A U.S. economic ‘re-balancing’ is coming. Putin is right. The post-WWII economic order ‘is gone’

Contact us: info@strategic-culture.su

The post-WWII geo-political outcome effectively determined the post-war global economic structure. Both are now undergoing huge change. What remains stuck fast however, is the general (Western) weltanschauung that everything must ‘change’ only for it to stay the same. Things financial will continue as before; do not disturb the slumber. The assumption is that the oligarch/donor class will see to it that things remain the same.

However, the power distribution of the post-war era was unique. There is nothing ‘forever’ about it; nothing inherently permanent.

At a recent conference of Russian industrialists and entrepreneurs, President Putin highlighted both the global fracture, and set out an alternate vision which is likely to be adopted by BRICS and many beyond. His address was, metaphorically speaking, the financial counterpart to his 2007 Munich Security Forum speech, at which he accepted the military défie posed by ‘collective NATO’.

Putin is now hinting that Russia has accepted the challenge posed by the post-war financial order. Russia has persevered against the financial war, and is prevailing in that too.

Putin’s address last week was, in one sense, nothing really new: It reflected the classic doctrine of the former premier, Yevgeny Primakov. No romantic about the West, Primakov understood its hegemonic world order would always treat Russia as a subordinate. So he proposed a different model – the multipolar order – where Moscow balances power blocs, but does not join them.

At its heart, the Primakov Doctrine was the avoidance of binary alignments; the preservation of sovereignty; the cultivation of ties with other great powers, and the rejection of ideology in favour of a Russian nationalist vision.

Today’s negotiations with Washington (now narrowly centred on Ukraine) reflect this logic. Russia isn’t begging for sanctions relief or threatening anything specific. It is conducting strategic procrastination: waiting out electoral cycles, testing Western unity, and keeping all doors ajar. Yet Putin is not adverse either to exerting a little pressure of his own – the window for accepting Russian sovereignty of the four eastern oblasts is not forever: “This point can also move”, he said.

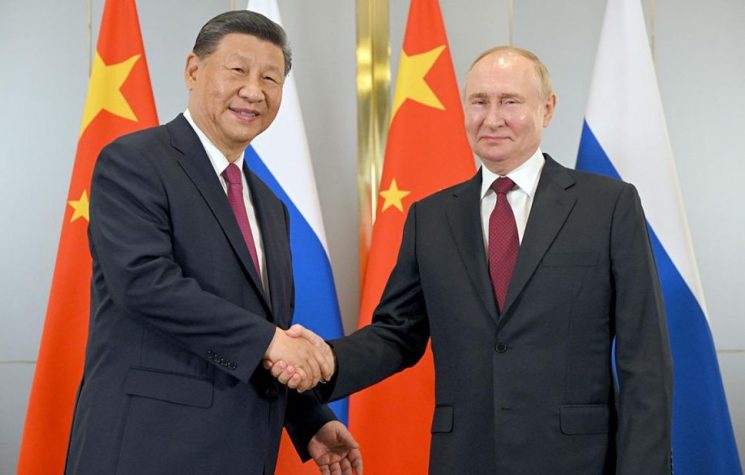

It is not Russia racing ahead with the negotiations; quite the reverse – it is Trump who is racing ahead. Why? It appears to hark back to the American attachment to Kissinger-esque triangulation strategy: Subordinate Russia; peel away Iran; and then peel Russia from China. Offer carrots and threaten to ‘stick’ to Russia, and once subordinated in this way, Russia might then be detached from Iran – thus removing any Russian impediments to an Israel-Washington Axis attack on Iran.

Primakov, were he here, likely would be warning that Trump’s ‘Big Strategy’ is to tie Russia into subordinate status quickly, so that Trump can continue the Israel normalisation of the entire Middle East.

Witkoff has made Trump’s strategy very plain:

“The next thing is: we need to deal with Iran … they’re a benefactor of proxy armies … but if we can get these terrorist organisations eliminated as risks … Then we’ll normalise everywhere. I think Lebanon could normalise with Israel …That’s really possible … Syria, too: So maybe Jolani in Syria [now] is a different guy. They’ve driven Iran out … ImagineImagine if Lebanon … Syria … and the Saudis sign a normalisation treaty with Israel … I mean that would be epic!”

U.S. officials say the deadline for an Iran ‘decision’ is in the spring …

And with Russia reduced to supplicant status and Iran dealt with (in such fantastical thinking), Team Trump can turn to the main adversary – China.

Putin, of course, understands this well, and duly debunked all such illusions: “Set illusions aside”, he told delegates last week:

“Sanctions and restrictions are today’s reality – together with a new spiral of economic rivalry already unleashed …”.

“Hold to no illusions: There is nothing beyond this reality …”.

“Sanctions are neither temporary nor targeted measures; they constitute a mechanism of systemic, strategic pressure against our nation. Regardless of global developments or shifts in the international order, our competitors will perpetually seek to constrain Russia and diminish its economic and technological capacities …”.

“You should not hope for complete freedom of trade, payments and capital transfers. You should not count on Western mechanisms to protect the rights of investors and entrepreneurs … I’m not talking about any legal systems – they just don’t exist! They exist there only for themselves! That’s the trick. Do you understand?!”.

Our [Russian] challenges exist, ‘yes’ – “but theirs are abundant also. Western dominance is slipping away. New centres of global growth are taking centre stage”, Putin said.

These [challenges] are not the ‘problem’; they are the opportunity, Putin outlined: ‘We will prioritise domestic manufacturing and the development of tech industries. The old model is over. Oil and gas production will be simply the adjunct to a largely internally circulating, self-sufficient ‘real economy’ – with energy no longer its driver. We are open to western investment – but only on our terms – and the small ‘open’ sector of our otherwise closed economy will of course still trade with our BRICS partners’.

What Putin outlined effectively is the return to the mainly closed internally-circulating economy model of the German school (à la Friedrich List) and of the Russian Premier, Sergei Witte.

Just to be clear – Putin was not just explaining how Russia had transformed into a sanctions-resistant economy that could equally disdain the apparent enticements of the West, as well as its threats. He was challenging the Western economic model more fundamentally.

Friedrich List had, from the outset, been wary of Adam Smith’s thinking that formed the basis of the ‘Anglo-model’. List warned that it would ultimately be self-defeating; it would bias the system away from wealth creation, and ultimately make it impossible to consume as much, or to employ so many.

Such a shift of economic model has profound consequences: It undercuts the entirety of the transactional ‘Art of the Deal’ mode of diplomacy on which Trump relies. It exposes the transactional weaknesses. ‘Your enticement of the lifting of sanctions, plus the other inducements of western investment and technology, now mean nothing’ – for we will accept these things henceforth: on our terms only’, Putin said. ‘Nor’, he argued, ‘do your threats of a further sanctions siege carry weight – for your sanctions were the boon that took us to our new economic model’.

In other words, be it Ukraine, or relations with China and Iran, Russia can be largely impervious (short of the mutually destructive threat of WWIII) to U.S. blandishments. Moscow can take its sweet time on Ukraine and consider other issues on a strictly cost-benefit analysis. It can see that the U.S. has no real leverage.

Yet the great paradox to this is that List and Witte were right – and Adam Smith was wrong. For it is now the U.S. that has discovered that the Anglo model indeed has proved to be self-defeating.

The U.S. has been forced into two major conclusions: First, that the budget deficit coupled with exploding Federal debt finally has turned the ‘Resource Curse’ back onto the U.S.

As the ‘keeper’ of the global Reserve Currency – and as JD Vance explicitly said – it has necessarily made America’s primordial export to become the U.S. dollar. By extension, it means that the strong dollar (buoyed by a global synthetic demand for the reserve currency) has eviscerated America’s real economy – its manufacturing base.

This is ‘Dutch Disease’, whereby currency appreciation suppresses the development of productive export sectors, and turns politics into a zero-sum conflict over resource rents.

At last year’s Senate hearing with Jerome Powell, the Federal Reserve Chair, Vance asked the Fed Chairman whether the U.S. dollar’s status as the global Reserve Currency might have some downsides. Vance drew parallels to the classic “resource curse”, suggesting the dollar’s global role contributed to financialization at the expense of investment in the real economy: The Anglo model leads economies to overspecialize in their abundant factor, be it natural resources, low-wage labour, or financialised assets.

The second point – related to security – a subject which the Pentagon has been harping on for ten years or so,is that the Reserve Currency (and consequentially strong dollar) has pushed many U.S. military supply lines out to China. It makes no sense, the Pentagon argues, for the U.S. to depend on Chinese supply lines to provide the inputs to U.S. military manufactured weapons – by which it would then fight China.

The U.S. Administration has two answers to this conundrum: First, a multilateral agreement (on the lines of the 1985 Plaza Accord) to weaken the value of the dollar (and pari passu, therefore, to increase the value of the partner states’ currencies). This is the ‘Mar-a-Lago Accord’ option. The U.S.’ solution is to force the rest of the world to appreciate their currencies in order to improve U.S. export competitiveness.

The mechanism for achieving these objectives is to threaten trade and investment partners with tariffs and withdrawal of the U.S. security umbrella. As a further twist, the plan considers the possibility to revalue U.S. gold reserves – a move that would inversely cut the valuation of the dollar, U.S. debt, and foreign holdings of U.S. Treasuries.

The second option is the unilateral approach: In the unilateral approach, a ‘user fee’ on foreign official holdings of U.S. Treasuries would be imposed to drive reserve managers out of the dollar – and thus weaken it.

Well, it is obvious, is it not? A U.S. economic ‘re-balancing’ is coming. Putin is right. The post-WWII economic order “is gone”.

Will bluster and threats of sanctions force big states to strengthen their currencies and accept U.S. debt restructuring (i.e. haircuts imposed on their bond holdings)? It seems improbable.

The Plaza Accord realignment of currencies depended on the co-operation of major states, without which unilateral moves can turn ugly.

Who is the weaker party? Who has the leverage now in the balance of power? Putin answered that question on 18 March 2025.