The new era marks the end to ‘old politics’: The Red vs Blue; Right vs Left labels lose relevance.

Contact us: info@strategic-culture.su

Even the need for transition – just to be clear – has only just begun to be recognised in the U.S.

For the European leadership however, and for the beneficiaries of financialisation who haughtily lament Trump’s ‘storm’ unwisely unleashed on the world, his base economic theses are ridiculed as bizarre notions completely divorced from economic ‘reality’.

That is completely untrue.

For, as Greek Economist Yanis Varoufakis points out, the reality of the western situation and the need for transition was clearly spelled out by Paul Volcker, former chair of the Federal Reserve, as long ago as 2005.

The harsh ‘fact’ of the liberal globalist economic paradigm was evident even then:

“What holds together the globalist system is a massive and growing flow of capital from abroad, running to more than $2 billion every working day – and growing. There is no sense of strain. As a nation we don’t consciously borrow or beg. We aren’t even offering attractive interest rates, nor do we have to offer our creditors protection against the risk of a declining dollar”.

“It’s all quite comfortable for us. We fill our shops and garages with goods from abroad, and the competition has been a powerful restraint on our internal prices. It’s surely helped keep interest rates exceptionally low despite our vanishing savings and rapid growth”.

“And it’s [been] comfortable for our trading partners too, and for those supplying the capital. Some, such as China [and Europe, particularly Germany], have depended heavily on our expanding domestic markets. And for the most part, the central banks of the emerging world have been willing to hold more and more dollars, which are, after all, the closest thing that world has to a truly international currency”.

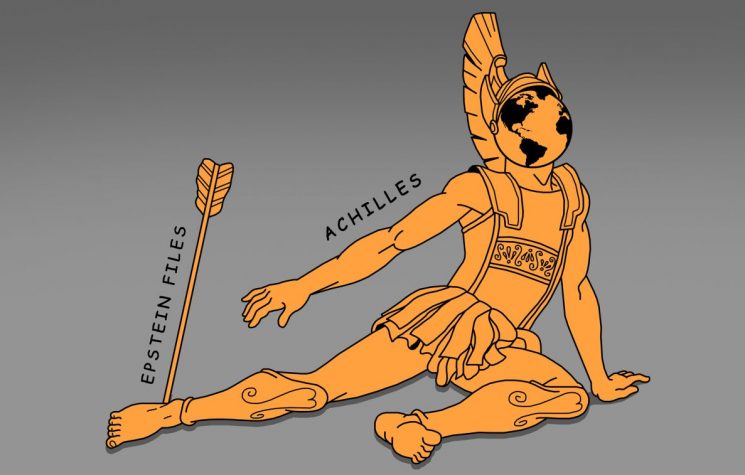

“The difficulty is that this seemingly comfortable pattern can’t go on indefinitely”.

Precisely. And Trump is in the process of blowing up the world trading system so as to re-set it. Those western liberals, who today are gnashing teeth and lamenting the advent of ‘Trumpian economics’, are simply in denial that Trump has at least recognised the most important American reality – ie. that the pattern can’t go on indefinitely, and that debt-led consumerism is way past its sell-by date.

Recall that most participants in the western financial system have known nothing other than Volcker’s ‘comfortable world’ their entire life. No wonder they have difficulty thinking outside their sealed retort.

That does not mean, of course, that Trump’s solution to the problem will work. Possibly, Trump’s particular form of structural rebalancing could make matters actually worse.

Nonetheless, restructuring in some form clearly is inevitable. It comes down otherwise to a choice between bankruptcy slow, or fast and disorderly.

The dollar-led globalist system worked well initially – at least from the U.S. perspective. The U.S. exported its post-WW2 manufacturing over-capacity to a newly dollarized Europe, who consumed the surplus. And Europe too, enjoyed the benefit of having its macroeconomic environment (export-led models, guaranteed by the U.S. market).

The present crisis began however, when the paradigm inverted – when the U.S. entered on its era of unsustainable structural budget deficits, and when financialisation led Wall Street to build its inverted pyramid of derivative ‘assets’, resting upon a tiny pivot of real assets.

The raw fact of the structural imbalance crisis is bad enough. But the western geo-strategic crisis goes much deeper than just the structural contradiction of inward capital flows and a ‘strong’ dollar eating the heart out of the U.S. manufacturing sector. Because it is bound up, too, with the concomitant collapse of core ideologies underpinning liberal globalism.

It is because of this western deep devotion to ideology (as well as to the Volker ‘comfort’ provided by the system) that has triggered such a torrent of anger and outright derision towards Trump’s ‘rebalancing’ plans. Barely a western economist has a good word to say – and yet no plausible alternative framework is offered. Their passion directed at Trump simply underlines that western economic theory is bankrupt, too.

Which is to say that the deeper geo-strategic crisis in the West consists in both a collapse of archetypal ideology AND of a paralytic élite order.

For thirty years, Wall Street sold a fantasy (debt didn’t matter) … and that illusion just shattered.

Yes, some understand that the western economic paradigm of debt-led, hyper-financialised consumerism has run its course and that change is inevitable. But so heavily invested is the West in the ‘Anglo’ economic model that, for the most part, the economists stay paralysed in the spider’s web. There is no Alternative (TINA) is the watch phrase.

The ideological spine to the U.S. economic model lies firstly with Friedrich von Hayek’s The Road to Serfdom, which was understood to mean that any government involvement in the management of the economy was an infringement of ‘liberty’ – and tantamount to socialism. And then secondly, following the Hayekian union with the Chicago School of Monetarism in the person of Milton Friedman who would pen the ‘American edition’ of The Road to Serfdom (which (ironically) came to be called Capitalism and Freedom), the archetype was set.

Economist Philip Pilkington writes that Hayek’s delusion that markets equal ‘freedom’ and were therefore consonant with the deeply embedded American Libertarian current “has become widespread to the point of all discourse being completely saturated”:

“In polite company, and in public, you can certainly be left-wing or right-wing, but you will always be, in some shape or form, neoliberal; otherwise you will simply be not allowed entry to discourse”.

“Each country may have its own peculiarities … but on broad principles they follow a similar pattern: debt-led neoliberalism is, first and foremost, a theory of how to re-engineer the state in order to guarantee the success of markets – and its most important participant: modern corporations”.

So here is the fundamental point: The crisis of liberal globalism is not just a matter of re-balancing a failing structure. Imbalance anyway is inevitable where all economies similarly pursue, all together, all at once, the export-led ‘open’ Anglo-model.

No, the bigger problem is that the archetypal myth of individuals (and oligarchs) pursuing their own separate and individual utility maximisation – thanks to the hidden hand of market magic – is such that in aggregate, their combined efforts will be to the benefit of the community as a whole (Adam Smith) has collapsed too.

Effectively, the ideology to which the West clings so tenaciously – that human motivation is utilitarian (and only utilitarian) is a delusion. As philosophers of science like Hans Albert have pointed out, the theory of utility-maximisation rules out real world mapping, a priori, thus rendering the theory untestable.

Paradoxically, Trump nonetheless, is of course the chief of all utilitarian maximisers! Is he then the prophet of a return to the era of swash-buckling American tycoons of the nineteenth century, or is he the adherent of a more fundamental re-think?

Put plainly, the West cannot transition to an alternate economic structure (such as a ‘closed’, internal-circulation model) precisely because it is so heavily invested ideologically in the philosophical underpinnings to the present one – that to question those roots seems tantamount to a betrayal of European values and of the foundational libertarian values of America (drawn from the French Revolution).

The reality is that today the western vision of its claimed Athenian ‘values’ is as discredited as its economic theory in the rest of the world, as well as amongst a significant slice of its angry and disaffected own populations!

So the bottom line is this: Do not look to the European élites for any coherent view on the emergent World Order. They are in collapse and are pre-occupied by trying to save themselves amidst the crumbling of the western sphere and the fear of retribution from their electorates.

This new era does however also mark the end to ‘old politics’: The Red vs Blue; Right vs Left labels lose relevance. New political identities and groupings are already being formed, even if their contours are not yet defined.