sanctions’ against countries which do business with Russia raised a few eyebrows. For those who wondered whether Trump even knew what secondary sanctions are – sanctions which punish countries which do business with the country which you are sanctioning directly yourself – there was some comfort. Trump knows well what they are as in his first term in office, he dished them out to Japan, China. South Korea and Turkey for buying oil from Iran. And they failed.

The problem with secondary sanctions is twofold. Firstly, they’re practically impossible to impose unless you exercise your hegemony to the point of threatening to go to war with the countries you’re targeting. The first time round, he pulled the U.S. out of the JCPOA – the so-called ‘Iran deal’ – which Obama had secured with the Iranians but found months later that China had simply ignored them and carried on buying its oil from Iran. Then the others followed.

And, secondly, when they do fail you look pretty stupid for trying and failing to impose them. Weak rather than strong.

The problem for Trump is that he really should be careful what he wishes for. While it’s true to say that the current sanctions he has imposed have put more money into the Fed as consumers pay higher costs buying the same products, it harms and threatens local business as there is less cash about and so the demise in confidence has a knock-on effect. While it is also true that some big companies in Japan and Germany have relocated to the U.S. to offset them, the blueprint that Trump has – to create new jobs in manufacturing – is woefully out of touch with today’s economy. Manufacturing these days is done with robots.

There is really very little original joined-up thinking with Trump’s obsession with tariffs or sanctions. There is very little about international trade and politics he understands, but he believes tariffs or are a quick fix solution for the U.S. getting a fairer deal with countries around the world who have restricted U.S. goods into their markets for decades, like India. Yet his own hubris here is worrying. What he is trying to do is to devalue the dollar so that both U.S. companies get an edge with their export markets – as their goods would be cheaper – while trying to sustain, if not increase, America’s hegemony. The problem with this bold plan is its timing and its lack of originality. In 1971, Richard Nixon did exactly the same thing when he tried to rebalance the grotesque size of the dollar economy around the world verses a declining local manufacturing base – what some economists call the parasite which is five times the size of the animal which it has attached itself to. During that scary period, one of Nixon’s top people told the Europeans “it’s our dollar but it’s your problem”.

There is scant evidence that such a stunt can be pulled off again though in the multilateral world we live in. America simply doesn’t have the clout that it used to have although it’s easy to understand why he can still succeed with such a scheme when the EU rolled over and let him have a 15% tariff on their goods.

The Global South countries – which are expanding BRICS at an alarming rate – have more political and economic clout. They have leaders who put the pusillanimity of Ursula von der Leyen in a correct light – the EU is a super elitist globalist power base and very little to do with European citizens – and won’t be pushed around any more by the U.S.

Russia has proved that it can resist the U.S. and its sanctions by adapting its business practice and galvanising more lucrative trade with BRICS countries, while still selling oil to whomever it wants. A lot of Russian oil is bought by India and resold, often to countries whose citizens are woefully ignorant of the top dollar they are paying, like the UK. Trump believes this is how to hit Russia hard by bullying countries like India but such a move, if it succeeds in India, will only accelerate even more the process of homogenisation of BRICS countries while pushing more global countries to join it. If Indian firms are hit with a ‘super tariff’ or ‘secondary sanctions’ they may well go the full nine yards and simply forget about the U.S. market entirely; if they decide to weather the storm, again, more money will be taken away from millions of Americans draining liquidity and scaring U.S. firms who operate there while Modi does what everyone does when his with secondary sanctions on oil: work out an ingenious solution to keep buying the oil, albeit on a surreptitious basis.

And is Trump going to impose secondary sanctions on even European countries who brazenly import oil or gas from Russia, like Hungary, Italy, Czech Republic, Slovakia and Belgium? Some of the elites in these countries are worried about how their exports to the U.S. are even going to be sold with a new 15% tariff anyway.

Unlikely. India will be the target, the example to the world that the U.S. can flex its muscles. But India has some pretty powerful allies around the world who might rally to its aid, like Brazil, South Africa, China (and, of course, Russia) and such sanctions will almost certainly accelerate the process of BRICS expanding and it creating its own currency, central bank and banking platform – while others continue with ‘dollar dumping’ (where central banks of Global South countries sell their dollar reserves for a basket of other global currencies). Worse, and one aspect which shows that Trump is really gambling with the future of the U.S. economy – and in particular his blue collar support base – is the risk of a number of countries who start to lose confidence in U.S. debt which, in broad terms, is around 40 trillion dollars. About 20 percent of that is in U.S. treasury bonds, with Japan holding the most at 1 trillion dollars. If Japan were to decide that this bond is not so secure and might even lose its value, they might decide to sell it – but sell it to poorer countries or even at a fraction of its real worth, which would undermine the global confidence the U.S. has with its debt. It’s still America’s dollar, but it’s still the rest of the world who supports it. But for how long? Taking on Russia simply to nurse his own insecurities and foibles seems like playing Russian roulette. But trying to destroy Russia’s economy through secondary sanctions? Make that Russian roulette with all six chambers with a round in. Don’t worry about BRICS though as Trump has a solution for that. Yes, you’ve guessed it. More tariffs.