The central question is this: in the case of systematic imbalances, should the deficit countries, or rather the surplus countries, make the necessary adjustments to achieve the equilibrium?

Contact us: info@strategic-culture.su

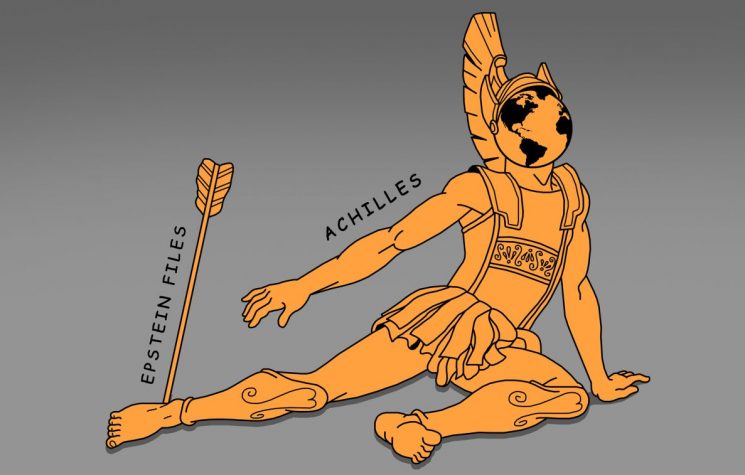

In addition to its more immediate and bombastic aspects, referring to the hyper-politicization and weaponization of the global monetary system by the US authorities, through the measures usually designated by the euphemism “sanctions” (actually, the practice of the most unbridled and savage piracy by the Hegemon), there is a deeper problem in international trade, regarding the forms of monetary regulation of the disparities of the balances-of-payments of countries involved in that trade.

Very briefly, the central question is this: in the case of systematic imbalances, should the deficit countries, or rather the surplus countries, make the necessary adjustments to achieve the equilibrium? Incidentally, we can add: in the case of an option for the devaluation of deficit countries, will currency devaluations be less harmful, or instead the so-called “internal devaluation” (as with the EU and the Euro in 2011, with the “sovereign debt crisis” of southern European countries)?

John Maynard Keynes has already faced a fundamentally analogous question when he proposed “BANCOR”, in 1944. This proposal was then passed over in favor of the so-called Bretton Woods system, the dollar-gold system, which recognized in the US currency a surrogate for gold (the metal until then central to international trade), making it a sort of a “general equivalent”, or a “super-currency”, and the US a kind of world monetary “super-sovereign”. This system was based on the exceptionally high weight of the US economy on a global level at the end of the war, and it generally assumed the US would generate enough global demand to be the buyer of other countries’ goods (or at least those supposedly “behaving well” in political terms), thus dragging behind them the economies of the other countries.

This fixing lasted until the end of the convertibility of the US dollar into gold in 1971, which was decided by the US authorities because of the strains placed on its balance of payments and its public budget by the Vietnam War, and by the correlative expansion of the “welfare state” that the US had experienced in the 1960s (with the implementation of the measures corresponding to the so-called “Great Society”). This change was supported by another important group of arrangements. The political economy of the end of convertibility basically consisted in the oil-producing countries accepting the dollar as the usual currency of trade for that commodity, which guaranteed the US currency a greatly increased global demand in a merely “artificial” way, thus also the preservation of its universal acceptability, despite the end of the convertibility into gold.

The question of compensation/clearing

But how can things be otherwise if, instead of the dollar-gold system, or the institutional arrangement that replaced it in 1971, we want international trade to be fundamentally between equals, without any Hegemon, but also without the drawbacks of a return to the previous “gold standard”, nor those of the isolationist vertigo that resulted from the collapse of that standard? Let us listen first to Jacques Sapir, referring to the current case of the BRICS:

The issue of compensation is important insofar as trade will be multilateral (the potential area being 22 countries, the 9 members of the BRICS and the 13 partner countries). One idea that is currently gaining a lot of ground in China and Russia is that each transaction should not be cleared immediately but at the end of a given period (from one trimester to one year) and that the compensations should be carried out at the level of the “big players” (including individual commercial players). This system seems to be inspired by what existed for Western Europe in the context of the European Payments Union (1950-1957). At the time, the calculation of transactions and the final settlement was done in dollars. In the BRICS Clear system, it will be a “stablecoin” that will serve as the unit of account, while the final settlement will be in local currencies.

But sooner or later, an attempt to build systems based on national currencies will run into limitations under the form of low liquidity in their markets (for some of these currencies), legislative restrictions on convertibility, a high level of exchange rate risks, as well as an imbalance in mutual trade, leading to the accumulation of chronic debts. This is why one of the proposed solutions is very similar to the system implemented in the context of the European Payments Union coupled with a digital currency platform, which will offer a much faster payment speed than traditional payment systems (such as SWIFT). The configuration of a payment zone organized around China, India and Russia, and including partner countries and a number of countries currently in contact with the BRICS, would be optimal in terms of the size and balance of agro-industrial trade flows (food, fertilizers, agricultural machinery) within the framework of multilateral compensation.

The “BRICS Clear” initiative should be seen as going far beyond the interests of China and Russia, even if it is particularly important for Russia due to Western sanctions. Just as the EPU was a factor of European integration in the late 1950s, which was embodied in the Treaty of Rome, the “BRICS Clear” initiative should allow a form of integration not only between the BRICS member countries, but also with the “partner” countries.

(“The BRICS challenge the Western order: the end of the dollar’s hegemony has begun”, 1rst of November 2024, translation and emphasis mine).

The way these imbalances in mutual exchanges are eventually resolved is of enormous importance in terms of the significance, not only economic, but also socio-political, of the extremely interesting experience that unquestionably are the BRICS. Depending on one case or the other (regulation in principle inducing surplus countries to consume more, or alternatively forcing deficit countries as a rule to consume less, that is, to practice “austerity”), the trajectories may be very different, in some respects even opposite.

BANCOR and its enemies

As a rule, it will be advisable to think in a “Keynesian” (or perhaps “post-Keynesian”) way, that is, to choose the first mentioned way. This will have significant repercussions in terms of the general level of economic output, which will be promoted, the functional distribution of income, in which the labor share will be supported, and the personal distribution of income, where excessive asymmetries can be tackled. Allow me, in this regard, an extensive transcription of an article by Prabhat Patnaik:

The thrust of the BRICS Declaration is also on removing the hegemony of the US dollar and having more international trade in national currencies that have fixed exchange rates vis-à-vis one another. Removing the hegemony of the dollar is undoubtedly a laudable objective; but it is not enough. What is also required is the elimination of the hegemony of finance. And for this, at least three conditions are necessary: first, adjustments to remove current account imbalances must be made by countries with current surpluses, rather than by countries with current deficits; second, until imbalances are eliminated, surplus countries should be willing to hold all the IOUs [promissory notes] of deficit countries that come their way; and third, there should be no asset transfers (“denationalisation”) to settle outstanding debt.

Surplus countries making adjustments rather than deficit countries is desirable not just for eliminating dominance, but also from the point of view of world output and employment, and hence the welfare of the world’s working people. If the surplus country has to adjust, then it will raise its domestic absorption of goods and services, which, since its own output will be close to full capacity, will reduce its exports. The deficit country, even if it keeps the same level of domestic absorption as before, will, since its imports have fallen, experience a larger output and employment. Hence, taking the two countries together, there would be an increase in aggregate demand, resulting in larger output and employment. And if the surplus country’s increased absorption takes the form of larger consumption by its working people, then the benefit of the working people in the two countries will be even greater: in the surplus country through larger consumption and in the deficit country through larger employment.

In contrast, if the deficit country has to make the adjustment, as is the current practice, then there has to be a reduction in its domestic absorption, which will create a recession within it. The overall level of world aggregate demand will go down at the expense of the working people of the world, especially of the deficit country. Eliminating current imbalances by making deficit countries adjust is thus inferior to making surplus countries adjust, though admittedly the latter is more difficult to enforce.

In addition, the elimination of dollar hegemony without an arrangement to make surplus countries adjust, will also give rise to some other currency’s hegemony, not to the elimination of hegemony altogether. Assume for instance that BRICS countries trade only among themselves and in national currencies that have fixed exchange rates between them (otherwise rampant currency speculation will make any trading arrangement unsustainable). If a country has a persistent current account deficit vis-à-vis another, then either it reduces its domestic absorption to remove this deficit, which is the current practice, or keeps supplying IOUs to the surplus country until pressure builds up against its currency, and it can no longer maintain a fixed exchange rate. In the latter case, some currencies, namely those of the surplus countries, will acquire hegemony over the others; the replacement of the dollar, no doubt highly desirable, will only have led to its substitution by some other currency, not to the elimination of currency hegemony.

(The Kazan Summit of BRICS, 10th of November 2024, emphasis mine).

Indeed, and returning to our starting point, the crucial issue really seems to be whether it should be the deficit countries or the surplus countries that make the necessary adjustments for balance. Keynes, it should be repeated and emphasized, had already basically faced this question by the time of his famous Bancor proposal, which was passed over in 1944 in favor of the Bretton Woods system, that is, the dollar-gold system, which lasted until the end of dollar-gold convertibility in 1971.

Although he was undoubtedly circumstantially pressured by the difficult position of the United Kingdom vis-à-vis the US at the end of World War II, which immediately suggested the advisability of an adjustment not on the side of the deficit countries but on that of the surplus countries, the position defended in 1944 by Keynes is nevertheless also, and more fundamentally, supported by his general theoretical assumptions about the advantages of regulating the functioning of economies in a “demand-side” manner; that is, betting on the consistent promotion of global demand, which is supposed to systematically tend to be insufficient. This approach assumes, however, and this is crucial, high (and even tendentially increasing) levels of state intervention in economic activity.

Oppositely, a “pre-Keynesian” approach takes it for granted that markets must, if their “normal” functioning is allowed through voluntary abstention from intervention by public authorities, guarantee both optimal levels of activity and output, and a satisfactory distribution of income.

The “pre-Keynesian” attitude is firmly rooted in the conceptual foundations of the functioning of the World Bank, the International Monetary Fund, and the World Trade Organization itself. It is also the one that underlies the institutional arrangements that produced the Euro. If there is an imbalance, for example, with Germany being in surplus and the so-called “PIGS” (Portugal, Italy, Greece and Spain) symmetrically in a situation of deficit, the conclusion that is drawn within this institutional-mental framework is not that Germany should be induced to consume more, but that the PIGS will have to submit to an “austerity” treatment.

Neoliberalism fully ahead of Europe’s destinies

Although that may be considered a strange form of indulgence vis-à-vis German “neo-mercantilism” (as it was also called), it is nevertheless perfectly consistent with the neoliberal and “anti-statist” purposes of the EU, and particularly the EMU: primacy of the market, curbing of the growth of state intervention in the economy (end of “Wagner’s law”), with a levelling down of taxation and regulations, accompanied by unrestricted freedom of capital movements.

As noted by Wolfgang Streeck, the Euro is essentially built on a Hayekian arrangement. The genius of the solution, from a neoliberal point of view, lies in the fact that a customs union of very different countries, therefore with a very small area of intersection of interests, prevents concerted and continuous political action. Therefore, state intervention tends to be reduced to a common minimum – which, in the case of the EU, is further reinforced by the fact that Community legislation has officially precedent over the legislation of each member state. However, even without this, the central idea is that, bringing together states with very different economies, each of them tends to act as a brake on the others, and is simultaneously inhibited by them.

That federations of states can best agree on liberating their economies from state intervention – i.e., on what contemporary political science has called ‘negative integration’ – has been pointed out by Friedrich von Hayek as early as 1939. International federation, so says Hayek, will be needed in the future to restore and preserve international peace; but a federation that fails to integrate its economy will not stand; and economic integration among countries both different and [formally] equal can proceed only in the form of market integration: the institutionalization of a single market free from state intervention, because member states will not be able to agree anything other than that. Hayek’s 1939 article builds a bridge between Austrian economics, Schmitt’s interwar ‘authoritarian liberalism’, German post-war ordoliberalism and the neoliberalism of European Monetary Union since the 1990s.

(Wolfgang Streeck, “Heller, Schmitt and the Euro”, in “How will Capitalism End”, London, Verso, 2016, page 159; emphasis mine).

The customs union, under these conditions, is neoliberal in substance, or is not at all. Any trade imbalance is thus systematically identified as a problem of excessive consumption in the countries with a deficit, and the therapy consists always of the same old same, although “austerity”, like the Devil (The infernal names – Wikipedia), really has a thousand names. But the content does not change: to deregulate, to “let the market function”, to prevent states from intervening – where the unpleasant presence of universal suffrage could possibly create pressures for them to do so. To maintain (last but not the least) a strict discipline to contain aligned countries that may be tempted to “deviant” behaviors.

The arrangement, however, proved to be detrimental to the economic performance of all the member countries in the long run: even before the grotesque episodes configuring the recent collective suicide in the wake of the Ukrainian conflict, the EU lost ground vis-à-vis the rest of the world. Within it, the PIGS have fared even worse, losing ground compared to the Union’s average. Portugal, for example, had been catching-up with the average of the 6 founding countries almost every year from 1960 to 2001, and it shifted into systematic lagging-behind ever since then, with the creation of Euro. It converged in GDP per capita with Europe while it was “outside Europe”; it diverged from it downwards systematically since it finally managed to “step into Europe”.

More generally, however, this arrangement tends to produce increasing regional disparities within the Union. At the level of income distribution, the pressures thus induced are also generically towards the growth of inequalities; and bringing a functional distribution of income less favorable to labor, which reinforces the problems created by the brakes deliberately put on the possible growth of “welfare state” devices.

Neoliberalism partially ahead of the world’s destinies

Patnaik notes this connection between economic state intervention and economic growth, but worldwide, in another article (“The Stagnation of the World Economy”, 6th of October 2024). The goal of keeping states away from economic intervention arguably led to a significant global economic slowdown. Assuming the form of regulation of world trade through the institutional framework prevailing today (a social-Darwinian framework, systematically promoting “competition” as a supposed spur of continued improvements), in order for a state determined to intervene not to become a “sucker”, the potential beneficial multiplier effects of the increase in its public spending seeping away in the form of the unbalanced promotion of its imports, it is necessary: either to be dealing with a “closed commercial state”, in the manner of what was conceived more than two centuries ago by Johann Gottlieb Fichte, and is to a large extent practiced today in Cuba and in North Korea; or that a sufficiently large number of countries decide to do so, jointly promoting policies both expansionist (or “Keynesian”) and “dirigiste”.

Patnaik is, however, perhaps a little too peremptory on the question of the repercussions of a currency devaluation. If the exchange rate is used, certainly not to let it float freely, but imposing on it an administratively fixed purpose, based on the commercial situation of a country, the external account of this (hypothetically, in a deficit situation) can approach equilibrium much more easily via a currency devaluation than imposing it the therapy of the so-called “internal devaluation”. The exchange rate devaluation, admittedly, is potentially good for the trade balance, but also an inducer of capital flight and a rise in interest rates, partially cancelling out the benefits in terms of import-export. In any case, it is necessary to think about the possibility of administratively fixed currency devaluations by deficit countries: this (most likely complemented by restrictions on capital movements) is better than the “internal devaluation” model applied in Europe to the PIGS in the 2010s.

Anyway, this is probably only a secondary issue. The main thing to retain is the “Keynesian” idea of regulating trade balances “from above”, assuming as a principle that, in situations of imbalances, the surplus countries should be selectively punished, forcing them to consume more, with a view to rebalancing the others – but also to avoid recessionary pressures. These are mostly associated with (and in fact result from) the devices of the so-called “austerity”, reducing the overall demand of each country through the containment of public spending, under the fake allegation that this would allow the strengthening of private spending and private investment, which would tend in turn to compensate for the economic withdrawal of the State via the so-called “trickle-down” effects. The rich, in other words, in case they are allowed to pay less taxes, would tend to do for themselves, without legal restrictions, the same as the State, but usually better than the State, by virtue of being always submitted to the (supposedly rationalizing) logic of market devices. And, of course, they would also spontaneously distribute the benefits of this to the rest of the population.

A legend, let us recognize, with understandably shrinking credibility…