Japan’s economy does not require a prophet or crystal ball to tell you what lies ahead in its very near future: that is, that Japan has become the ticking time bomb for the world economy.

In case you haven’t been able to hear under all the media thunder of doomsday prophesying by so-called “experts” on China’s future economic performance (which has been going on for close to a decade and is more akin to wishful thinking than economic analysis), Japan’s economy does not require a prophet or crystal ball to tell you what lies ahead in its very near future: that is, that Japan has become the ticking time bomb for the world economy.

According to NIKKEI Asia, in an October report, Japan’s “yen weakened past 150 against the dollar reaching a new 32-year low as the policy gap widens between the Bank of Japan and the U.S. Federal Reserve…The Fed has repeatedly raised interest rates to tackle inflation, while the Bank of Japan maintains its ultraloose monetary policy to support the economy.

The Fed’s hawkish monetary policy, along with persistent inflation expectations, has pushed the benchmark 10-year U.S. Treasury yield up to 4%. The Bank of Japan, meanwhile, is continuing to hold the 10-year Japanese government bond yield near zero. The Japanese central bank conducted a bond-buying operation for the second straight day to keep the yield within its implicit range of -0.25% to 0.25%.

The yield gap is prompting investors to invest in dollars rather than yen, exerting strong downward pressure on the Japanese currency.” [emphasis added]

In response to this the Bank of Japan (BOJ) decided to maintain its “ultraloose monetary policy” as BOJ Governor Haruhiko Kuroda “highlighted downside risks to the economy and indicated his willingness to accept a weaker yen.” By mid-November it was reported that the Japanese economy shrank for the first time in four quarters as inflation and the weak yen hit the country. “Japan has a history of having suffered from extreme yen strength,” Kuroda added, suggesting that excessive weakness is easier to bear than a too-muscular currency.

By mid-November, NIKKEI Asia reported “Bank of Japan’s ultreasy policy under pressure as inflation hits 40-year high,” with food prices increasing by 3.6% on the year in October, well above the 2% target. Governor of the BOJ, Kuroda responded “The bank will continue with monetary easing, aiming to firmly support Japan’s economy and thereby achieve the price stability target of 2% in a sustainable and stable manner, accompanied by wage increases.”

By mid-January Japan had reported a record low in annual trade deficit of $155 billion USD for 2022.

This is not a sudden outcome for Japan’s economy but rather has been a slow burn over a 12 year period. Alex Krainer writes: “Over the ensuing 12 years and several rounds of ever greater QE [quantitative easing], the imbalances have only worsened and in February last year, the BOJ was forced to go full Mario Draghi, all-that-it-takes, committing to buy unlimited amounts of JGB’s [Japanese Government Bonds]. At the same time however, the BOJ capped the interest rates on 10-year JGBs at 0.25% to avoid inflating the domestic borrowing costs…Well, if you conjure unlimited amounts of currency to monetize runaway government debt, and you keep the interest rates suppressed below market levels, you are certain to blow up the currency.”

Not unrelated to this unfolding of Japan’s economy was the meeting of the Trilateral Commission in Tokyo, Japan for their 50th anniversary this past November.

For those who are unaware, the Trilateral Commission was founded in the wake of the Watergate and oil crisis of 1973. It was formed under the pretense of addressing the “crisis of democracy” and calling for a reshaping of political systems in order to form a more “stable” international order and “cooperative” relations among regions.

Alex Krainer writes:

“The commission was co-founded in July of 1973 by David Rockefeller, Zbigniew Brzezinski and a group of American, European and Japanese bankers, public officials and academics including Alan Greenspan and Paul Volcker. It was set up to foster close cooperation among nations that constituted the three-block architecture of today’s western empire. That ‘close cooperation’ was intended as the very foundation of the empire’s ‘three block agenda,’ as formulated by the stewards of the undead British Empire.”

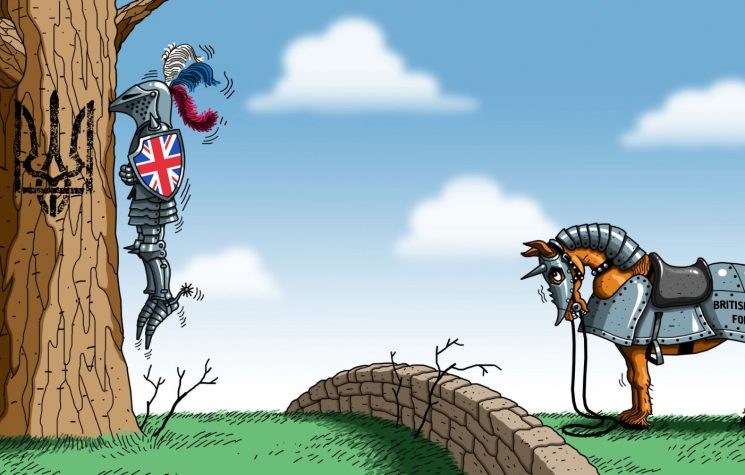

Its formation would be organised by Britain’s hand in America, the Council on Foreign Relations, (aka: the offspring of the Royal Institute for International Affairs, the leading think tank for the British Crown).

Project Democracy would originate out of a Trilateral Commission meeting on May 31st, 1975 in Kyoto Japan, where the Trilateral Commission’s “Task Force on the Governability of Democracies” findings were delivered. The project was overseen by Trilateral Commission Director Zbigniew Brzezinski and its members James Schlesinger (former CIA Director) and Samuel P. Huntington.

It would mark the beginning of the end, introducing the policy, or more aptly “ideology”, for the need to instigate a “controlled disintegration of society.”

However, it appears certain participants of this Trilateral Commission are starting to catch on that this alliance between the United States, Western Europe and Japan for the restructuring of regions (à la League of Nations) is not what they so naively thought it would be, that is, that it would not be just about the disintegration of competing economies but would include their very own.

In the end, all would be expected to bend the knee in subservience to the head of a new world empire. As one of the attendees of this latest Trilateral meeting joked “some…say that all the significant events in the world have been predetermined by the Trilateral Commission,” he said to laughter from the veteran attendees, however, “we don’t know who’s in, what they are saying!”

Interestingly, three reporters from NIKKEI Asia were invited to observe this 50th anniversary gathering of the Trilateral Commission, the first time that press has been allowed entry into the notoriously secretive meetings. The meeting began with Rahm Emanuel, the U.S. Ambassador to Japan, delivering his remarks in a speech titled, “Democracy vs. Autocracy: You are going to see 2022 as an Inflection Point in the Success of Democracy.”

Interestingly, it seems that the Asian delegates weren’t too impressed.

NIKKEI Asia reported: “…the press has been invited to highlight a rift that may be emerging between Asia and the other wings of the organization. ‘We feel that the U.S. policy toward Asia, especially toward China, has been narrow-minded and unyielding. We want the people in the U.S. to recognize the various Asian perspectives,’ said Masahisa Ikeda, an executive committee member of the Trilateral Commission. Ikeda has been named the next director of the Asia Pacific Group [of the Trilateral Commission], and is scheduled to assume the position next spring.

…A new sentiment has now emerged from the Asia Pacific Group: Without proper steering, the U.S.-China rivalry may lead the world into a dangerous confrontation.” [emphasis added]

The U.S. Ambassador to Japan, Rahm Emanuel was quoted as saying while democracy is “sloppy” and “messy,” “the institutions of the democratic process, the political stability of the United States, NATO, the European countries, have held.”

However, there were many attendees who disagreed with Emanuel’s pro-U.S., pro-NATO, anti-China stance. “What is the ambassador saying?” a former Japanese official said on background. “We must engage China. If we force countries to choose sides, the Southeast Asian nations will choose China. The key is to not force them to choose,” he said.

“I feel very much embarrassed and disappointed to see the complete void of Chinese participation in this meeting,” said a former Japanese financial official. A veteran member from the Philippines agreed, saying there is no point talking about Asia without the participation of the region’s largest country and expressed concern about dividing the world into two camps. “When two elephants fight, the ants get trampled. And we’re feeling it. When two elephants fight to the death, we will all be dead. And the question is: What for?” [emphasis added]

A South Korean professor told Emanuel in the Q&A period that there are concerns in Asia about the zero-sum thinking in U.S. foreign policy toward China. “We have to develop some deliverable strategy to persuade and engage un-like-minded countries as well.”

NIKKEI Asia also reported “There were also members who noted how the liberal international order that Washington advocates is different from the original liberal order that was formed after World War II. ‘The original order, led by the U.S., sought a multifaceted extensive international system based on multilateral institutions and free trade among the democratic bloc,’ a South Korean academic said. The Six Party Talks on North Korea’s nuclear weapons was one such example of the original order, the academic said, noting that the U.S., China and Russia were all at the table.” [emphasis added]

The NIKKEI Asia report ended with a veteran of the Trilateral Commission – a former Philippine cabinet minister – who stated “Just in the past week, we edged toward a nuclear confrontation,” referring to the missile blast in Poland, that was initially suspected to be a Russian-made missile, but was more likely a Ukrainian air-defense missile that landed in NATO territory ‘by mistake.’ “And we edged toward that because of the type of zero sum games that us elders are playing. Is this what you want for your future? You don’t want a situation in the future where everybody’s edging toward the cliff and being macho about it without realizing that this is a zero-sum game that could wipe out the planet. It is beyond climate change,” the veteran said.

Japan’s “Shock Therapy” as a Response to the “Crisis of Democracy”

The Trilateral Commission is a non-governmental body, its members include elected and non-elected officials scattered throughout the world, ironically coming together to discuss how to address the “crisis of democracy” in the most undemocratic process possible. It is an organisation meant to uphold the “interests” of its members, regardless of who the people voted into political office.

On Nov 9th, 1978, Trilateral Commission member Paul Volcker (Federal Reserve Chairman from 1979-1987) would affirm at a lecture delivered at Warwick University in England: “A controlled disintegration in the world economy is a legitimate object for the 1980s.” This is also the ideology that has shaped Milton Friedman’s “Shock Therapy”. By the time of Jimmy Carter’s Administration, the majority of the government was being run by members of the Trilateral Commission.

In 1975 the CFR launched a public study of global policy titled the 1980’s Project. The general theme was “controlled disintegration” of the world economy, and the report did not attempt to hide the famine, social chaos, and death its policy would bring upon most of the world’s population.

The study explained that the world financial and economic system needed a complete overhaul according to which key sectors such as energy, credit allocation and food would be placed under the direction of a single global administration. The objective of this reorganization would be the replacement of sovereign nation states (using the League of Nations model).

This is precisely and demonstrably what has occurred to Japan’s economy over the past four decades, as showcased in the Princes of Yen documentary based off of Richard Werner’s book by the same title. As Werner demonstrates, Japan’s economy was purposefully put through multiple economic crises throughout the 80s and 90s in order to push through massive structural reform despite their economy having been one of the world’s top performing before foreign tampering.

As Werner insightfully remarked, the best way to have a crisis is to manufacture a bubble, that way, nobody will stop you.

To understand the incredible significance of this, we will need a quick review of what occurred to Japan’s economy over a 40-year period.

Japan’s Offering to the Gods on the Altar of “Free Trade”

By the 1980s, Japan was the second biggest economy in the world next to the United States and was a leader in the manufacturing of consumer technology products to the West, including the United States. Due to Japan’s investment in automation tools and processes, Japan was able to produce products faster and cheaper than the United States that were also superior in quality.

One of the examples of this was competition between the two in the memory chip DRAM market. In 1985, there was a recession in the United States in the computer market, resulting in the biggest crash in over ten years for Intel. Complaints from certain quarters in the United States began criticizing Japan for “predatory” and “unfair” trade practices despite the recession in 1985 being a demand problem and not a competition problem.

Long story short, President Reagan, who was supposed to be all about free markets, in the spring of 1986 forced the U.S.-Japan Semiconductor Agreement with METI (Ministry of Economy, Trade and Industry in Japan).

Part of the conditionalities of this agreement were that the American semiconductor share in the Japanese market be increased to a target of 20-30% in five years, that every Japanese firm stop its “dumping” into the American market and the Americans wanted a separate monitoring body to help enforce all of this.

No surprise here, the Japanese companies refused to do this and METI had no way of forcing them to do so.

President Reagan responded by imposing a 100% tariff on $300 million worth of Japanese goods in April 1987. Combined with the 1985 Plaza Agreement which revalued the Japanese Yen the U.S.-Japan Semiconductor Agreement gave the U.S. memory market the extra boost it needed. (for more details on story of how the U.S. tampered with the Japanese semiconductor market refer here).

The Plaza Accord was signed in 1985 by Japan, Germany, France, Britain and the United States. The agreement depreciated the United States Dollar against the Japanese Yen and the German Deustche Mark in an effort to improve the competitiveness of American exports. How very “free market”!!! (Refer here for the story of De Gaulle and Adenauer’s attempt to form the European Monetary System which was sabotaged by Anglo-America). Over the next two years after the signing of the Plaza Accord, the dollar lost 51% of its value against the yen. Japan entered the Plaza Accord to avoid having its goods tariffed and locked out of the American market.

The Yen’s appreciation plunged the Japanese manufacturing sector into recession. In response to this, the Bank of Japan loosened monetary lending policies and lowered interest rates. This cheap money was supposed to be funneled into productive efforts. Instead, it went into stocks, real estate, and asset speculation. This is when Japanese real estate and stocks reached their peak price level.

Between 1985 and 1989, stocks rose in Japan by 240% and land prices by 245%. By the end of the 80s the value of the garden surrounding the Imperial Palace in central Tokyo was worth as much as the entire state of California.

Although Japan is only 1/26th of the size of the United States its land was valued at four times greater. The market value of a single one of Tokyo’s 23 districts, the Central Chiyoda Ward exceeded the value of the whole of Canada.

With asset and stock prices rising inexorably even traditional manufacturers could not resist the temptation to try their hand at playing the markets. Soon they expanded their finance and treasury divisions to handle the speculation themselves. The frenzy reached such proportions that many leading manufacturers, such as the car maker Nissan, made more money through speculative investments than through manufacturing cars.

The Princes of Yen documentary explains: “Many credited the boom in Japan’s economy to high and rising productivity. In reality, Japan’s stellar performance in the 1980s had little to do with management techniques. Instead of being used to limit and direct credit, window guidance was used to create a giant bubble. It was the Bank of Japan who had forced the banks to increasing their lending by so much. The Bank of Japan knew that the only way for banks to fulfill their loan quotas was for them to expand non-productive lending.”

Between 1986 and 1989, Toshihiko Fukui was the head of the Banking Department at the Bank of Japan and would later become the 29th Governor of the Bank of Japan. This was the department that was responsible for the window guidance quotas.

When Fukui was asked by a journalist “Borrowing is expanding fast, don’t you have any intention of closing the tap of bank loans?” Fukui replied “Because the consistent policy of monetary easing continues, quantity control of bank loans would imply a self-contradiction. Therefore, we do not intend to implement quantitative tightening. With structural adjustment of the economy going on for quite a long period, the international imbalances are being addressed. The monetary policy supports this, thus we have the responsibility to continue the monetary easing policy as long as possible. Therefore, it is natural for bank loans to expand.”

In Japan, total private sector land wealth rose from 14.2 trillion yen in 1969, to 2000 trillion yen in 1989.

The Princes of Yen documentary reported: “At his first press conference as the 26th governor of the Bank of Japan, in 1989, Yasushi Mieno said that ‘Since the previous policy of monetary easing had caused the land price rise problems, real estate-related lending would now be restricted.’ Mieno was hailed as a hero in the press to put a stop to this silly monetary policy that was responsible for the increasing gap between the rich and the poor. However, Mieno was deputy governor [of the Bank of Japan] during the bubble era, and he was in charge of creating the bubble.

All of a sudden land and asset prices stop rising. In 1990 alone, the stock market dropped by 32%. Then in July 1991, window guidance was abolished. As banks realised that the majority of the 99 trillion yen in bubble loans were likely to turn sour, they became so fearful that they not only stopped lending to speculators, but also restricted loans to everyone else. More than 5 million Japanese lost their jobs and did not find employment elsewhere. Suicide became the leading cause of death for men between the ages of 20 and 44.

Between 1990 and 2003, 212,000 companies went bankrupt. In the same period, the stock market dropped by 80%. Land prices in the major cities fell by up to 84%. Meanwhile, the Governor of the Bank of Japan, Yasushi Mieno, said that ‘Thanks to this recession, everyone is becoming conscious of the need to implement economic transformation’.”

Between 1992 and 2002, ten stimulation packages worth 146 trillion yen were issued. The thought was domestic demand had to be boosted by government spending and then loan demand would also rise. For a decade the government executed this approach, boosting government debt to historic levels.

Richard Werner remarked “The government was spending with the right hand, putting money into the economy, but the fundraising was done through the bond market, and therefore it took the same money out of the economy with the left hand. There was no increase in total purchasing power, and that’s why the government spending couldn’t have an impact.”

By 2011, Japan’s government debt would reach 230% of GDP, the highest in the world. The Ministry of Finance was running out of options. Observers began to blame the Ministry of Finance (despite the clear sabotage by the Bank of Japan’s actions) for the recession, and started to listen to the voices that argued that the recession was due to Japan’s economic system.

In Japan, the authorities and the Bank of Japan argued, as did the Western powers almost two decades later, that the taxpayer should foot the bill. However, taxpayers have not been responsible for the banks problems, therefore, such policies have created a moral hazard (a moral hazard is a situation where an economic actor has an incentive to increase its exposure to risk because it does not bear the full costs of that risk).

According to the Princes of Yen documentary, Finance Minister Masajuro Shiokawa had turned to the Bank of Japan asking it to help stop deflation, or fight deflation at least. The Bank of Japan consistently defied calls by the government, by the Finance Minister and the Prime Minister of Japan, to create more money to stimulate the economy and end the long recession. At times the Bank of Japan even actively reduced the amount of money circulating in the economy, which worsened the recession. The Bank of Japan’s arguments always came to the same conclusion, namely that the blame lay in Japan’s economic structure.

It should also be noted that a whole generation of Japan’s economists were sent to the United States to receive PhDs and MBAs in U.S. style economics. Since neoclassical economics assumes that there is only one type of economic system, namely, unmitigated free markets, where shareholders and central bankers rule supreme, many Japanese economists quickly came to regurgitate the arguments of U.S. economists.

By the late 1990s, Japan’s economy was heading for the rocks. Ira Shapiro who worked as a U.S. ‘negotiator’ of U.S.-Japan talks during this period stated “Primary sector deregulation is needed to overcome the entrenched interests of large insurance companies, life and non-life, and the Ministry of Finance bureaucracy.”

On Shapiro’s Federalist Society biography page, he is described as playing “a central role in the negotiation and legislative approval of the North American Free Trade Agreement (NAFTA) and the multilateral Uruguay Round that created the World Trade Organization and the current trade rules.”

These U.S.-Japan talks needed to reach an agreement by a deadline decided by the United States. If no agreement were met after the declared deadline, then the U.S. had threatened to impose trade sanctions.

Richard Werner clarified what would be the consequences of Shapiro’s demands to the Japanese; that securitisation of the real estate was being pushed however, in order to have meaningful securitisation we need deregulation, and to get deregulation you have to reduce the power of the Ministry of Finance. This in turn would allow the Bank of Japan, who was under the purview of the Ministry of Finance, to gain power.

From the mid 1990s onwards the Government began to dismantle much of the power structure of the Ministry of Finance. The Bank of Japan, on the other hand, saw its influence grow significantly. The Bank of Japan was cut loose from the Ministry of Finance pretty much making it independent.

Soon after his retirement from the position of governor of the Bank of Japan in 1994, Mieno embarked on a campaign, giving speeches to various associations and interest groups. He lobbied for a change in the Bank of Japan law. His line of argument was to subtly suggest that the Ministry of Finance had pushed the Bank of Japan into the wrong policies. To avoid such problems in the future, the Bank of Japan had to be given full legal independence.

In 1998 monetary policy was put into the hands of the newly independent Bank of Japan.

In early 2001, a new type of politician was swept into power. Junichiro Koizumi became the Prime Minister of Japan. In terms of his popularity and his policies he is often compared to Margaret Thatcher and Ronald Reagan. His message was simply: no recovery without structural reform.

Princes of Yen remarked: “During 2001, the message of no economic growth without structural reform had been broadcast on an almost daily basis on the nation’s TV screens. Japan was shifting its economic system to a U.S. style market economy, and that also meant that the centre of the economy was being moved from banks to stock markets. To entice depositors to pull their money out of banks and into the risky stock market, reformers withdrew the guarantee on all bank deposits, while creating tax incentives for stock investments.

As U.S. style shareholder capitalism spread, unemployment rose significantly, income and wealth disparities rose, as did suicides and incidents of violent crime. Then, in 2002, the Bank of Japan strengthened its efforts to worsen bank balance sheets and force banks to foreclose on their borrowers…Heizo Takenaka [the new Minister for Financial Services] was supportive of the Bank of Japan’s plan to increase foreclosures of borrowers…Takuro Morinaga, a well-known economist in Tokyo, argued forcefully that the Bank of Japan inspired proposal by Takenaka would not have many indigenous beneficiaries, but instead would mainly benefit U.S. vulture funds specialising in the purchase of distressed assets…[When Toshihiko] Fukui’s support for the bankruptcy plan was voiced… [he] was an adviser of the Wall Street investment firm Goldman Sachs, one of the largest operators of vulture funds in the world.”

Richard Werner remarked: “Mr. [Toshihiko] Fukui [29th Governor of the Bank of Japan], and also his mentor Mr. [Yasushi] Mieno [26th Governor of the Bank of Japan], and his mentor Mr. [Haruo] Maekawa [24th Governor of the Bank of Japan], and you’ve guessed it, these are some of the Princes of the Yen that the book is all about. They have said on the record in the 80s and the 90s, ‘What is the goal of monetary policy? It is to change the economic structure.’ Now how do you do that? Well, you need a crisis. They made a crisis in order to change the economic structure.”

The department responsible for the window guidance quotas at the Bank of Japan, was called the Banking Department. The man at the head of this from ‘1986 to ’1989, was Toshihiko Fukui. Mr. Fukui thus directly helped create the bubble. When Fukui had become governor of the Bank of Japan, he would say “While destroying the high-growth model, I am building a model that suits the new era.”

Richard Werner remarked: “They have succeeded on all counts. If you look at the list of their goals, destroy the Ministry of Finance, break it up, get an independent supervisory agency, reach independence for the Bank of Japan itself by changing the Bank of Japan law, and engineer deep structural changes in the economy, by shifting from manufacturing to services, opening up, deregulating, liberalising, privatising, the whole lot.”

[Part 2 will discuss what caused the Asian Crisis of the Tiger Economies, the American 2008 crash and the European Debt Crisis, as well as the relevance of Shinzo Abe’s assassination in shaping today’s world economic and geopolitical situation. The author can be reached at https://cynthiachung.substack.com.]