The EU leadership is resolved to ignore protest messaging, however loud it becomes.

There is a whiff of desperation floating across the Brussels battlespace. Forget the Ukraine war – that is a lost cause, and just a matter of time, until its final unravelling; yet the Ukraine – as icon of how the Euro-élite have elected to imagine themselves – could not be less existential. It is (cynically) seen in Brussels to be key to keeping the 27 member states in ‘lockstep’ that is – and an opportunity for a power grab: ‘We Europeans are ‘victims’, like Ukraine, of Putin’s actions’; ‘All must sacrifice to the newly installed command ‘war economy’’.

Consider the fears (as perceived by Brussels) of abandoning Ukraine to plead with Moscow for gas and oil. A speech by President Macron last week gave a ‘teaser’ to what might follow: Macron told an ambassadors’ conference in the Élysée last week, that the EU should not allow East European warmongers to determine EU foreign policy, or even allow East Europeans to act unilaterally in support of Kiev. “A commentator joked that Macron at least avoided Jacques Chirac’s infamous remark that Eastern Europeans had missed an opportunity to ‘shut up’”.

The EU Establishment therefore are acting with alacrity to ensure ‘a 27 lockstep cohesion’ against the risk of consensus dissolving before the nightmare scenario of an Euro 2 trillion increase in gas and power spending; a hike in unitary energy bills by 200% across Europe (that amounts to 20% of household disposable income) (figures from Goldman Sachs Research). The large demonstrations in Europe over the last weekend were clear in their message: ‘We want the gas back. F*** NATO’.

The EU leadership is resolved to ignore such protest messaging, however loud it becomes.

Russia says that unless sanctions are lifted, no gas will flow through Nordstream 1. It is a gun at the EU head (in response to the sanctions imposed on Russia). Were the EU leadership however, to attend to the protestors’ call for the EU to forget Ukraine and lift sanctions on Russia, East Europeans would of course put another gun to the EU head (the veto over EU foreign policy issues). Macron is right.

That is the internal prospect of dissolution. Externally, the view is no more rosy. There is a marked lessening of respect for EU values across the non-West. Its standing is eroding. Africa and the Global South stand aloof over Ukraine; OPEC+ has made its position abundantly clear by actually cutting crude production (100,000 barrels/day); and Iran just blew the EU a raspberry by saying ‘no deal’ until the ‘unresolved uranium particle issues’ are closed.

As a Global Times editorial this week explained: “Since the Russia-Ukraine conflict broke out, the U.S. and its allies have tried to make others support their sanctions, but didn’t bother to think why their baton is no longer working. Quite simply, the West’s waning influence is because of their abuse of power, selfishly disregarding and preying on the interests of other countries. How can the international community trust the West after all it has done?”.

No OPEC or Iranian oil as salve to the EU ‘sacrifice’ for Ukraine. Many in the non-West rather, are migrating to the BRICS and the SCO alliance.

Nevertheless, the EU is sticking to its ‘Saving Ukraine’ principles. So, after “labouring non-stop through the weekend”, the EU is proposing ‘historic interventions’ in the energy market – including a levy on excess profits of electricity and energy companies, and measures ranging from gas-price caps to a suspension of power derivatives trading.

In a word, every other commodity market is about to be ‘regulated’ or capped to death. And the EU is taking its ‘economic war with Russia’ to an explicitly very literal interpretation:

The so-called internal market ‘emergency instrument’, “set to be presented on September 13, lays out several stages that open up varying powers to the Commission depending on the situation”. Via this new instrument the Commission will seek emergency powers giving it the right to re-organise supply chains; sequester corporate assets; re-write commercial contracts with suppliers and customers; order companies to stockpile strategic reserves; and force them to prioritise EU orders over exports.

Hmmm. If adopted, that would transform the EU literally into a wartime Command Economy.

It would also Gulliverise member-states into lockstep conformity through the centralised control supervising of the entire matrix of economic infrastructure – from which there will be no opt-outs (because … because ‘we must all scarifice’).

So, Europe will not ration what little energy it gets by price; but rather, it will subsidise industrial production and households – even if the newly printed funding involved means pushing Europe into an inflationary depression and currency collapse. The numbers and liquidity required to do this likely will be massive. Germany’s consumer bailout alone comes in at $65 billion.

But these subsidies miss the point. They may offer European consumers some short-term relief, but costs aren’t the main problem. The problem remains whether oil and natural gas will be available at any meaningful price – price is moot when supply nears zero.

Supply is one thing. The structural contradictions to this command economy construct however, are quite another. How exactly does this explicitly inflationary ‘bailout’ pair with the ECB’s determination to raise rates in order to fight inflation? Clearly it doesn’t. Borrowing or printing money to pay for imported energy (in dollars) – while running rising twin deficits – is a great way to destroy one’s currency. And it means inflation is not transitory. Thus, by force of logic, the EU must ration by diktat (just as in war). But how?

In kinetic war, the answers are much more predictable: Prioritise the industrial manufacture of artillery shells and tanks. In economic war, aimed at achieving something rather different – the basic functioning of a diverse consumer economy – the choices are not so obvious: i.e. domestic household heating vs manufacturers’ operational needs; low energy usage industry vs intensive industrial use; industries serving consumer strategic needs vs luxury or security needs; and balancing equity vs high level political connections.

These are the kind of questions economists in fully planned systems ask daily – and get wrong because they have no pricing mechanisms or feedback mechanisms on which to steer their decisions.

Okay, so we all know that the Pavlovian EU answer will be simply to pour money into renewables, but will that be the right answer? Europe’s business model basically is high end (i.e. costly) production, leveraged on the input of cheap energy from Russia. As Credit Suisse guru, Zoltan Poszar, has adduced: No less than $2 trillion of German manufacturing added-value is contingent on a mere $20 billion of gas from Russia – that is 100-times leverage. It is a hugely inverted pyramid resting on a relatively tiny apex of fossil fuel. Does anyone really believe that low energy-intensive windmills will keep that $2 trillion of German output levitated?

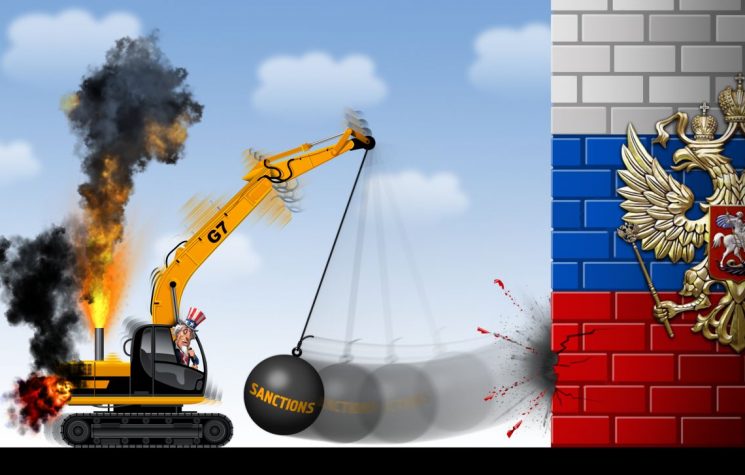

Separately, but as part of the collective West’s financial war on Russia, the G7 finance ministers have agreed to proceed with a plan to cap the price of Russian oil exports. This initiative would not replace G7 countries’, or the EU’s separate embargoes on Russian oil, but would be supplemental.

Since over 90% of the world’s ships are insured through London-based insurers like Lloyds of London, U.S. and EU officials expect the initiative to impact Russian energy revenues massively. The cap would be actuated through the “comprehensive prohibition of (insurance) services” that would be permitted only where the cargoes are purchased at, or below a price, that will be set by a “broad coalition of countries”.

This scheme essentially is the brainchild of U.S. Treasury Secretary, Janet Yellen: “This price cap is one of the most powerful tools we have to fight inflation and protect workers and businesses in the United States and globally from future price spikes caused by global disruptions.”

In Yellen’s vision, the price would be set above the price level that Russia requires to balance its national budget (and thus incentivise Russia to continue to pump oil); yet be below the price required to keep western economies thriving – and low enough deeply to cut into Russia’s oil revenues, thereby weakening its economy, and its war effort.

But it won’t work. Russia can easily replace Western insurance. The two main paths are self-insurance (you reserve part of your revenues in a fund to pay claims if needed), and captive insurance (you set up your own insurance companies with participation by affected parties). Shakespeare actually described it in The Merchant of Venice in 1598.

Simply put, Russia can easily get insurance on other markets not participating in the boycott including Dubai, India, and China – along with Russia itself. So, insurance will not serve as an effective weapon against Russia, and the price cap will fail.

In essence, Russia has both effectively won the military war in Ukraine, and the global financial sanctions war (though both are far from over). The longer the denial continues, the more Europe will be hurt economically. That is obvious; and also obvious is that it will be ugly this winter in Europe.

Yet so far, the EU leadership is doubling down on its mistakes, as they see the situation serving their wider ambitions. The early pandemic period in Europe was characterised by member states putting their own national needs – somewhat chaotically – first (albeit, against the background of EU total ineptitude). Social distancing was 1m in one country, 2m in another; while masks requirements and rules for social gatherings were all over the place – and in Germany even changed from one region to another.

The EU Establishment, however, did belatedly take action. It smelled from this crisis the pungent aroma of opportunity: It embarked on a power grab. It seized Euro-wide control over vaccine procedures, travel restrictions and, with lockdown, emergency powers over citizens’ lives.

With the energy-cut off, the EU again is invoking ‘emergency powers’, amid bleak fear-inducing media headlines. It is perceived in Brussels as a further opportunity for the élite to impose intervention ‘lockstep’ on the 27, and to seize central control over matters that formerly were national competences (often subject to parliamentary accountability).

The caps and regulations are in process, and on 13 September the EU will consider giving itself said powers to ‘re-organise’ supply lines; sequester assets; re-write commercial contracts; order stock piling and assert the primacy of EU orders over all others.

The energy crisis will be ‘used’ in this way. The objective is always central control. For the ideologues it is now also the chance to ‘speed up de-fossilisation’ and to decry ‘backsliding on renewables’ – whatever the pain imposed on citizens. This messaging is flooding European websites.

The (Green Party) German foreign minister said it plainly: I will put Ukraine first “no matter what my German voters think”, or how hard their life gets.

Were one to ask, is this then the WEF (‘Davos’) agenda unfolding? It would be difficult to give a categoric ‘no’.

In any event, the EU is built as a steamroller steadily crushing flat the path towards more central control; more news management; more citizen surveillance. The acquis, the ECJ, and the bureaucracy simply grind forwards in unstoppable momentum: Reverse gear was never included. In fact, the architecture has almost no provision for reversal, except by invoking Article 50 – quitting the Union, and that intentionally has been made unbearably painful.

So, expect the EU leaders dogmatically to persist with transforming the EU into a Soviet-style command economy. And even to seek more powers, the more the economy weakens. The EU is sanguine that public protests can, and will be, repressed forcibly (possibly with the army on the streets). Protests have begun. However, it is only September, and the haze of summer still lingers on … winter beckons, yet somehow seems a distance away.

What is certain is that with the EU massively supporting demand through widespread bailouts – at a time of already reduced supply and aggravated by command economy type disruptions and shortages – higher inflation is coming, and the Euro will be ‘toast’.

Is there a way out? Perhaps a figure will arise, taking all by surprise. Maybe the Euro crashing and the U.S. November midterm election outcomes will be the catalyst that will allow such a figure to arise and articulate a vision that seems to offer some solution. The solution, after all, is pretty obvious. But first, comes the pain.