The responses to the first crisis of U.S. hegemony unleashed forces that ultimately eroded its power

Contact us: info@strategic-culture.su

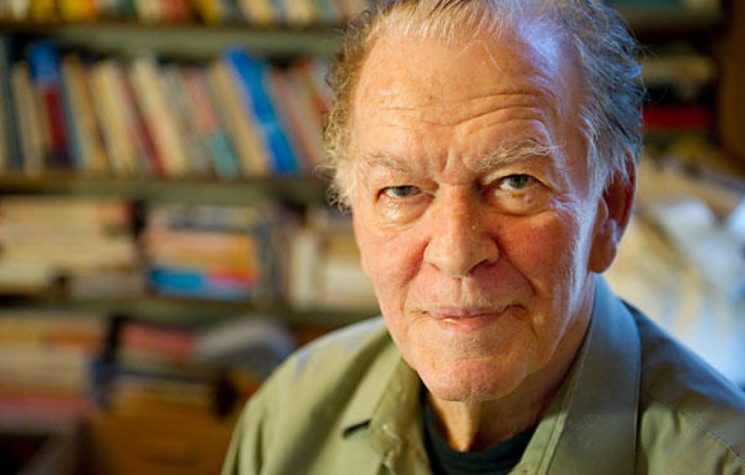

Gene Sharp, widely considered the godfather of color revolutions, published his first book, the three-volume The Politics of Nonviolent Action, in 1973, at a time when the U.S. was mired in a series of crises – economic, political, military – that were eroding confidence in its government domestically and thwarting its geopolitical ambitions. The response to those crises – expansion of its hegemony through conventional and hybrid warfare often outsourced to non-state actors, financialization of the economy and weaponization of the dollar – set the course for the following decades. After fifty years it is abundantly clear that though these responses disrupted the post-war global order and led to the U.S. ‘unipolar moment’, they did nothing to address issues that are systemic and structural. If anything, these ‘solutions’ created more, and more intractable, problems for the hegemon that culminated in the crisis of legitimacy the U.S. is currently facing.

The Politics of Nonviolent Action was based on a research, funded by the U.S. Department of Defense, that Sharp had conducted while studying at Harvard in the late 1960s when the university was the epicenter of the Cold War intellectual establishment – Henry Kissinger, Samuel Huntington, Zbigniew Brzezinski were all teaching there. At first glance it might seem contradictory that Gene Sharp’s research topic would draw the interest of both the Pentagon and the CIA. In fact, it is far from surprising: the defeat and losses suffered in Vietnam had left a deep wound in the American psyche, and internationally this brutal imperialist aggression had fueled a strong anti-American sentiment. Moreover, as the U.S. hegemony started to hit the skids, fears mounted over the economic cost of the arms race with Moscow.

Sharp’s theory and practical guidelines for its implementation seemed to provide the solution Washington was seeking to bolster its power, and undermine its geopolitical, ideological and military rival, the Soviet Union.

Sharp, who would later be described as the “Clausewitz of nonviolent warfare,” offered an alternative to the dominant view that security and defense must be provided by the state. As early as the 1960s the executive branch had encouraged the outsourcing of non-inherently governmental functions to private firms. The practice would gradually increase and eventually extend to military functions – at the end of the Cold War military contracting exploded. It became so prevalent that The New York Times called contractors the fourth branch of the government [1].

The strategy and tactics outlined by Sharp would enable the U.S. to weaponize social forces behind the Iron Curtain without triggering a military conflict, an option deemed too dangerous since the Soviet Union had thousands of nuclear warheads. But most importantly, the job of capturing intellectual elites, inciting division and conducting ideological infiltration could be outsourced to non-state actors such as NGOs, media organizations, lobbies, religious groups, aid agencies, and transnational diaspora communities. As the number of stakeholders and their agendas increased, so did their involvement in shaping the national and foreign policy of the U.S. But as the saying goes, too many cooks in the kitchen spoil the broth.

In those years Washington was contending with another formidable challenge to its hegemonic ambitions. A negative balance of payments, growing public debt incurred during the Vietnam War and monetary inflation by the Federal Reserve caused the dollar to become increasingly overvalued. The drain on U.S. gold reserves culminated with the London Gold Pool collapse in March 1968. By 1970, the U.S. had seen its gold coverage deteriorate from 55% to 22%. In 1971 more and more dollars were being printed in Washington than being pumped overseas. Does it sound familiar?

The U.S. leadership decided to scuttle the gold-backed dollar and thus revolutionize the system of monetary management known as Bretton Woods.

The Bretton Woods system for more than two decades had guaranteed economic growth and a relative paucity of financial crises but throughout most of the 1960s the dollar had struggled to maintain the gold peg and contain the rising economic power of Germany and Japan. At the Rome G-10 meeting in November 1971, U.S. Treasury Secretary, John Connally told his counterparts “The dollar is our currency, but your problem.” This blatant expression of arrogance set the tone and aptly described what would become an exorbitant privilege.

In 1973 when the dollar switched to floating exchange rates its value fell 10%. A few years later, in his book The Alchemy of Finance, George Soros gloated over this ‘revolution’: “Exchange rates were fixed until 1973; subsequently, they became a fertile field for speculation.” Incidentally, the preface of this book was written by Paul Volcker the under secretary of the Treasury for international affairs from 1969 to 1974 who had played an important role in President Nixon’s decision to suspend the gold convertibility of the dollar.

The unilateral decision to sink the Bretton Woods order firmly established the U.S. dollar as the currency of choice for international reserves at many central banks, and elevated U.S. debt to being de facto international money. This new regime based on global floating exchange rates increased capital movements but restricted the policy choices of major countries – under the enormous pressure of capital flows, they were forced to accept conservative monetary policies and to abolish Keynesian expansionary fiscal policies.

Under the new regime, the U.S., unlike other countries, was allowed to run massive debt and print money to weather economic crises, and when excess liquidity drove up global inflation the Fed would raise interest rates and tighten monetary policy. This move would then widen its interest rate gap with other countries, consequently attracting international capital to Wall Street. From 1973 onwards the U.S. has abused its privilege of printing the world’s main reserve currency and has wielded the dollar as a weapon. It was only a matter of time before the inevitable backlash.

The Sorcerer’s Apprentices

Due to the division of academic fields into distinct disciplines, each with its own research focus, so far no one has noticed the strange concurrence of events that I have briefly outlined. The publication of Gene Sharp’s first work, aptly described as a Hybrid War field manual, coincided with the end of Bretton Woods, a turning point that gave new impetus to the financialization of the American economy. Finance was ‘liberated’ from any functional connection to the real economy, becoming a source of great wealth from speculation but also the grand destabilizer of both the domestic and global economy.

Those who had a vested interest in this ‘liberation of the economy’ invested millions of dollars in the ‘liberation from Communism’ and the grooming of new elites that would put an end to the controlled economies and politics of the Eastern Bloc. The fall of the Berlin Wall led to what George Soros called an “explosive period of growth” for his hedge fund.

Though a single coincidence might be dismissed as chance, when multiple coincidences align, they suggest an underlying pattern. Once you notice it, you may discover a reinforcing loop, sequences of mutual causes and effects.

The demolition of the existing international monetary order enabled by the demise of Bretton Woods marked a turning point: the structure of the economy, the distribution of wealth, and the distribution of power changed dramatically. While large multinational companies and financial capital organized a takeover of political power, labor and middle-class interests were pushed to the side-lines. Dollar dominance in the global financial system led to an era of hyper-globalization characterized by the primacy of shareholder capitalism, with deregulation and privatization acting as its handmaidens.

Left unchecked, capital is naturally footloose and expansionistic, always seeks to maximize profit. Once money became virtually free and investment risks could be easily offset, it went looking for investment opportunities abroad, relocated production and supply chains, leaving behind a long trail of socio-economic devastation.

As Vladimir Lenin pointed out over a century ago, “The non-economic superstructure which grows up on the basis of finance capital, its politics and its ideology, stimulates the striving for colonial conquest.

Since we are speaking of colonial policy in the epoch of capitalist imperialism, it must be observed that finance capital and its foreign policy, which is the struggle of the great powers for the economic and political division of the world, give rise to a number of transitional forms of state dependence (…) The export of capital, one of the most essential economic bases of imperialism, still more completely isolates the rentiers from production and sets the seal of parasitism on the whole country that lives by exploiting the labor of several overseas countries.”

Giovanni Arrighi dealt critically with the Leninist theory of imperialism, cleared up some of its ambiguities, observing that it is virtually the only theory of Marxism to which non-Marxist economists give serious consideration. Arrighi [3] explained that whenever a previous phase of commercial/industrial capitalist expansion reaches a plateau, a predominance of finance capitalism is a recurring, long-term phenomenon. Whereas by mid-century the industrial corporation had displaced the banking system as the prime economic symbol of success, the late twentieth-century growth of derivatives and of a novel banking model ushered in a new period of finance capitalism.

The relative decline of both U.S. hegemony and its core economy in the 1970s had obviously alarmed American elites. The production of profit from the manipulation and global expansion of financial capital promised to solve the crisis of both state and capital by bolstering American hegemony. But as it became the biggest and most profitable sector of the economy it would hold the government hostage to its interests. The success of monetary policy led to it being the chief method with which policymakers tried to address economic problems. This, in turn, facilitated the increasing financialization of the U.S. economy and the movement of American capital abroad along with its relentless de-industrialization in the United States.

But let’s return to Gene Sharp. Ten years after publishing his seminal study on ‘civil disobedience’, Gene Sharp joined hands with Peter Ackerman to found the Albert Einstein Institution – despite its name it had nothing to do with the physicist. Ackerman was a banker who had amassed a fortune with junk bonds when he headed international capital markets at Drexel Burnham Lambert, an American multinational investment bank that in the mid-Eighties had become Wall Street’s most profitable firm, with earnings of $545 million on revenues of more than $4 billion before going bankrupt.

The Albert Einstein Institution (AEI) would soon be integrated into the apparatus of the U.S. stay-behind network interfering in the affairs of allied states, whitewashing covert actions, orchestrating regime change operations and color revolutions in any country deemed an obstacle to the global expansion of Anglo-American capital and its neoliberal ideology.

In 2005 Thierry Meyssan researched AEI and outlined its involvement in these operations. AEI has since continued to play an active role in all the color revolutions that failed or succeeded in overthrowing governments and destabilizing sovereign countries.

While AEI claims to be an independent non-profit, it has significant connections to the U.S. defense and intelligence community. One prominent AEI consultant was Colonel Robert Helvey, former dean of the National Defense Intelligence College. AEI’s regular donors included U.S. government-funded organizations like the U.S. Institute for Peace, the International Republican Institute, and the National Endowment for Democracy (NED) which was set up in 1983, the same year as AEI.

NED’s purpose was to serve as an umbrella group for a network of democracy-promotion NGOs such as the National Democratic Institute (NDI), the International Republican Institute (IRI), the Centre for International Private Enterprise (CIPE), the Centre for International Media Assistance (CIMA) et al.

All the above groups, and many more that have mushroomed since, have a lot in common. They are so organic to American imperialism that in 2001 Joint Chiefs of Staff chairman Colin Powell referred to human rights groups and NGOs as “force multipliers and an important part of our combat team.”

They operate in the gray zone between Hard and Soft Power – no longer juxtaposed but conceptualized as a continuum integrated into a single framework – and receive tax-deductible donations from corporate-financier groups (often indirectly through the think-tanks they control) in addition to state funding. As the lines between NGOs and government are blurred due to the pervasive “revolving door” dynamic, their members have the power to shape domestic and foreign policy.

George Soros jumped on the color revolution bandwagon not only because of his visceral hatred for Communism and the Soviet Union. In 1973, as the Bretton Woods system, and fixed exchange rates, came to an end, Soros co-founded the Soros Fund Management (later renamed Quantum Fund). From 1973 to 1980, the portfolio gained 4,200% while the S&P advanced about 47%. In a book he published in 1987, The Alchemy of Finance, Soros expounded his ‘theory of reflexivity’ highlighting that market participants not only respond to information but can also influence the market ‘reality’ by their beliefs, biases, desires and actions, thus creating feedback loops that drive markets but also boom/bust cycles. “In financial markets expectations about the future have a bearing on present behavior. But even there, some mechanism must be triggered for the participants’ bias to affect not only market prices but the so-called fundamentals which are supposed to determine market prices (…) The thinking of participants, exactly because it is not governed by reality, is easily influenced by theories. In the field of natural phenomena, scientific method is effective only when its theories are valid; but in social, political, and economic matters, theories can be effective without being valid. Whereas alchemy has failed as natural science, social science can succeed as alchemy. The historical process, as I see it, is open ended. Its main driving force is the participants’ bias.” [4]

Though it’s well known that the psychology behind market movements is a complex interplay of emotional and cognitive biases, Soros didn’t simply leverage on these biases to manipulate markets, his ambition was to manipulate historical processes through “social alchemy”. In several interviews Soros explained that he was guided by exactly the same philosophy in his ‘philanthropic activities’ in Eastern Europe as in the financial markets.

To this purpose he funded an army of social and political activists who would take part in color revolutions, bankrolled parties, media outlets, infiltrated and lobbied educational institutions, governments and supranational organizations through his NGOs. The weaponization of human rights, exploitation of domestic grievances, and support of ultra-liberal, progressive forces deepened rifts in society and achieved the sort of partisan and ideological polarization that would unleash chaos not only in the countries where Washington sought regime change, but in the U.S. too. The results of the ‘social alchemy’ of this sorcerer’s apprentice are there for all to see.

However, for parasitic financiers like Soros crises are just an opportunity to increase their power and line their pockets. Hedge funds profit from geopolitical instability and stock market volatility. Political chaos, boom and bust cycles are their bread and butter because when investors are worried, they want to be hedged.

He Who Sows the Wind Will Reap the Whirlwind

The destabilization of the monetary order, and the destabilization of the post-1945 world order through color revolutions laid the ground for American-led globalization and gave impetus to the financialization of the U.S. economy. In the 1970s and 1980s we witness the increasing removal of capital controls by national governments worldwide, and in the U.S. the gradual erosion of the Glass-Steagall Act (1933) that, in response to banking crisis had imposed the separation of commercial and investment banking. The Act would eventually be repealed in 1999.

The turn to neoliberalism produced the State decentralization that Sharp, Soros and others of their ilk favored. In a capitalist society when you transfer authority and responsibility of major government functions to ‘civil society’ and the private sector, you don’t strengthen democracy, you actually transfer power to multinational corporations, various supranational oligarchic clans and lobbies.

Under the pressure of capitalist relations all that is solid melts into air, all that is holy is profaned, to paraphrase Marx. The reduction of all human relations to the “cold cash nexus” in an increasingly marketized and commodified society means that customs, practices, and institutions on which people have relied or which they have valued in non-commercial terms cease to exist or remain only as parodies of themselves or empty abstractions. Before long, the system breeds a new species: Marx labels it “a new financial aristocracy, a new variety of parasites in the shape of promoters, speculators and nominal directors, a whole system of swindling and cheating by means of corporation promotion, stock issuance, and stock speculation.” Marx knew in the 1860s that the general law of capitalist accumulation could be modified by many circumstances. But in every case, it “followed that in proportion as capital accumulates, the situation of the worker, be their payment high or low, must grow worse.” [5] And that’s where we are now.

The new Dollar-Wall Street Regime [6], to borrow Peter Gowan’s definition, gave rise to a parasitic rentier class that would benefit from chaos because it was well positioned to take advantage of any crisis to increase its power. This class had a vested interest in destabilizing and overthrowing governments that resisted the long march of neoliberalism and its ideological underpinning. And to this purpose it joined hands with Anglo-American intelligence apparati, created a mind-boggling network of NGOs and think tanks to advance its objectives, build clientele, dole out favors.

Once the Soviet Union collapsed, the Dollar-Wall Street Regime identified in Nation-States the new obstacle to a capitalist world-empire with the U.S. occupying its commanding heights, imposing its rules, flouting or adapting them to suit its perceived interests.

Fueled by money-printing and unsustainable debt, the U.S. superficially looks wealthy, but is actually teetering on the edge. Under the cover of ‘boom and bust’ rot and decay have set in, and the parasitic rentier class has weakened its host. Sure, the U.S. is still trying to punch above its weight, but the global balance of power has already shifted.

The flouting by the U.S. of multilateral conventions whenever these conventions interfered with its interests is an indicator of the weakness, not the strength. Double standards and blatant hypocrisy have eroded American legitimacy.

American corporations, financial institutes, NGOs and media became integral to U.S.-led globalization as they developed a multi-faceted governance paradigm that extended to all sectors of society. Over a hundred years ago, drawing on the analysis of rent-seeking capitalism provided by both Marxist and liberal economists, Lenin reached the following conclusions, “Monopoly under capitalism can never completely, and for a very long period of time, eliminate competition in the world market. The tendency to stagnation and decay, which is characteristic of monopoly, continues to operate, and in some branches of industry, in some countries, for certain periods of time, it gains the upper hand. The export of capital, one of the most essential economic bases of imperialism, still more completely isolates the rentiers from production and sets the seal of parasitism on the whole country that lives by exploiting the labor of several overseas countries.”

Ironically, what looked like an expression of power, monopoly and dollar dominance, resulted in the erosion of that same power. Private groups, and their interests, have been allowed to shape national and foreign policy but they can’t develop a grand strategy that would enable the U.S. to prop up its waning hegemony.

The U.S. is now going through another crisis after it overcame the 1970s one through the financialization of its economy, delocalization of industrial production, geopolitical expansion through conventional and hybrid warfare and the weaponization of the dollar. The limits of that strategy have been reached and ascending powers have demonstrated a stronger resilience and power of attraction than the U.S. imagined. The 2008 global financial crisis not only revealed the weakness of U.S. hegemony, it also showed the relative strength that the Chinese economy had acquired. This strength, combined with social cohesion, an emphasis on win-win cooperation with foreign partners rather than control and domination, imposition of arbitrary rules and ideological diktats, proved particularly attractive. In the year following the 2008 financial crisis Brazil, Russia, India, and China held the first leaders summit in Russia under the name BRIC and South Africa joined them in 2010. The BRICS initial focus was on improving the global economic situation and reforming financial institutions. As these five countries shared a vision of non-interference and a commitment to a true form of multilateralism in which countries are equal partners, they gradually increased their cooperation and attracted to the group emerging countries that also advocated a reform of global governance and a fairer world order.

This new reality of sovereign countries determined to defend their national interests contrasts with the flawed neoliberal thesis of transnational capitalism in which interdependence and integrated global chains would overcome the rivalry between national states. Countries of the Global South are rejecting this thesis because they understand that the dilution of their sovereignty doesn’t lead to peace, but in fact to neocolonialism – their subordination to the interests of Western finance and multinational corporations. As neoliberalism showed its totalitarian nature and the old hegemonic power shot itself in the foot by weaponizing the dollar and relying on double standards, coercion, war and chaos to impose its rules and anti-values, it’s hard to see how the U.S. can continue to lay claims to international leadership.

The current crisis of legitimacy is far more serious than those the U.S. weathered before – de-dollarization is shaking one of the main pillars of its power and reshaping the global economy. The impact will be acutely felt in the U.S., where de-dollarization will likely lead to a broad depreciation and underperformance of U.S. financial assets versus the rest of the world.

[1] Martha L. Phelps, A History of Military Contracting in the United States, in The Routledge Research Companion to Outsourcing Security, 2016

[2] Vladimir Lenin, Imperialism, the Highest Stage of Capitalism, 1916

[3] Giovanni Arrighi, The Long Twentieth Century: Money, Power and the Origins of Our Time, 2010

[4] George Soros, The Alchemy of Finance, 1987

[5] Karl Marx. Capital Vol.1

[6] Peter Gowan, The Global Gamble: Washington’s Faustian Bid for World Dominance, 1999