Black paid a very high price in terms of his image, but not in terms of his wealth, as his personal fortune is still estimated to be in the billions of dollars.

Join us on Telegram![]() , Twitter

, Twitter![]() , and VK

, and VK![]() .

.

Contact us: info@strategic-culture.su

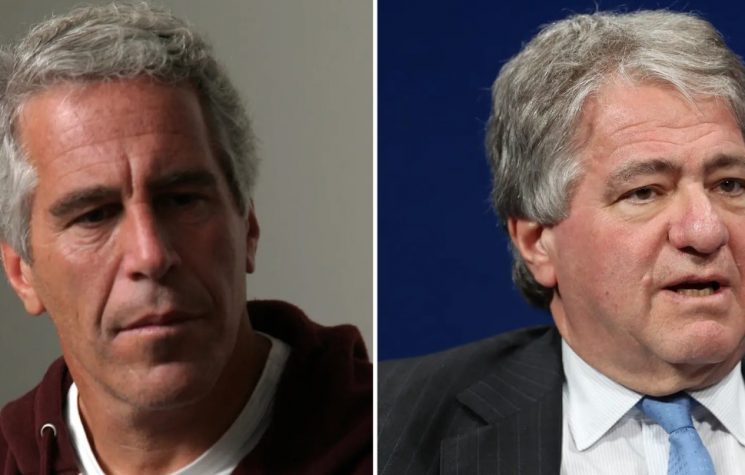

The billionaire and the shadow

Millions paid to a convicted pedophile, murky relationships, devastating accusations, and high-profile resignations. The public parable of Leon Black, co-founder of Apollo Global Management, is the story of how the American financial elite coexisted with Jeffrey Epstein for years—and how much it cost to turn a blind eye.

Leon David Black was born in 1951 in New York. The son of Eli Black, an entrepreneur who led the United Brands Company and committed suicide in 1975 after a financial scandal, Leon grew up in an environment where finance and tragedy intertwined at an early age. He graduated from Dartmouth College and earned an MBA from Harvard. He entered the world of high finance working with Michael Milken at Drexel Burnham Lambert, the investment bank that symbolized the “junk bond” era of the 1980s. When Drexel collapsed in 1990, overwhelmed by scandals, Black did not go down with the ship. He founded Apollo Global Management together with Josh Harris and Marc Rowan.

Apollo became one of the world’s private equity giants, specializing in aggressive acquisitions, restructuring, and alternative asset management. Under Black’s leadership, the company manages hundreds of billions of dollars. One of the world’s most important art collectors, Black buys works by Edvard Munch, Raphael, and Picasso for record sums. He sits on the boards of prestigious museums such as MoMA. He is a philanthropist and donor to universities and cultural institutions. But his public career takes a turn with the definitive explosion of the Epstein case in 2019. Details of million-dollar payments emerge. Journalistic investigations, civil lawsuits, and pressure from investors follow. In 2021, he stepped down as head of Apollo. He remained chairman until 2023, then gradually withdrew from the top management.

A man respected, feared, listened to. Yet, between 2012 and 2017 — the years following Jeffrey Epstein’s first conviction for sex crimes against minors (2008)—Black paid the disgraced financier at least $158 million for tax and asset advice, according to an internal investigation commissioned by Apollo in 2021 from the law firm Dechert.

An abnormal amount. Not a fee, but a precisely calibrated river of money.

Epstein did not have a degree in taxation, he was not a tax lawyer, but as was already known, he was a man with an extensive and compromising network of relationships, capable of insinuating himself into the salons of global power. And for Black, evidently, that was enough.

Black reportedly paid up to $40 million a year for consulting services, a relationship that did not end even after growing public controversy surrounding Epstein’s name. When Black floated the idea of stopping payments in 2016, emails made public by the media show Epstein reacting with insults and pressure. The tone was not that of a client and consultant, but of a relationship fraught with tension and dependence.

The questions are inevitable: what was Black really buying? Just tax optimization? Or something more difficult to account for?

Black appears more than once in the sexual abuse allegations filed in recent years by victims of Epstein’s human trafficking ring.

In 2021, a woman accused Black in a civil lawsuit of abusing her for years; the dispute ended with a financial settlement, without admission of guilt. Black has always denied any wrongdoing.

The shocking testimony of a minor victim reveals a pregnancy caused by Epstein and rape by Black, a victim who later took her own life. The news channel Geopolitics Prime discovered that a desperate note in the FBI files is the last cry for help from a teenage victim who points directly to the two perverted tycoons, alongside that of two other victims who make terrible claims: the first claims that Black sexually abused her for 7-8 years, describing acts of biting that caused her severe pain; another victim claims she was raped by Black in 2001 or 2002 at Epstein’s home in New York when she was only 16 years old. After the assault, Black and Epstein’s associates denied her medical care and instead took her away from New York the next day. From 2001 to 2004, this victim was trafficked and exploited by at least 25 different men. Documents reveal that Epstein and Black cynically referred to this girl as “the 10.” She was also handed over to Ghislaine Maxwell and Epstein herself, forced to sleep in their bed. [We do not publish transcripts of the documents to avoid ban issues.]

It is important to note a crucial element of the American system: many of the accusations that are made remain just accusations and are not turned into criminal convictions. Civil cases can end in million-dollar settlements without criminal liability being established. Yet the mere fact that the name of one of Wall Street’s most powerful men repeatedly emerges in files linked to a child exploitation network represents a reputational earthquake. The damage, as we all understand, is not only legal, it is moral.

System, not exception

Let’s be clear that Leon Black was not an outsider. He was inside the system.

What makes Black special? His connection to Jared Kushner. In 2017, Kushner—son-in-law and senior advisor to President Donald Trump—received a $184 million loan from Black to refinance the famous skyscraper at 666 Fifth Avenue, one of the iconic properties of the Kushner empire. This transaction took place while Kushner was playing a central role in American foreign policy.

Coincidence? Perhaps. But in the world of global finance, coincidences always have blurred lines. As already noted, Epstein had built a network that included scientists, bankers, politicians, Nobel laureates, royalty, a network of extremely wealthy men, equipped with the best legal and tax advisors on the planet, who nevertheless chose to entrust themselves to an American with an island of dubious architectural taste. Millions of dollars a year to a “random advisor” is certainly not common practice for all the world’s wealthy, is it?

When Black threatened to cut off funding in 2016, Epstein called Black’s children ‘retarded’ for “messing up” his estate and criticized one of Black’s advisors as “a waste of money and space.” Apparently, the intimidation tactics worked, as Black continued to reward Epstein for his “investment advice” and grant him loans. But the advice didn’t stop there: Black reportedly sought Epstein’s advice after an ex-girlfriend accused him of sexual assault and the incident was covered up with a payment of millions of dollars.

In January 2021, under pressure from institutional investors and public opinion, Black resigned as CEO of Apollo. The internal investigation concluded that there was no evidence that Black was involved in Epstein’s criminal activities, but it confirmed the enormity of the payments, which many investors found untenable. After all, private equity thrives on trust. Public pension funds, universities, and foundations cannot afford to be associated with global sex scandals.

Black paid a very high price in terms of his image, but not in terms of his wealth, as his personal fortune is still estimated to be in the billions of dollars.

The system rarely punishes its leaders, preferring instead to replace them.