By adding to their challenges in his bid to strike a pyrrhic blow against Russia, Zelensky may find even bigger obstacles erected against Ukraine’s bid to join the western club.

Contact us: info@strategic-culture.su

On 1 January, Ukraine ceased to allow the transit of Russia gas to Europe. This ended almost uninterrupted supply of Russian piped gas to Europe, through sovereign Ukraine, since the collapse of the Soviet Union. Some in the west have celebrated this as victory over Russia. More likely, it will backfire on Ukraine’s NATO and European aspirations.

I have always considered the sale, purchase and supply of gas or any other commodity as an entirely commercial matter. In that regard, even while posted to the British embassy in Moscow, I dismissed suggestions that Russia was weaponizing its energy supplies.

There was only one occasion, in 2009, when Russian gas supplies to Europe were halted temporarily following a dispute over Ukraine’s non-payment of its accumulated debts. Russia worked hard to position itself as a reliable supplier of gas specifically because it sells gas domestically at heavily subsidized prices; gas exports therefore subsidize domestic consumption.

Having good relationships with European consumers was prioritised, as Alexander Medvedev, the Deputy Chairman of Gazprom remarked to UK Members of Parliament who visited the British Embassy in early 2017.

Ukraine’s recent decision to end a long-standing gas supply route to Europe seems just another minor twist in the long-running saga of energy disputes between both countries.

In the big scheme, it won’t strike a major blow to Russia, despite Poland’s Foreign Minister declaring it a victory. Gas, like oil, flows to where the demand is. War in Ukraine has seen a huge increase in Russian oil supplies to India and a continued growth in Russian gas supplies to China. Meanwhile, Russia has increased its LNG exports to Europe to replace cheaper piped gas supplies.

When you look at the big numbers, Russia’s position as an export powerhouse hasn’t changed since the onset of the Ukraine crisis in 2014. During that time, the world has endured commodity price slumps, COVID and now, war. The President of BP in Russia told me in early 2015 that energy professionals always focus on the long term and adjust to deal with short-term peaks and troughs in demand.

Since 2014 Russia has, on average, exported $420bn worth of goods each year, two thirds of that oil and gas. After a hugely profitable year in 2022 when energy prices surged, Russia remained above that trend average in 2023, looks set to be again in 2024, and there’s nothing that suggests to me 2025 will be different.

Transit through Ukraine had already dropped to around 20% of its prior level by the end of 2024. Putin talks often about his desire to reinstate piped supply to Europe, although that may in part be a ploy to sow discontent, especially in Germany, where a huge loss of competitiveness has driven social discontent. I doubt many in the Kremlin will see the loss of Ukraine transit as the end of the world.

The two biggest losers here will be unrecognised breakaway republic of Transnistria within Moldova. In a perverse arrangement, a major power station in Transnistrian supplied around one third of all Moldovan electricity, using Russian gas piped across Ukraine. Western pundits, including at CSIS have bizarrely tried to pin the blame on Russia for the shut off of gas to Transnistria and, therefore, electricity to Moldova. However, the core point with Transnistria, is that the authorities in Tiraspol (Transnistria) need to engage with the Moldovan Government in Chisinau to resolve energy shortages in both places; specifically, Transnistria may have to bite the bullet on more expensive gas delivered from Europe to restart its power plant and provide electricity to Moldova in return. That’s a simplification of a hugely complicated issue for another day. But beyond its 1500 troops permanently stationed in Transnistria, Russia has little interest in direct involvement right now. Moldova has always been a tiny customer for Gazprom, although the country has strategic significance to Russia given its Russian speaking community and bordering the EU and NATO; for now, Kremlin officials will happily watch the discord unfold to its advantage.

Of greater strategic importance to Ukraine, is Slovakia.

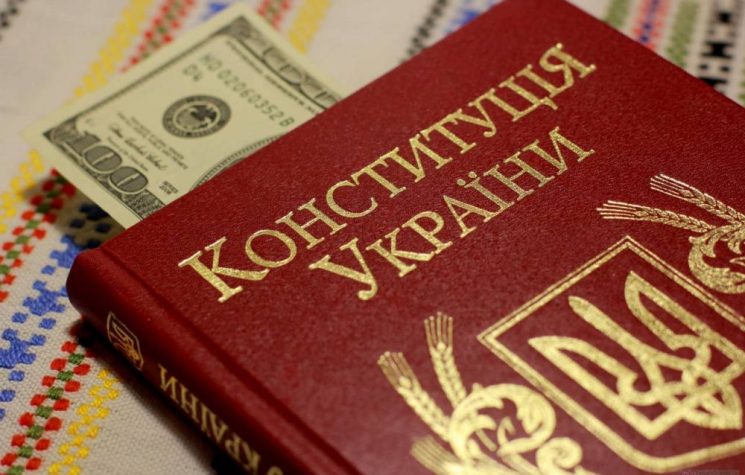

Prime Minister Robert Fico had warned that cutting gas transit via Ukraine would hurt the EU more than it hurts Russia. It probably will. Shipped LNG from the US and other countries is more expensive than piped Russian gas by around 30-40%. And as Politico has pointed out, the reason for that is massive profiteering in Europe with large trading companies sealing long term contracts with US suppliers and selling gas at a massive markup. So the EU can’t blame the Americans, as the LNG in US ports costs four times less than when it reaches European consumers. Russian gas was cheaper in large part because Gazprom fixed long term contracts with gas suppliers in the countries supplied. In the case of Slovakia, a long-term contract had been in place for gas supply until 2027.

All the indications are that Slovakia will be able to resolve any gas supply issues over the winter from other sources. But in any case, the real issue at stake here has nothing to do with either economics or energy security.

It’s about how statecraft can become victim to the tyranny of short-term thinking. Ukraine’s already shaky future aspirations to join NATO and the EU rests on support from member states such as Slovakia. Across Central Europe there is a growing anti-war and anti-sanctions consensus. Austria may soon join Slovakia and Hungary at its core, if Herbert Kickl becomes the new Chancellor. Romania may also join if the stalemate over Presidential elections is broken and Georgescu rises to power.

Mainstream politicians and journalists have the luxury of criticising the growing band of right wing political leaders in Central Europe as pro-Putin puppets. Less affluent than countries in western Europe, the impact on Slovakia, Hungary and others will economically and politically be more severe. By adding to their challenges in his bid to strike a pyrrhic blow against Russia, Zelensky may find even bigger obstacles erected against Ukraine’s bid to join the western club.