All that needs to be done is to help the markets take their course, for the Russian authorities to ensure that Russian produce reach their points of departure.

Contact us: info@strategic-culture.su

Recent reports in Tass and similar outlets that Russia and her BRICS partners are setting up a Russia-based grains exchange cannot go without comment. Not only has Russian Agricultural Minister Oksana Lut told reporters that this exchange is on its way, but that settlement will be done in the exotic currencies of the BRICS nations. Russian President Putin seems to have backed this approach, when he remarked that settlement of Western grains contracts is primarily conducted in London and Paris, neither of which is a major grains producer.

Although Lut went on to say “The BRICS countries now … produce about 40% of grain crops, 50% of fish, 50% of dairy products worldwide,” those are largely irrelevant facts as to where any relevant market should be situated. If Lut thinks the BRICS countries will replace the London Metals Exchange and the Chicago Mercantile Exchange any time soon, she might be well advised to read my earlier article on how to begin the process of setting up a Russian market that is fit for purpose.

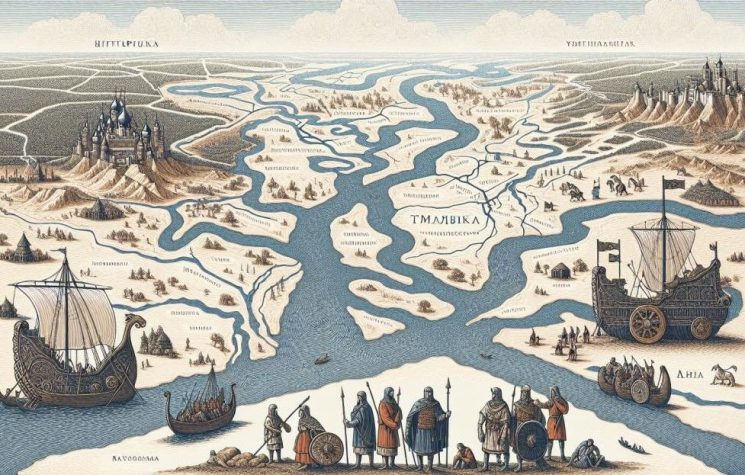

The key thing, from the point of view of Russian producers, is to establish a firm set of brokers that bring the product from point of origin (farm or mine) to point of departure (port, pipeline or railway station), and thence onwards to China, India, Indonesia, or wherever the market is. Until the product leaves Russia, payment is in roubles, and foreign currencies are not a factor. Those foreign currencies only become a factor, once the product changes from Russian into non-Russian hands, and it can become an acute problem, if the other currency is the Indonesian rupiah, or some similar exotic or volatile currency.

Once they are loaded onto, for example, a Chinese ship in a Russian port for delivery to China, then the Chinese yuan comes into play, with the Chinese/Russian (or Russian/Indonesian) exchange rate only then being of concern to brokers making the transaction.

Basic hedges coming into play so far in our simple example are rouble hedges caused by changing weather conditions, such as torrential rains or prolonged frosts, in Russia from the time of product order to the time of product delivery, and exchange rate hedges to cover currency turbulence during the same period. With those brokers being regulated by Chinese and Russian government officials, their transactions should be a relatively straightforward affair; other BRICS countries would afterwards require more effort to bed down.

Just as Rome was not built in a day, so also did it take well in excess of a century for the Chicago and London markets to reach their present state of unmatched sophistication. In that regard, it should be remembered that the CBOT, one of the CME’s forerunners, began trading in standardised exchange traded forward contracts in 1864, and that the little acorn of the Chicago Butter & Egg Board, a spin off of the Chicago Produce Board, later evolved into the giant oak tree of the CME.

The point there is that the proposed BRICS grains exchange should learn to walk before it can run and, if that point has not been made clearly enough, Ms Lut should recall not only Barings Bank, Silver Thursday and Metallgesellschaft that all went belly up, but the fate of the CIA’s Nordstream pipeline terrorist attack and all that depended on it.

Foreign exchange hedging is not an immediately acute issue, as the international markets give us live prices for the Yankee dollar and the prices for non-exotic currencies, such as the Chinese yuan, can easily be derived from them.

Because other BRICS currencies are considered as more exotic or, if you prefer, more problematic, they do not lend themselves to the simpler fixes the Chinese yuan does. That said, in the particular markets we are concerned with, fixes should be achievable using the Chinese yuan as a basis.

This Reuters report, coupled with this Brookings report, examines the risks of clearing houses failing, something that is very relevant in this BRICS example, all the more so as the terrorists, who blew up Nordstream, would make it a high priority target and, if foreign exchange derivatives were in the mix, a very easy one at that.

If we look at current wheat prices, we see that they have been particularly volatile of late, due to changing weather patterns in Russia and elsewhere, showing us, inter alia, the need for a good mechanism for Russian producers to hedge their products. Although the necessary wheat futures are available for trading in the Chicago Board of Trade (CBOT), Euronext, Kansas City Board of Trade (KCBT) and the Minneapolis Grain Exchange (MGEX), if Russian producers can ship to China or some other partner country, such exchanges become redundant to their immediate needs.

Although China, India, Russia, the US, France, Australia, and Canada are the biggest wheat producers, Russia is the world’s biggest exporter of wheat, followed by the United States, Canada, France, Ukraine, Australia, and Argentina, with Ukraine and Russia accounting for nearly 30% of global wheat exports prior to 2022.

Despite the Russian Union of Grain Exporters (RUGE) getting Putin to back their BRICS grains exchange proposal, WorldGrain.com urges caution on the very pragmatic grounds that most BRICS countries, Russia and Brazil excepted, are net wheat importers rather than massive wheat exporters, thus making redundant an OPEC type alliance to challenge the International Grains Council. Further, as over 95% of grain is traded over the counter, the need for a sophisticated BRICS exchange is not immediately apparent.

Although Putin was correct to say there is something lop-sided in Russia accounting for a quarter of global grain exports, while the global prices are set by Western exchanges, such as the American CME Group and the French MATIF, with supplies being controlled by large European and American traders, such as Cargill and Viterra, what does that matter to brokers exporting wheat from Vladivostok to Shanghai, who need no Western help in doing any of that and who have a guideline price to work from, thanks to those same Western concerns.?

Although Allaboutfeednet neatly summarises the official Russian position in all this, their argument is analogous to those false arguments Australians, Kiwis and Argentinians propounded regarding mutton and beef, when they were integral spokes of Britain’s economic empire. Russia does not have to reinvent Chicago, Kansas, Paris or London by the banks of the Moskva River, not least because there is no need to.

All that needs to be done is to help the markets take their course, for the Russian authorities, Russia’s Armed Forces included, to ensure that Russian produce reach their points of departure and that Russian, Chinese and other ships, pipelines and trains take it from there. Once Russia gets those basics in place on her eastern and southern flanks, the rest will quickly fall into place.