While President Trump keeps trying to support a stock market via noises about negotiations with China progressing well, things are spiraling out of control in Hong Kong.

The protests continue to escalate and show no signs of slowing down. The goal has explicitly become attacking the legitimacy of the Hong Kong government and bringing down an economy vulnerable to a falling property market.

The attack vector here is not directly political, Hong Kong is being attacked by the West via student proxies through its currency peg.

The Hong Kong dollar is tightly pegged to the US dollar and defending that peg by the Hong Kong Monetary Authority has left the city-state vulnerable to a massive property collapse if commerce continues to plummet as protestors keep targeting vital centers like the airport and hotel districts.

A collapse of the Hong Kong dollar peg, like all price floors/ceilings, is inevitable. Pegging one currency to another will always create an unsustainable imbalance of payments that the central bank can only cover for so long.

In Hong Kong’s case the peg has fueled, alongside China’s spectacular growth, a property market that is insanely over-valued. So, attacking the value of said property is how you attack the peg. The longer these protests go on, fueled and organized by outside elements (read US and British intelligence actors), the higher the probability that capital will flee Hong Kong and undermine the peg, creating a massive market dislocation overnight.

Think back to 2015 when the Swiss National Bank finally broke its peg to the euro after having turned itself into a hedge fund trying to stop the appreciation of the franc versus the euro. The bottom fell out of the euro/franc pair overnight, adjusting 30% in a matter of minutes.

When a major peg like that breaks, systems break. Societies break as well. Part of the pressure the West is applying to China is for open its capital account and submit to western control via hot money inflows. The Hong Kong dollar peg is the key weakness to the current arrangement.

It goes hand in hand with Trump’s moronic tariffs and the Treasury Department’s sanctions on Chinese firms doing business with Iran. It’s a multi-layered strategy.

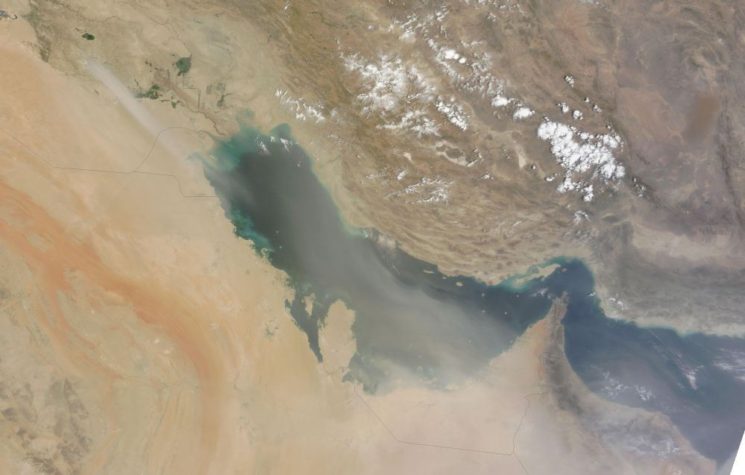

Speaking of Iran…

Now that you have some idea of the stakes in Hong Kong, let’s talk about what’s happening in Saudi Arabia.

While Trump tries to pull his Middle East policy decisions from the brink of war, making deals with Turkey’s Erdogan and Russia’s Putin (through Erdogan) to unlock the stalemate in Syria, his allies in Riyadh and Tel Aviv are fuming and finally rightfully scared for their futures.

Iran and its proxies have gained the upper hand not only in Syria but in Yemen and the Persian Gulf. China is no longer playing games with Trump over buying Iranian oil, announcing that they are ready to invest up to $280 billion in Iran’s oil and gas industry.

The attacks on Saudi Armaco assets by the Houthis in Yemen have put Crown Prince Mohammed bin Salman behind the eight ball and his only options are to sue for peace. The same can be said for Trump now that he’s been revealed for having half a brain and not willing to risk World War III over a drone and some oil tankers.

Speaking of oil tankers, the Saudis and/or the Israelis, who have the most to lose by Trump paying peacenik, are likely the ones responsible for the attack on the Iranian oil tanker in the Red Sea. If they can’t get the US to start the war, maybe they can goad the Iranians.

Not likely.

Trump and the embattled and likely out-of-power Benjamin Netanyahu tried vainly to frame the conflict with Iran solely about nuclear weapons. But it’s never been about that. It’s been about continuing the policy of chaos to blunt the rise of China and Russia as the new lords of Eurasia.

Nothing more, nothing less.

And destabilizing the region to split off Iran from Russia and China has failed completely. Iran was never going to back down. Putin told the world that North Korea would rather eat dirt than give up its nuclear weapons. Iran is in the same frame of mind. They would rather be annihilated than give the US an inch after seventy years of egregious intervention and starvation.

So, here we are. The Saudis are the weak link in the US’s Mideast Alliance. Hong Kong is China’s soft financial underbelly. It comes as no surprise to me to see classic color revolution behavior in Hong Kong spring up within weeks of a failed attempt to get Trump to start a war with Iran – when they shot down the US drone over its airspace.

Because once Trump refused to jump off the edge of the Abyss, everything that has happened since then has been predictable. Increased threats to Saudi assets, further instability of the world’s oil infrastructure against the backdrop of political paralysis in Israel.

Netanyahu went off the reservation making attacks on Iraqi Shi’ite militias and likely ginning up protests against an Iraqi government no longer a satrap of D.C. and Tel Aviv.

The end result is now the Saudi government is in very serious trouble. Oil prices cannot rally and will likely crash in the coming weeks as the global slowdown grips traders by the hind brain. At that point I will be shocked if the Houthis do not attack the Saudis again, this time more boldly.

What’s at stake in that attack is no different than that in Hong Kong, the peg of the Saudi Riyal to the US dollar. MbS cannot finance his country’s future without the Aramco IPO, which is now off the table until 2020 at the earliest. And he can’t fund his current spending at $55 oil.

Something has to give.

And that’s why the reporting on the Hong Kong protests have focused on the economic damage the city is experiencing.

It’s a simple bit of blackmail. A peg for a peg.

The Hong Kong dollar for the Saudi Riyal. China needs Hong Kong to return to normalcy. British banks do not want Hong Kong under Chinese control. So many of their traders are targets for extradition for questioning.

This was never about twenty-somethings twerking in a public park. This was about wresting control of the offshore yuan market from the British banks laundering money through Hong Kong to fund intelligence and military operations across Asia.

Saudi Arabia needs to survive to keep the petrodollar somewhat intact and the outflow of dollars continuing while Trump runs the biggest deficits the world has ever seen.

If the Saudis give up the peg, the dollar transmission system begins to collapse. Global trade is the base money of global economy. It is the source of the direction of the flow of capital, from there it is levered up in the shadow banking markets.

Did you ever wonder why the Fed had to switch on the lights at its overnight Repo window? Now it’s open permanently. And that’s most likely about troubles coming from Europe. Add Hong Kong and Saudi Arabia into that mix and we have a hot time in the old house.

Trump is okay with ending some parts of the US empire while maintaining other parts of it. But he’s been fighting for it to happen on his schedule, not Iran’s, not Russia’s and not China’s.

Time’s run out. And now the world is beginning to burn.