American hegemony is at an end and multi-polarity, with Russian-Chinese relations at their helm, is here to stay for a long, long time, Declan Hayes writes.

The emerging Sino-Russian strategic energy and metals’ market will be an unparalleled success, thanks in large part to Irish (sic) Joe Biden, who has committed strategic blunders that even outdo those of Hitler and Napoleon’s Grande Armée, which destroyed itself in Russia because Tsar Alexander refused his orders to blockade Britain.

Though Hitler was slave to many demons, chief amongst them was the economic policies of the weaselly Hjalmar Schacht, who was the first to turn Queen’s Evidence at Nuremberg. Schaft’s economic policies delivered Germany from the frying pan of the Great Depression into the inferno of Hitler, Stalingrad, Kursk and destruction. By following Schaft’s policies, the Third Reich could end no other way than in destruction. This was because the Reich’s survival depended on enmeshing itself in more and more conquests, in a process Steinbeck’s The Moon is Down described as a fly catching more and more flypaper.

Though Russia’s boundless resources present NATO’s flies with limitless flypaper, the USA cannot physically occupy it. And nor, despite its best efforts, can it financially strangle or otherwise emasculate it.

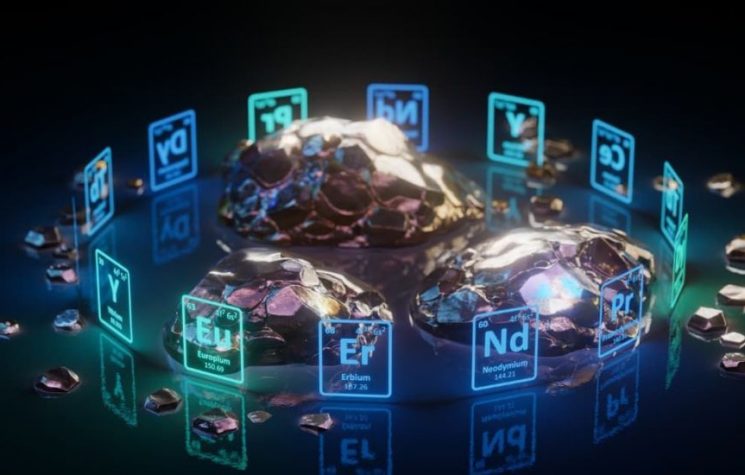

This is because Russia has a vast reserve of strategic natural resources, a nuclear armed army to protect them and powerful allies, China in particular, to defy Empire. Russia is awash with aluminum, copper, fertilizer, neon, nickel, palladium, petroleum, soybeans, titanium, wheat, and a large variety of other commodities too numerous to adumbrate but, when combined, add up to an impressive trading portfolio that no longer needs London based intermediaries to off load them.

Preliminaries

An important benchmark for pricing these commodities is their spot price in Rotterdam, Houston, Singapore, New York or some similarly well established hub. This price is contractually set by the clearing house and that contract specifies barge, cargo ship, pipeline or some other mode of delivery. Independent price assessors help establish the spot price and the forward, futures and options prices all ebb and flow as derivatives from that spot price. Russia, China and their allies are replicating all that and more.

Large and liquid markets, such as those which pertain in London, Chicago, New York or similar financial hubs have market makers and underwriters to ensure the markets work round the clock and are insulated against shocks, such as the 9/11 attacks or the 1979 Afghan and Iranian upheavals. Russia and China are sufficiently deep pocketed to provide that protection and to provide naval protection through the Black Sea, the Sea of Japan or the Malacca Strait, should that be warranted to guard against British, American or allied piracy.

As China is running monthly trade surpluses of hundreds of billions of dollars and her foreign exchange reserves are in the trillion of dollars, under-writing markets in these valuable and liquid commodities’ markets is not an issue; NATO’s daydreams notwithstanding, these resources will not end up rotting in Russian fields or barns.

As China and Russia are very major trading partners with one another and even have thriving currency swap facilities with one another, there is, with Western sanctions, the imperative to increase this trade and expand on those swap markets. The Central Banks of Russia and China, as long ago as 2014, signalled their intentions to do just that by signing a 150 billion yuan central bank liquidity swap line agreement to counter American sanctions.

Despite NATO’s wishes to the contrary, Russia is just too important militarily, economically and financially for China to betray their common destiny. These swap and other derivative markets will continue to grow in size and in complexity with or without the involvement of the Anglo-Americans and their NATO satellite powers. Russian, Chinese and affiliated regulators can specify in their contracts a place of delivery, much as the American markets do for potatoes, pigs’ bellies, orange juice, Colombian coffee and a galactic range of other products. Crucially, however, the Russo-Chinese exchange would follow the old KISS principle of keeping it simple, stupid.

That would mean many of these products would be handled by government-regulated market makers in Russian ports like Primorsk, Nakhodka, Novorossiysk, Ust-Luga, Murmansk, Sokol Sakhalin and Varandey which, between them, handle the bulk of Russia’s vast gas and petroleum exports. Approved Indian, Pakistani and Chinese partners could collect the goods in any of those ports or arrange, through approved operators, for delivery outside of Russia. Rosneft, Lukoil, Surgutneftegas, Gazprom, Tatneft and similar prominent Russian firms would, of course, be central to all of this.

There is nothing new or particularly Sino-Russian in any of this. Saudi Aramco has a very sophisticated system in place to manage its entire oil supply and apartheid-era South Africa had something similar with respect to its vast gold stocks. With such unimaginable wealth at stake and with so much talent available in the BRIC countries, putting the nuts and bolts of all of this together and expanding it globally is entirely feasible.

If we assume, for illustrative purposes, that Vladisvostok was Russia’s exit port and Shanghai China’s entry port, then we would have spot prices in both ports connected by a cost of carry, by an interest rate in other words, much as we currently have with gold derivatives and U.S. government rates, and London Inter Bank Offer Rates (LIBOR) and almost all other global interest rates.

Depending on the political temperature in Russia, the cost of carry rate could be higher than, lower than, equal to or totally independent of LIBOR. Although establishing such a Chinese oriented benchmark would put unprecedented pressure on the City of London, the British, being resilient, would relish the chance to rise to the occasion, and bully for them.

And they will get such a chance as the Shanghai Interbank Offer Rate (SIBOR) follows the Tokyo (TIBOR) rate and largely goes its own way, even eventually replacing LIBOR as the world’s main benchmark rate; that process is already being accelerated by China giving preferential long term loans to its strategic trading partners and even offering to finance the Sakhalin and similar areas with Japan, should Tokyo so wish. With China doling out long term strategic loans, albeit in much higher volumes than Japan once did, this added Russo-Chinese pressure on Tokyo will show that the Japanese remain as resiliently stubborn as ever, even as their American overseers dissipate Japan’s markets in front of them.

Given just how starved the EU, Japan and Britain will be of resources, they could have a mini-Olympics between themselves and the USA to determine which of them is the most resilient. However, as the emerging system will force them to divest themselves of their gold reserves should they wish to buy Russian resources, the medals might best be made of plastic, if they can get the necessary amounts to mint them and the vacuous Hollywood stars to present them.

Price Discovery

Back in the real world, because achieving depth and liquidity in these emerging Russo-Chinese markets is critical to their success, proper pricing would be essential. Oil exemplifies several ways how this can be done. Let’s say the spot Amsterdam price is U.S.$100 a barrel and the Saudis need a $70 barrel price to take care of their needs. We then have a range of $70 to $100 to begin our price discovery, ex Vladisvostok, let’s say.

If the overseers decide $100 (or $60) is an appropriate price, then that amount is paid in a weighted average of Chinese yuan, Russian rubles, and Indian and Pakistani rupees, out of which is deducted the cost of Chinese, Indian and Pakistani imports, with approved agents from those countries able to trade in shadow Russian rubles to settle accounts between themselves.

This qualitatively differs from the Iraqi and Syrian markets, which have had their collateral stolen by brazen acts of Anglo-American piracy and brigandage. China, as already explained, has enough cash on hand to grease the wheels of business for centuries to come.

Once these basic markets click into gear, advanced forward markets would be easily established thereafter. Thus, in our example, if the spot price ex Vladivostok is $100 a barrel and the 30 day cost of carry is 10% (to simplify the math), then, under stable conditions, the 30 day forward price is $110, and the 60 day forward price is 110×1.1= $121 and so on.

Because settlement day suffers the turbulence of the witching hour in the American and British markets, one would have to expect similar hiccups in this proposed model. However, there is one key, fundamental difference. The Anglo-American markets are heavily, deliberately and insanely exposed to speculators to deepen and widen their markets; this one is not.

The primary and over-riding objective of this market, which is now forming before our eyes, is to give to all the peoples of Russia, China and the Indian sub-Continent the building blocks to secure themselves and others a viable future, free from the piracy of the Royal Navy and the predatory and pick-pocketing instincts of The London Metal Exchange, the Chicago Mercantile Exchange and all allied with or subservient to them.

The Anglo Americans rightly pride themselves on their accounting and settlement processes, which they inherited from their Dutch teachers following the 1674 Treaty of Westminster. And they are right to point to systematic managerial deficiencies during the Soviet era. However, not only have those ships long ago sailed but China’s legions of accountants, with their high tech abacuses, have made them all as redundant as the Pharaoh and his scribes. Russia, China, Pakistan and India will outshine London, just as surely as night follows day.

Though the illiquidity of gold and of the yuan have been cited as stumbling blocks, because Chinese and Russian brokers, working in tandem from Shanghai and Vladivostok, would settle and clear accounts in accepted, non-hostile currencies, they are not deal breakers. Business will not only continue but the current stabilisation of the ruble and the (over-inflated) oil price show that to be the case. Irish (sic) Joe Biden jumped the gun and Russia, China, India and Pakistan are laughing at him.

A Tale of Two Currencies

None of this is opinion but plain market fact. Although NATO’s journalists tell us that Ukraine is winning the war, the markets say otherwise. As the Ukrainian hryvnia has more than halved in value since the 2014 fascist putsch, with its attendant neoliberal “reforms” that have devastated living standards and have caused the country to be labelled second poorest in Europe, after Moldova (where Irish military intelligence are actively making things worse), the ₴ has defied gravity (and its own name) by stabilizing, from its original 1996 rate of 1.76 to the dollar, at around 30 to the dollar, before and, crucially, during the current conflict.

The hryvnia’s war-time performance is quite incredible as, unlike the Bosnian marka and the Bulgarian lev, the hryvnia has been a free floating currency for a number of years. Its current resilience is, on the surface, remarkable against a background of war, death and destruction, the occupation of large parts of Ukraine by Russia’s peace-keeping forces, the capital city under siege, the flight of over four million people eager to divest themselves of their illiquid and, presumably, near-worthless currency, together with the oligarchs’ Pavlovian flight of capital in response to turmoil.

The only explanation for the hryvnia’s survival is that it is being artificially and most likely illegally kept on life support by Ukraine’s sleazy oligarchs and the foreign power blocks they collude with. There is no other way it could be defying gravity.

The Russian ruble, in contrast, fell from about 65 to 150 to the euro, following a series of unprecedented attacks on it and on everything Russian in an effort to get Russian society to implode. However, as the ruble has rebounded without the artificial and presumably illegal help Ukraine is receiving, the long term prognosis has to be bullish on Russia. The tribulations of both of these currencies will not have gone unnoticed in London or, more importantly, in Beijing.

Threats

Although the Royal Navy was founded by actual pirates and the British, with their American allies, have been reverting to their base instincts by hijacking Iranian oil tankers, taking on the combined nuclear armed navies of Russia, China, Pakistan and India would test even Britannia’s far-famed mettle.

Although not even the British, the Americans or their European vassals would, we hope, be crazy enough to have a High Noon nuclear shoot out, one would have to expect some form of further retaliation before Perfidious Albion finally capitulates, returns all the assets it has stolen and pays due reparations to all its colonial and neo-colonial vassals out of its deleted purse.

One possible trick would be to try to corner thin markets in strategic metals, much as how the Hunt brothers’ Silver Thursday market price collapse played out. However, with the Russian, Chinese and allied regulatory authorities keeping a very watchful eye on the play, any such attempted squeeze would fail. Further, as Russia’s exports are so much in demand and, as Anglo-American Russophobia has shredded their contract law far beyond redemption, Perfidious Albion has no hope of getting any of those Sino-Russian markets in a death grip. Their race is run.

Anglo American Piracy

Because the Anglo American theft of Russia’s reserves suggests there is no honor among today’s thieves, we can expect confidence in the spendthrift Anglo American caste system to find significant resistance even in its German, Japanese and other vassal states; Canada does not count as it is a micro economy, which was included in G7 only to give the USA extra leverage.

The ruble’s robustness has shown that the theft of these assets has not undermined Russia’s domestic economy and Russia’s ongoing peace keeping operations in Armenia, Syria and Ukraine, coupled with the economic stances of China, India and Pakistan, show that America’s days as bully boy of the world are ending.

Anglo-American bullhorn diplomacy is just the proverbial dead cat’s bounce, the last hurrah of a bullying, spendthrift culture that believed there would never be a day of reckoning. Hitler’s constituents thought the same until the order went out that donations of winter woolies were needed to deal with some inclement weather in Russia. Though today’s Germans are also being told to darn their socks and don their winter woolies, Germany 2022 is not yet as dire as Germany 1942.

Germany needs Russia’s gas and the world’s 600 LNG carriers, whose average capacity is 140,000 cubed meters of gas, cannot save them as the maximum they could deliver is just north of 1,00,000,000 cubic meters a year. As Russia delivers 150 billion cubic meters annually and, as the 600 LNG carriers are already contractually bound, Germans face the same cold prospects their grand parents faced as Hitler’s Reich collapsed around them.

If the Germans want to take a break from reading about the Reich’s implosion, they might profitably examine Germany’s own Metallgesellschaft hedging debacle or the Burmah Oil fiasco, both of which yours truly wrote about years ago. Burmah Oil, which began life robbing Iranian oil for the Royal Navy, came a cropper as the world economy tanked by leasing oil tankers from Greek and Chinese brokers, who obviously knew much more than them about that specialized business.

We are now experiencing a similar global reshuffle. The Bretton Woods system, which the USA imposed on a devastated Europe against Lord Keynes’ informed but enfeebled protests, is dying by the same doomed strategies of arrogant over reach into Russia that destroyed both Hitler and Napoleon. Although there can be no certainty what the economic future will hold, American hegemony is at an end and multi-polarity, with Russian-Chinese relations at their helm, is here to stay for a long, long time.