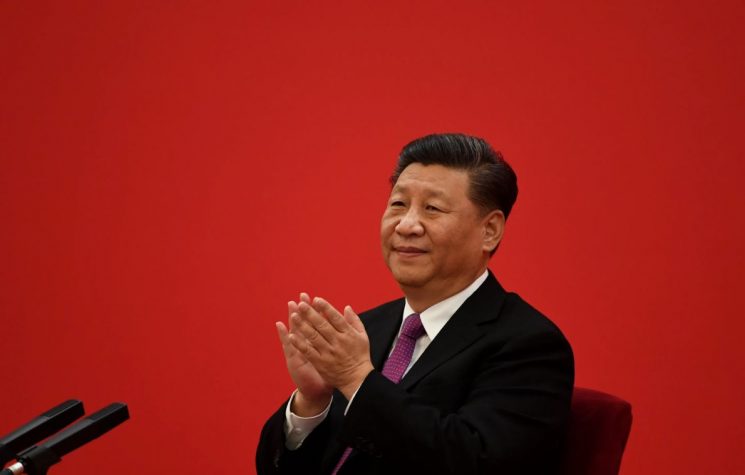

One wonders as to how important the Chinese President Xi ‘s visit to Saudi Arabia is and what the birth of petroyuan brings to the world and even more importantly what ‘the jackal on its dying legs’ aka the USA will do about it?

If the so-called petrodollar, created half a century ago when Saudi Arabia and other monarchies in the Gulf agreed to sell their oil exclusively in dollars, was one of the reasons for the world to be in ‘dire’ need of the U.S. currency, does that mean that with their decision to start selling their own oil in yuan as well, that the U.S. great global power of yesteryear is now vanishing into thin air? If that is so, those commentators who described the meeting of Xi Jinping and the leaders of the Arab world in Riyadh as a crucial milestone and of epic importance are right indeed and their enthusiasm is surely well balanced and to the point. Besides, as a sure sign that these remarks are not far from reality, one can use the American CNN which by way of using sour grape metaphor says that Saudi Arabia and China will be in accord about everything from the security issues to the matters of oil industry, but they agree not to meddle with each other’s internal affairs. Sour grapes metaphor coming from CNN is here as if this agreement would have a pernicious effect rather than a beneficial one in their bilateral relations.

Foreign Policy magazine couldn’t help noticing that Xi’s visit to Ryadh is a sure sign that the monogamous relationship between Riyadh and Washington has drawn to its end. In today’s cold war, not only Saudi Arabia refuses to take sides but it will approach Beijing even further and Moscow too. In the eve of the long-awaited and undoubtedly meticulously prepared official visit to Saudi Arabia, gathering together the whole Arab world on that occasion, Beijing Global Times indicated that a possible free trade agreement, agreements on selling oil in yuan and the future membership in the organization BRICS + will further endanger U.S. hegemony and bring the Gulf countries ever closer. China’s pursuit in internationalizing Chinese yuan has an attractive partner in Riyadh.

Beijing purchases more than 25 % of Saudi oil and if these are expressed in Chinese yuan, the Saudi oil will help the Chinese currency to position itself and come to the global financial forefront. Moreover, this can set a precedent and get other exporting countries to join them in selling oil in yuan – the portal Middle EastTime reports, indicating all the more reasons for such a economical and political move.

Prohibitively brutal sanctions against Russia have revived the old fears of the old system based on the U.S. dollar. As a result, the countries such as Saudi Arabia are trying to lessen their heavy dependence on the U.S. currency and certainly the renewed talks on petroyuan indicate that the new alternatives devour U.S. dominance world order all the more so. Some tend to believe that it is already happening that Saudi Arabia is selling some amount of oil to China in yuan already but neither the Chinese nor the Saudis want to place a particular emphasis on that publicly. CNN warns that both sides are well aware how sensitive this issue is for the USA. Both sides are overly exposed to petrodollar yet there is no reason for their mutual trade to be carried out using the currency of a third party other than theirs. Particularly because the third party is not a friend of either of them anymore.

Thus, CNN warns, Xi’s visit to Riyadh is yet another move towards the erosion of the dollar status as the reserve world currency.

In trying to unravel the mystery of what the Saudis and the Chinese are up to, the Wall Street Journal which was the first one to have announced this revolutionary agreement to sell oil for yuan rather than for dollars, is now drawing our attention to a vitally important detail. Namely, one of the agreements includes the Chinese Commercial Bank, which is a direct participant in CIPS, which is the Chinese version of SWIFT, a system for international financial transactions which is in effect under the control of the USA.

Wall Street Journal announces ever more profound cooperation between the two countries. This agreement provides future insights in which Saudi banks are joining CIPS which stands for ‘cross-border interbank payment system’) which will accelerate the use of yuan in Saudi – Chinese oil trade.

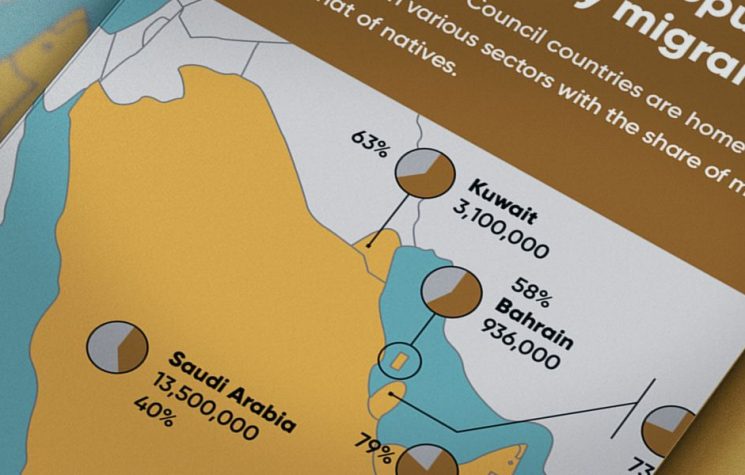

The policy makers in the USA should be worried a lot because of this. The Gulf Cooperation Council (GCC) gave all the reasons for concern for the USA and most definitely did Xi Jinping do the same when he appeared on TV for that occasion, announcing that China will buy even more oil and liquid gas from Arab partners in the Persian Gulf in the future by way of the Shanghai Stock Exchange for oil and natural gas and they will be paying in yuan for the purchased resources. Any move of Saudi Arabia towards ridding of the U.S. dollar in its oil business dealings will cause tectonically powerful political earthquake – says Reuters very succinctly immediately afterwards pointing out that Saudi Arabia and its Gulf partners opposed the pressure coming from the USA in wanting them to stop their relations with China and their partner from the OPEC plus organization which is Russia, which then again goes to say that unlike the ‘cold fist bump greeting’ by Saudi future king to succeed to the throne, Crown Prince Mohammed Bin Salman with Biden in Jeddah five months ago, the highly ceremonial welcome for Xi Jinping in the capital Riyadh complete with all the flamboyant smoke curtains in the colours of Saudi Arabia and China was surely not random and nor was it purely symbolic

One wonders as to how important the Chinese President Xi ‘s visit to Saudi Arabia is and what the birth of petroyuan brings to the world and even more importantly what ‘the jackal on its dying legs’ aka the USA will do about it? We are yet to find out.