The Savings and investment union announced by Ursula von der Leyen is a fundamental political choice about the future of Europe and its peoples.

Contact us: info@strategic-culture.su

In recent months, we have all heard the pressure from European Commission President Ursula von der Leyen to accelerate the creation of a Savings and investment union (SIU). Initially presented as a tool to mobilize financial resources for the benefit of European citizens and to promote the green and digital transition, the most concerning aspect of this campaign lies, once again, in the uncritical, passive, and submissive acceptance of the Commission’s intentions and decisions.

Under closer scrutiny, this is yet another agenda. How many agendas has von der Leyen presented to us, only for things to keep getting worse? That agenda was designed to benefit the usual suspects: the most prominent private and corporate interests (elsewhere referred to as “oligarchs”), at the expense, as always, of collective interests, public welfare, and the national interests of many member states.

To fully grasp the intentions behind this SIU, we must first understand what it is. Theoretically, the SIU is presented as: “an initiative aimed at integrating the financial markets of member states to boost investment, economic growth, and financial stability.” In this framework, the SIU is ostensibly intended to facilitate access to cross-border financial products for “citizens and businesses,” while promoting long-term savings and investment. A marvel, indeed. In the EU, there is a vast amount of money in term deposits (€10 trillion) and even more in public, mutual, and associative funds whose contributions could be diverted toward other types of solutions, luring beneficiaries with the siren song of easy money from venture capital.

According to the European Commission, this union could improve long-term savings options, encourage products like individual pension plans (PEPP), and promote “sustainable” investment funds linked to the EU’s energy and climate agendas. All of those funds are private, just as those people like it. A fundamental characteristic of any EU agenda is relegating the state to a secondary, minimalist role – except when it comes to footing the bill.

This union also intends to create broader and more integrated mechanisms for investor protection, ostensibly by strengthening transparency and regulation to ensure financial products are safe and suitable for risk profiles. Finally, this aggregated, mobilized, and circulating capital will supposedly foster business financing, theoretically facilitating SMEs’ access to alternative funding sources like crowdfunding and capital markets. SMEs are always used as justification, but rarely end up as the ultimate beneficiaries of these proposals.

There are already planned measures, such as the aforementioned PEPP (Pan-European Personal Pension Product), a private pension product that can be offered across the EU, free from the burden of intergenerational solidarity that characterizes public pension systems; the revision of legislation to “improve” investor protection and market transparency; the regulation of fintech and crowdfunding (technological financing and public fundraising platforms like Patreon), creating harmonized rules for collaborative financing platforms; and the introduction of fiscal incentives by member states to stimulate savings and investment. All this promises greater product diversification and “investment” solutions, higher financial returns (since, in theory, there will be more competition), and enhanced security, as common rules supposedly reduce the risks of fraud and financial malpractice.

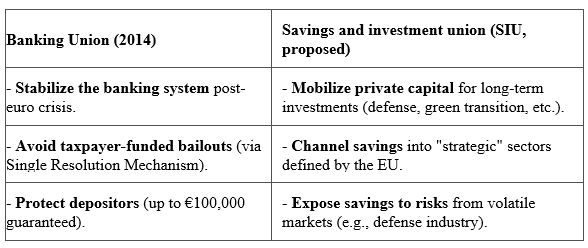

Do not mistake the Savings and investment union for a component of the Banking Union. No, the SIU is, at most, complementary. The SIU and the EU’s Banking Union share the goal of integrating financial markets but differ in scope, mechanisms, and associated risks.

Let’s compare their stated objectives:

The Banking Union aimed for centralized supervision (ECB), common rules for bank insolvencies, and a focus on financial stability. The SIU, on the other hand, seeks to attract savings and investment toward risk through the harmonization of financial products, fiscal incentives for cross-border investments, and a heightened focus on profitability and “strategic priorities” like defense and the green transition.

As the saying goes, “once bitten, twice shy,” and from von der Leyen’s Commission, Europeans can expect nothing but pretty words upfront and knives in the back. The real problems of the SIU lie in its “associated risks” and “unspoken intentions.”

Contrary to what the EU claimed, the Banking Union, launched in 2014 as a response to the euro crisis, also promised greater competition, stability, and depositor protection. In practice, however, it only solidified the dominance of big banks, reducing the diversity of Europe’s financial sector – the opposite of what was promised.

Banking concentration increased, driven by a wave of mergers and acquisitions. In Spain, the number of banks fell from 55 in 2008 to 10 in 2023. In Germany, regional banks (Landesbanken) lost relevance to giants like Deutsche Bank and Commerzbank. By 2023, the 10 largest banks in the EU controlled around 70% of financial assets (ECB, 2023). As we can see, the myth of “too big to fail” did not hold, and if the largest banks collapse, states will still have to bail them out.

With this capital concentration – the Banking Union should be renamed the “Banking Concentration Union” – competition decreased, and big banks benefited from the new rules, while small institutions faced higher regulatory costs and greater difficulties competing on a transnational scale. The result is felt daily in our wallets: higher fees for customers, fewer credit options for SMEs, and less financial innovation. The exact opposite of what was promised. A déjà vu of the privatization processes in Portugal and Europe.

The truth is that, like all EU regulations, the Banking Union also favored only the big players. The regulatory system, heavier and more complex (e.g., Basel III), demands resources only available to large banks. The ECB supervises only the big banks, leaving smaller ones under national authorities, creating asymmetries – for example, in access to credit. The largest banks can finance themselves (sometimes at negative rates) through the ECB, while small banks must secure funding at higher rates. Capital concentration led to political power concentration and lobbying capacity, further widening the gap between big and small, rich and poor.

It is therefore only fair to predict that the same will happen with the SIU. Both initiatives reflect a problematic logic: the Banking Union socialized banking risks (with strict rules for banks but no debt mutualization), producing what we can now call “socialism for the rich and capitalism for the poor,” a modern version of the medieval “sin of greed,” which only affected the poor because the rich were already wealthy.

The SIU, meanwhile, aims to socialize financing for political projects (like defense), transferring risks to citizens. In other words, it wasn’t enough to have socialism for banks and big clients – now, the EU will focus on socialism for large financial funds. The intention is clear, reflecting the submissive, passive, and docile state of member states and their leaders.

If the Banking Union, with all its neoliberal implications, required a financial crisis as justification, the SIU doesn’t even need that. The consensus for war is so deep that even external propaganda fell short of the usual, with the war in Ukraine serving as enough justification.

The big winners of the SIU will be major asset managers (BlackRock, Allianz), which will dominate the new savings markets. Standardized products (like PEPP) will favor global players, not small investors, transferring risks to citizens, workers, and their families while profits flow to the financial elite, just as happened with the Banking Union.

The result is simple: more centralization and, consequently, less financial democracy, further widening the already enormous and growing gap between rich and poor. The truth is that every time von der Leyen signs one of her “acts,” our incomes suffer, our living conditions decline, and the idle oligarchy that leeches off European growth grows fatter, year after year.

Just as the Banking Union failed to deliver a diversified and competitive system, instead increasing the power of big banks, the SIU is heading for the same fate. If the EU does not impose limits on capital concentration and market share and demand real guarantees for small savers (which would limit the intention of attracting the touted €800 billion), “financial integration” will be nothing more than a euphemism for more private control over the money of European citizens.

Is it worth trusting a structure that, in practice, always benefits the same giants?

This question takes on another dimension when we consider that BlackRock, the American asset manager, will be one of the biggest beneficiaries – and most prominent promoters – of this union. The ties between German Chancellor Friedrich Merz and this company are anything but coincidental, just as it is no coincidence that von der Leyen, also German, is pushing so decisively for yet another fiasco.

And to make matters worse, this one has neocolonial overtones. It’s not enough that we’ve handed over our defense, energy strategy, and academia to the U.S. – now, we’re going to hand them the meager savings of European workers.

But don’t be fooled into thinking the potential harms of the SIU stop there. At first glance, the idea of a SIU seems appealing: centralize and manage Europeans’ savings, allowing them to be invested in strategic projects like green infrastructure, innovative technology, and other priority areas. However, when we look at who the main proponents of this initiative are and what the recent trends in European economic policy have been, we realize that this project has all the makings of further crushing our living conditions, opening the door to the savagery that already reigns in the U.S., where the working classes have been conditioned into the childish belief that their stability depends on some form of “passive income” and a supposed “financial literacy” that competes with that of the system’s owners. After the U.S., it’s now time to aggressively target the incomes of workers meant for solidarity-based safety nets.

It’s no coincidence that the SIU announcement also comes amid intensifying pressures to privatize historically public or mutualist sectors. From state pension funds to social security systems and mutual insurers, there is a clear trend of transferring assets and responsibilities from the public domain to private hands. This process, often disguised as “modernization,” “transparency,” “rationality,” or “efficiency,” directly erodes social rights and increases inequality. Just compare the returns of a public pension system with those of a private individual system to understand why big corporations attack the former. There’s a lot of money going to the “wrong hands,” they must think.

As we will see, once the SIU is implemented, the urgent calls for “social security reform,” the imperatives of “letting everyone choose their pension,” and the demographic emergency of “pension system reform” will follow. All for one thing and one thing only: to reduce funds allocated to social security and increase those available for SIU financial products – in other words, for BlackRock and friends. The pressure on centrist liberal, social liberal, social democratic, or reactionary conservative governments will be absolutely brutal, almost certainly leading to the justification that “the EU made us do it.”

In the outdated 18th-century theory, the invisible hand works wonders. By concentrating European citizens’ savings in a unified system, governments and financial institutions would gain access to vast resources currently dispersed across national or regional systems. However, in a completely unbalanced, biased, and skewed system, these resources will be captured by large financial conglomerates and corporations, who will use them to fund their interests.

A clear example of this dynamic is what happened with pension funds in several European countries. In the 1990s and 2000s, many states adopted individual capitalization models, transferring part of the state’s responsibilities to private funds, also in an attempt to free up capital for investment, or so they claimed. The result was higher management fees, less transparency, and, in some cases, the collapse of systems that were once robust and solidarity-based. The SIU will replicate this model on a continental scale, accelerating the transformation of public systems into mechanisms controlled by financial markets. Given what we know today, we can no longer claim that this isn’t the intention.

Moreover, the proposal raises doubts about its ability to ensure equity and social justice. Who will decide where the funds are invested? Will projects that directly benefit citizens, like affordable housing or public healthcare, be prioritized, or will large industrial and financial conglomerates be favored? Recent experiences show that, without rigorous and democratic regulation, capital tends to flow where profits are highest, regardless of the real needs of populations.

The financing of militarism is the other side of the coin and constitutes one of the strongest political appeals of the proposal. In addition to all the systemic and political risks already mentioned, it will also add the danger of military confrontation. Armed to the teeth, what do we think people like Merz, von der Leyen, or Macron will do? Once the plundering of the working classes is complete, where will the next project of plunder be directed?

The EU faces a familiar dilemma: how to finance massive investments in defense without violating budgetary rules (like the Stability and Growth Pact)? This is where the SIU comes in! Mobilizing private capital, facilitating long-term investments in strategic sectors like defense through specialized investment funds (e.g., critical infrastructure or dual-use technology funds); issuing adapted green/social bonds (like “defense bonds” for sustainable energy security and military projects); or encouraging institutional savings, directing part of pension savings (PEPP) or pension funds toward defense assets with an adequate risk profile – there are many strategies that will be used to attract the necessary resources.

Another option under the SIU is the creation of a “defense capital market,” harmonizing rules to facilitate IPOs, capital increases, or debt issuance by defense companies. Finally, fiscal obstacles could be reduced – some countries tax investments in weapons, but exceptions could be made for European projects, making private investment in defense-related products more attractive due to lower tax burdens. In other words, European taxpayers will pay out of pocket to face an ever-greater risk of war.

Currently, the European Defence Fund (EDF) is financed by the EU budget, but its scope is limited. With a more integrated monetary union, strategies based on public-private partnerships could be implemented, such as the issuance of defense-backed bonds by investment banks (like the EIB). What was never done for housing or railways will now be done for war, always leaving the necessary royalties for private interests. Ideas like defense crowdfunding, attracting small investors’ funds to the much-touted cybersecurity or drone startups, later bought by big corporations, are another possibility in the minds of these people. As we can see, the SIU opens up a universe of possibilities, none of which benefit the people of Europe.

This scenario is not mere speculation. The fact is that the SIU proposal explicitly includes defense sector financing at a time when the EU is betting on a new rearmament cycle and the creation of a reinforced European Defence Fund. The Draghi Report, which underpins part of this initiative (it was part of the mandate), identifies defense as a priority area for absorbing European private capital. Thus, the SIU not only enables the diversion of savings to the military sector but could also make citizens unwitting accomplices in strengthening the European military-industrial complex under the pretext of securing better returns for their savings.

Another consequence of this exploitation will be the diversion of resources that would otherwise go to priority social areas, further entrenching a militaristic mindset that threatens peace and international cooperation. In concrete terms, it will delay by decades any real possibility of understanding between the EU and the Russian Federation – if it doesn’t make things even worse.

The European Commission insists that citizen participation will always be voluntary and that there are no plans for any form of savings confiscation. However, institutional pressure to “diversify” investments and the promise of higher returns may, in practice, marginalize traditional savings options and push European citizens toward financial products aligned with Brussels’ strategic objectives. The rhetoric of free choice thus hides a profound reconfiguration of the role of the welfare state and the fate of popular savings.

While “security” and “defense” are touted, the devastating impact of militarism on communities, both within and outside Europe, is neglected. Resources that could be used to fight poverty, social exclusion, and the climate crisis are instead wasted on weapons and war technologies.

Given this scenario, it is urgent to question the true nature of the Savings and investment union and resist its implementation. Nothing is more dangerous than merging corporate greed with the adrenaline of war. When big capital moves from profiting from war to investing in war, we will all be in danger.

The Savings and investment union announced by Ursula von der Leyen is not just a technical or financial issue – it is a fundamental political choice about the future of Europe and its peoples. If this path is followed, in the future, every one of us will be nothing more than a foot soldier in a permanent war economy.

How many times will European citizens need to be surprised by the same mistakes?