Our only “crisis” is this: we’ve nurtured the monster of systemic inefficiency that now suffocates us.

Contact us: info@strategic-culture.su

The imposition of protectionist policies by the U.S. and, to some extent, by the EU, ostensibly motivated by legitimate geoeconomic objectives (such as reindustrialization), is responsible for a paradox of investment inefficiency. This paradox reveals, once again, the true nature hidden behind Western agendas: pouring money into the economy and funneling available economic resources toward an unprecedented accumulation of wealth in human history while promoting an increasingly inefficient system. Addicted to easy profits, this system consistently opts for the most expensive—and consequently, most disastrous—strategies for our collective future. These are not my words, but those of Goldman Sachs in their report “Carbonomics: Tariffs, Deglobalization, and the Cost of Decarbonization”.

This behavior, which became apparent in the early 21st century, accelerated with the Subprime crisis. Instead of holding the true culprits of reckless speculation accountable, the powers entrenched in Washington and their servants in the EU, IMF, ECB, and World Bank chose to shift the blame onto the people of the South, particularly those in Southern Europe. They planted the prejudice that these nations had been “living beyond their means,” while shock austerity policies not only plundered national resources (public companies and fiscal reserves) to appease the urgency of “creditors” but also flooded Western economies with trillions of euros, feeding the voracious beast behind the gangsterized casino economy.

Unsurprisingly, none of this solved any problems. On the contrary! It fueled the monster of inefficiency and recklessness, with the sole purpose of accelerating the circulation of capital toward accumulation. Subsequent crises—COVID-19, the Ukraine war, and more recently, the “security crisis”—demonstrate that this resource-sucking monster has become an expert at inventing “crises.” Each new crisis is portrayed as more urgent, severe, and unprecedented than the last, invariably justifying the diversion of resources once allocated to education, housing, healthcare, or social security.

As noted by the Substack channel Another Angry Voice in one of its articles, we have reached the final stage of capitalism. Over the past 35 years (post-USSR), the acceleration of Western capitalism (the core of this mode of production) has transitioned from social democracy—which, despite its degeneration in the 1990s, still retained a significant portion of resources for public services—to neoliberalism, and more recently, to an even more brutal version. Varoufakis called it “Technofeudalism,” but it is nothing more than monopolistic capitalism—Sam Altman of OpenAI once said he was among those working for monopoly, because “competition is for losers”—and now we are entering the “gangsterist” phase. The result is simple: no one in the West can convincingly argue that the lives of workers (the overwhelming majority of the population) have improved in any essential aspect. Not only have they not improved, but they have worsened in every way!

The explanation is straightforward. From quantitative easing to quantitative easing, it has become absurdly easy for the oligarchy to demand money from states and watch it gush into their pockets in insane quantities. This exacerbates the debt levels of Western countries, leading to deficits, which in turn, justify more austerity, inside a vicious cycle of constant crushing and siphoning of resources meant for public services—services for all. Consider the German case: a government led by the CDU (Christian democrats) approved an irregular constitutional amendment to bypass deficit rules, allowing even more spending on war. This same CDU, under Merkel and Schäuble, was the party that forced the PIGS (Portugal, Ireland, Greece, Spain) to implement brutal austerity during the Subprime crisis, causing misery, hunger, and deaths in hospital emergency rooms because “there could be no exceptions to fiscal discipline.” Some call this “democracy.”

But before we could even catch our breath from this budgetary stretch, EU member states and the EU itself are preparing to pour trillions more into “businesses” to mitigate the effects of Trump’s tariffs. The Portuguese government, now led by a coalition of the liberal right (PSD), the reactionary right (CDS), and with support from the ultraliberal right (IL), is set to run a budget deficit for the first time in over eight years. It has also earmarked an additional €10 billion to address the problem. In other words, workers will pay higher prices for everything, while the business elite will concentrate the amounts given through subsidies. Meanwhile, more and more Portuguese workers, including graduates, are living and sleeping on the streets.

This reality demonstrates that every minor difficulty, every slight turbulence, is amplified to unprecedented levels by an army of “media outlets,” commentators, analysts, political scientists, and consultants. Their scripts are so well-rehearsed that they resemble a Star Wars-like drone army, tasked with generating alarmism, drama, fear, and outrage to justify yet another exception, another public fund, in an endless cycle of appropriation and concentration.

The numbers don’t lie. The EU alone allocated $1.17 trillion to “save” the banking sector during the 2007–2008 financial crisis (Crise financeira de 2007–2008 – Wikipédia, a enciclopédia livre), without any social conditions or demands. The money was simply pocketed and distributed as dividends to shareholders. During the COVID-19 crisis, expansionary monetary policies once again benefited banks, which borrowed at 0% interest from the ECB and lent at commercial rates of 10%, 20%, or 30%. Trillions of euros were handed to large corporations (the Recovery and Resilience Plan alone amounted to €700 billion, not counting what member states had already spent during the pandemic).

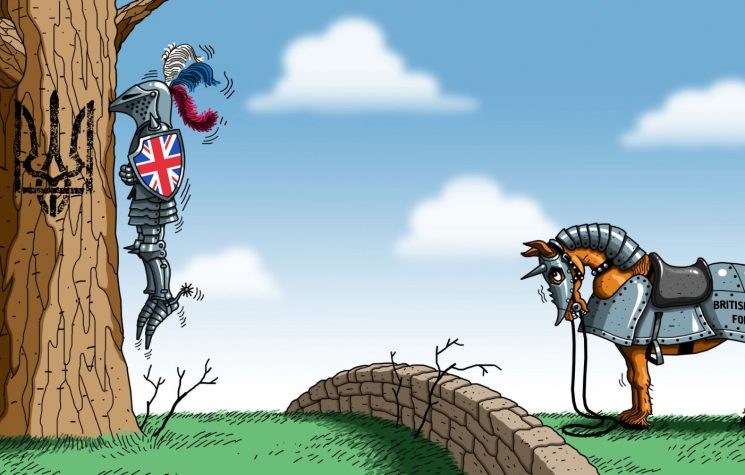

With the “Ukraine war,” on top of “aid” to the unfortunate country caught in Uncle Sam’s grip, the EU allocated vast funds to address the gas crisis, rising energy costs (particularly for “energy-intensive sectors”), approved tax incentives, subsidies for supply chain restoration, and incentives for the energy transition—from “dependence on Russia” to “dependence on the U.S.” All this was accompanied by labor market deregulation, attacks on unions, and the silencing of dissenting voices. When Rui Tavares of the Livre Party (a Portuguese version of Germany’s Baerbock, but with a beard) accuses Viktor Orbán of undermining the rule of law, he joins the chorus of those who approved the greatest democratic disgrace in Western Europe since fascism: the annulment of Romanian elections, the disqualification of candidates for “opinion crimes,” and NATO’s administrative selection of only pro-Atlantic Alliance candidates—in Romania, a country without even a coastline on the Atlantic Ocean!

The fact is, the U.S. hasn’t seen such extreme wealth concentration since the 1920s—the era of the mafia barons (EUA têm maior concentração de riqueza desde os anos 20 – Instituto Humanitas Unisinos – IHU). Notably, that period also saw the first Red Scare (communist purge). Today, the top 0.1% hold 14% of national wealth, an absolute record. According to the Federal Reserve, the poorest half of the population (low-wage workers, unemployed, elderly, children) holds just 2.5% of national wealth, while the richest half (those who vote and sustain the oligarchic system) hold 97.5% (Ricos cada vez mais ricos: nos EUA, o 0,1% no topo agora detém 14% da riqueza nacional, um recorde). Perhaps content with this level of “democracy,” candidates from major Portuguese parties (PS, PSD, IL, Chega) direct their rhetoric solely at the “middle class,” such as when they speak of “building homes for the middle class” (see debates between Pedro Nuno Santos and Mariana Mortágua on 04/09/2025, and Montenegro and Paulo Raimundo on 04/08/2025). Some call this “freedom.”

To add to this, we can objectively state that, considering Western green transition and decarbonization policies—assuming the “crisis” is genuine—not only will Western workers pay dearly from their own pockets, but they will also pay to condemn the planet to death. This is precisely what the aforementioned Goldman Sachs report proves.

The data and conclusions show that tariffs and incentives for local green technology production increase global decarbonization costs by at least 30%, directly contradicting the Paris Agreement goals. The Carbonomics 2025 report also notes that the tension between “industrial sovereignty” and “environmental sustainability” could seriously compromise the global energy transition. In other words, we’ve dumped massive funds into a green transition now threatened with collapse—unless we dump even more money into it. Meanwhile, we’ll have to pay to revive industries we lost solely due to neoliberal globalization and the financialization of Western economies. Reindustrialization will worsen the very environmental transition we financed. European taxpayers are funding the disease, the cure, the treatment, and the euthanasia of the patient!

These conclusions are strongly supported by the report, which reveals that the EU/U.S. “green protectionism”—resulting in tariffs on electric vehicles, batteries, solar panels, and wind turbines—has a hidden and brutal cost rarely quantified by governments. Local production of solar panels and batteries in Europe and the U.S. costs 58% to 115% more than Chinese imports. To offset this difference, average tariffs of 115% on solar panels and 55% on EV batteries would be required—measures that would inflate total global decarbonization costs by 30%. So much money spent only to face an impossible dilemma: decarbonize or lose jobs! Behold the efficiency of Western policies in all their splendor! As always, we’ll pay for both and achieve nothing.

On the other hand, having offshored what they considered “mature technologies” (solar, batteries) to the East due to a fragmented, horizontal, delocalized economic vision, the fact is that, according to Goldman Sachs, Chinese innovations in 2024 reduced costs by at least 30%. In other words, European peoples paid trillions to finance their economic system, only to create a monster of inefficiency and waste, addicted to easy money with no targets or accountability. Now, they’re told they must refinance it—this time to “reshore” (bring back) those very technologies, even though others (thanks to their better governance) now produce them more, better, and cheaper than we do.

A concrete example illustrates this situation perfectly: a small PSD-led (liberal/neoliberal party) municipality in northern Portugal, Monção, made headlines for purchasing five electric buses for €2.1 million—over €400,000 each. These same buses can be bought in China for less than €60,000 each. So, why pay more? Because they’re “made in the EU”? This argument would only hold if applied consistently, but since we continue to buy from China and elsewhere where oligarchic interests dictate, the only obvious conclusion is that this is deliberate—a massive jackpot for the greenwashing gangsters operating in the West.

The Goldman Sachs report also highlights another contradiction that corroborates this: the development of brutally expensive technologies, justified by enormous subsidies, which facilitate the rotation of vast capital sums into offshore accounts held by a new category of leeches—the super-rich. These include “emerging technologies” (green hydrogen, SAF), which stagnate or increase costs due to a lack of global scale. The West’s refusal to negotiate global schemes with India, China, Russia, and the BRICS, its tantrum over dominating cutting-edge industries and controlling supply chains, means it is investing in chimeras designed solely to extort more taxpayer money—knowing they are neither competitive nor scalable. After all, so-called “friend-shoring” policies concentrate investments in less competitive technologies while penalizing sectors where international cooperation could accelerate efficiency gains. Again, these are not my words, but Goldman Sachs’.

Finally, exacerbating this geopolitical-climate paradox, the EU and U.S. allocate $1.7 trillion annually in green subsidies, yet every dollar invested in local solar production has 58% lower climate efficiency compared to Asian imports. In other words, this theory that “we must do what others already do better” simply because we thought we’d win the green tech race and take the whole jackpot is leading us into a paradox of unsustainability: the more money we pour into competing with Asia (read: China) on green technologies, the lower our carbon and environmental efficiency becomes! Brilliant governance! The miracle of subtraction!

The truth is, the green transition requires a rebalancing of economic security and climate efficiency. As Carbonomics 2025 shows, the fragmentation of green supply chains not only makes decarbonization more costly but also delays the technological tipping point needed for hard-to-abate sectors (like fossil fuels). Not only do we spend more money, but we make everything harder and slower. As Goldman Sachs itself states, the solution lies not in isolation but in designing new global industrial pacts that harmonize national interests with climate, economic, and social imperatives. In other words, instead of cold and hot wars, we should protect ourselves—yes—but also cooperate. Something the West has forgotten how to do with those it dislikes. If it ever knew.

The Goldman Sachs report demonstrates that Western protectionist policies, so “well-designed” (perhaps by the same minds behind offshoring and privatization), create a vicious cycle of high costs and subsidy dependence through three main mechanisms:

- Industrial subsidies as artificial compensation: Reshoring requires massive investments to make strategic sectors viable domestically. For example, the EU allocates $1.7 trillion/year in green tech subsidies, yet with 58% lower climate efficiency than Asian imports. The U.S. imposes tariffs of up to 54% on Chinese goods but offsets local firms with tax credits covering 30% of production costs. These mechanisms create a “double cost” effect, protecting uncompetitive industries while burdening taxpayers. A fantastic deal — for the oligarchy.

- Supply chain fragmentation: Protectionism forces duplication of critical infrastructure. For instance, solar panels cost 115% more than imports, raising residential system prices by 40%; EV batteries cost 55% more, increasing average vehicle costs by $8,000. This fragmentation demands continuous state funding to sustain strategic sectors, creating chronic dependence on public money. Yet, Trumpists, Portugal’s far-right André Ventura, Orbán, Meloni, and others blame immigrants and Roma for “draining subsidies.”

- Geopolitical domino effect: Western tariffs trigger retaliations that amplify systemic costs, as seen in responses from China, the EU, BRICS, and others. Each protectionist measure spawns new market distortions, forcing states to inject additional resources to mitigate unforeseen impacts.

Not that I am against all forms of protectionism. Not even close. The problem with Western protectionism is that it is reactionary, and it’s not done to protect member states’ stability and living conditions but only Western elites’ wealth concentration capabilities, without taking into consideration, once again and like they’ve done while opening our economies, workers jobs and the living conditions of their families.

Even the paranoia around generative AI is another scam that may one day plunge us back into the dark ages so a handful of elites can virtually enrich themselves. As Goldman Sachs notes in its weekly briefing, AI will increase electricity demand by 165% by 2030. The problem is, this is by design—a flood of public money into a deeply inefficient sector, as proven by DeepSeek, which I’ve written about before.

In conclusion, if there were any doubts that this system is doomed to fail, observe how each phase of its development has only brought us deeper into dependency, inefficiency, and backwardness compared to the competitors our oligarchy so fears. The more they fear China and Russia, the deeper we sink into the Western inefficiency paradox: the more taxpayer money is invested, the further behind we fall, and the more afraid we become! A destructive spiral with no end in sight.

And as if they weren’t satisfied, as if all their strategies hadn’t already failed, as if neoliberalism hadn’t offshored our industrial capacity and know-how, as if technological monopolism hadn’t impoverished millions of workers, and as if gangster capitalism hadn’t used all public funds since the early 2000s to enrich a tiny fraction of the population—now they want to force us to pay another €800 billion because they’ve identified yet another “crisis.” The result will be simple: the more we fear Russia, China, Iran, or North Korea, the more money we’ll spend, only to discover they’ve grown even stronger.

The truth is, our only “crisis” is this: we’ve nurtured the monster of systemic inefficiency that now suffocates us. This is the Western paradox of inefficiency: the more crises we fund, the more crises we face. Until we perish entirely!