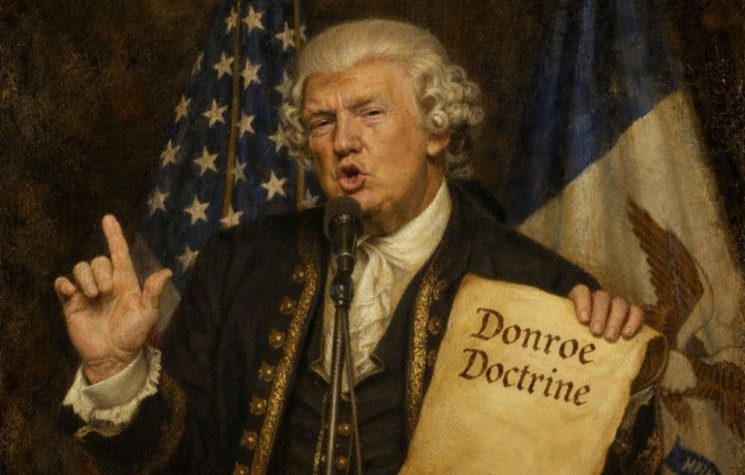

The NSS is not a pivot from Empire; it does, nonetheless, conclude that the means to domination requires a ‘Trump corollary to the Monroe Doctrine’.

Join us on Telegram![]() , Twitter

, Twitter![]() , and VK

, and VK![]() .

.

Contact us: info@strategic-culture.su

In his speech in Riyadh in May, President Trump set out his rationale to his transactional mode of policy formulation – making peace through commerce, rather than war.

The language in the 4 December US National Security Strategy (NSS) takes this several steps further: It is couched in the terms of ‘regions of influence’, rather than hegemony, and of managing stakeholder financial interests. It abandons the phraseology of a rules-based order and eschews appeals to democracy and Western values.

But what does this ‘peace through commerce’ really mean?

The core to the Trump geo-politics is revealed in the NSS as the risk of imperial collapse looming in the future. It talks about Atlas holding the globe aloft – and emphasises that the United States can no longer continue to shoulder the burden of empire.

The NSS, therefore, is ultimately centred around resolving the economic contradictions that has brought the US to this pass – burgeoning debt and an out-of-control fiscal matrix which, absent a solution, ordains that Empire will fold.

The core issue therefore becomes how to finance ‘Empire’ against a badly skewed and distorted economic reality. Clearly, the start point was to acknowledge that sanctions have failed. The attempt to lock China (and by extension Russia) out of the economic loop has failed, because they adapted – and strengthened their internal economies; and in China’s case enhanced their relevance to international supply chains.

So, we are seeing a marked shift to a different imperial ‘model’. The NSS indirectly suggests that without the dominance which allows Big Money and infrastructure investment being coerced into the US economy, and without continued dollar hegemony, the US is in big trouble.

The NSS therefore is not a pivot from Empire; it does, nonetheless, conclude that the means to (albeit) attenuated American domination does require a ‘Trump corollary to the Monroe Doctrine’.

In its introductory remarks, the NSS states that:

“American foreign policy elites, convinced that permanent American domination of the entire world was in the best interests of our country … [had] overestimated America’s ability to fund, simultaneously, a massive welfare regulatory-administrative state alongside a massive military, diplomatic, intelligence, and foreign aid complex”.

Here, the NSS put the issue of funding US foreign policy front and foremost.

Significantly, in context of the funding shortfall, the strategy document takes a swipe at the free trade system:

“They placed hugely misguided and destructive bets on globalism and so-called ‘free trade’, that hollowed out the very middle class and industrial base on which American economic and military pre-eminence depend”.

This aspect perhaps constitutes the most radical change of course envisioned by the NSS. It concerns two alternative architectures of economics: On the one hand, the British system of ‘free trade’ as espoused by Adam Smith, versus the ‘American System’ as advocated by Alexander Hamilton. The NSS document includes an explicit rejection of the ‘free trade’ system and even mentions the name of Alexander Hamilton – giving a clear indication of the direction in which Trump is travelling (at least aspirationally).

The ‘American system’ did not originate in the United States; it was first explicitly elaborated by the German economist Friedrich List in the 19th century. But the system earned the label ‘American’ because it was practiced in the US for some 150 years. During this time, the US used tariffs, state subsidies and other barriers to trade to nurture domestic industries and to protect high-paying jobs. But in the post-war period, the US reoriented its economic policy, progressively leaning in favour of the British system of free trade. Indeed, Trump has, from time to time, referred to Hamiliton’s resort to tariffs.

But just to be clear, a shift to a closed economic model – as China (and to an extent Russia) have done to protect themselves from US financial war – takes decades, and Trump does not have time. He is in a rush.

The most obvious contradiction to Trump’s move towards a transactional mode of operating is simply how to sell the US debt instruments needed to fund the budget when demand for dollars in international trade is decreasing. And this, at a time, when Trump simultaneously insists to lower debt service payments that threaten the solvency of his prestige ‘magnificent seven’ AI mega expenditures? Interest charges now account for 25 cents on every dollar raised in the US through taxation. Such a problematic contradiction requires gaslighting people into buying US debt — despite its declining returns.

His answer is to use tariffs as the instrument behind ‘shakedowns’ both of Allies and adversaries alike – to coerce pledges of billions of dollars in foreign investment. The US Treasury Secretary separately has ordered global investors to buy US debt. The contradiction here is that tariffs ultimately are paid by US consumers, and are inflationary — further adding to American economic woes.

How does this new business approach work geo-politically? In Ukraine, the ‘business approach’ presumes that the solution to the protracted conflict requires a system where the opportunity for financial benefit continues. i.e. that the strategic problem is about dividing the ‘Ukraine economic cake’ between ‘stakeholders’.

“Written in polite diplomatic terms, the continued payments are identified as “the prosperity agenda which aims to support Ukraine’s post-war reconstruction; the mooted joint US-Ukraine economic initiatives and the Ukraine recovery projects.” (This is code speak for the US Senate and EU retaining a financial mechanism to exploit for personal benefit”. (i.e. how to continue the usual boondoggle laundering of pay-offs).

“From the language, it appears that Witkoff and Kushner are confident they can construct a financial reward system for western banks, investors, politicians and Ukraine officials that will retain the benefits of war without the ancillary ingredient of bloodshed”.

“If the U.S. delegation can pull this off, then Russia can gain the territory they want, corrupt Ukraine officials can keep skimming investment money, the EU can retain the power it wants to extract financial payments, American politicians can use the “long-term recovery projects” for money laundering and quasi-public/private investment banks can benefit from the exploitation of Ukraine resources”.

This obviously is derived from experience in putting together a New York real estate deal.

Whilst it is true that financial interests are present in the Ukraine conflict, they are not the only interests at stake: Russia has an existential interest in creating a solid, water-tight security environment and in defeating NATO and its European adherents in a lasting fashion. And the Euro-élites have an equal and opposing desperation to land a crushing defeat on Russia.

The NSS says stability in Europe is an US primary interest – but another powerful faction in the US undermines stability in Europe by insisting that the Europeans rearm and be ready for war with Russia by 2027. The Euro-élites comply, because they cannot stand the prospect of Russia ‘winning’ and then becoming a significant actor within Europe. (Sour motives of vengeance are at play too, in certain important quarters of Brussels).

So, we can espy a further evolution of this Trump business model — as Alexander Christoforou outlines —

“Instead of trying to do everything yourself, you focus on core competencies as a business – right? And then you’re going to outsource everything else to partners. So, Europe will be outsourced to the Europeans. Asia will be outsourced to proxies in Asia … It’s like a franchise … we’re [the US is] going to focus on our neighbourhood [the western hemisphere] and then we’re going to have our three, four franchises out there and they’re going to pay us their 7% in franchise fees, but they’re going to take care of their region”.

Just to make matters clear, the NSS states:

“The terms of our agreements, especially with those countries that depend on us most and therefore over which we have the most leverage, must be sole-source contracts for our [US] companies. At the same time, we should make every effort to push out foreign companies that build infrastructure in the region”.

In the context of the US asserting ‘regions of influence’, a main takeaway from the NSS is the focus on the Western Hemisphere and the Americas. It even says the US will “assert and enforce a ‘Trump Corollary’ to the Monroe Doctrine there”.

It is here that we can observe a deeper zeitgeist underpinning the NSS –

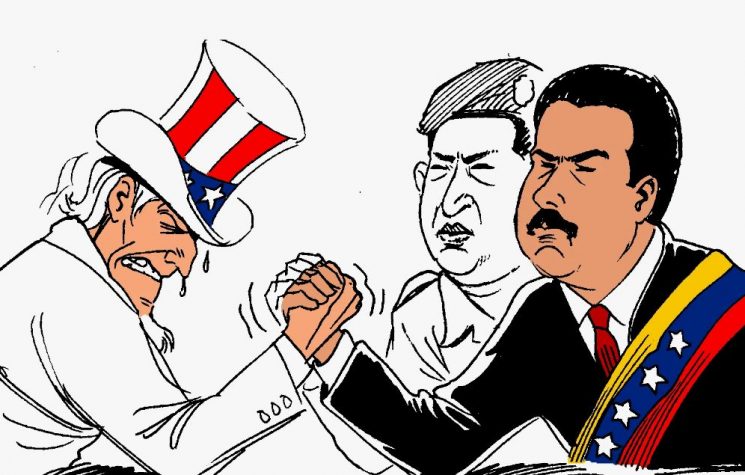

A return to the Hamiltonian economic architecture is very unlikely in today’s circumstances. Instead, what we see from US actions in Venezuela is presently cold, but potentially hot ‘competition’ over who shapes the next global system. Locking China out of Latin America is clearly on the table.

Alex Krainer reports that:

“The Venezuelan government this summer offered Washington the most generous terms any adversary has extended to the US in decades. Venezuela proposed opening all existing oil and gold projects to American companies – granting preferential contracts to US businesses – thus potentially reversing the flow of Venezuelan oil exports from China back to the United States”

“This wasn’t just a ‘deal’. Essentially, it was an unconditional surrender of resource sovereignty to American corporate interests”.

“The response from the Trump Administration: A hard ‘no’. Instead, [naval and] military assets continue to accumulate off Venezuela’s coast.

“Here is where it gets really interesting. Whilst Washington rejected Maduro’s offer, Beijing doubled down. China unveiled a zero-tariff trade agreement at the Shanghai Expo in November – and a bilateral investment treaty. Private Chinese companies, CCRC, are now investing over a billion dollars in Venezuelan oil fields under 20-year production contracts.

“So why would the US turn down exactly what it claims to want [Venezuela’s huge oil reserves], without firing a shot? The answer reveals something far more significant about how global power is likely to work in the future

“[Global power] will be about gaining control over the global economic architecture itself. And [the contest will revolve around] which system – Washington’s rules-based order or Beijing’s emerging alternative – will dominate in the Western Hemisphere and beyond. Venezuela has become the chessboard where two incompatible visions of world order are colliding.

“What China has constructed in Venezuela is not just a trading relationship. It is an integrated supply chain of loans ports and commodity corridors – a network that’s increasingly resistant to external pressure. And that’s exactly [what irks] from Washington’s perspective. Because when we talk about the emerging global order; we are discussing the competition between an American-led system and that which China espouses.

“The American approach … relies on the dollar. It depends on financial institutions like the IMF and World Bank that operate according to rules written largely in Washington. It requires countries to integrate into a trading system where the US and its allies maintain the ability to impose costs through sanctions primarily on actors who violate established rules”.

But China requires none of that: It builds on fundamentally different principles. It doesn’t require reform of political systems, nor adopting the dollar-based system. Nor does it insist on alignment with Washington’s foreign policy.

Why then did America reject the Maduro offer? Because the real issue is not oil. Oil is fungible. The key issue is as stated in the NSS: In Washington’s regional fortress, Trump’s Monroe Corollary asserts “that the US will make every effort to push out foreign companies that build infrastructure in the region”.

Trump is saying – by his naval blockade of Venezuela — that Chinese supply chains, loans, alternative payment systems and commodity corridors — will be “pushed out” from America’s fortress Western Hemisphere. Hence the naval blockade of Venezuela and Cuba.

This marks the first round in the war for who gets to shape the incoming economic architecture and system in Latin America — and of course beyond.

It is hugely symbolic — and dangerous. By what means — economic or militarily — will the Trump Corollary be enforced? Let’s see.