The Pilgrims Fathers’ City upon a Hill loved by Reagan, the image of American exceptionalism is, in reality, The Mint upon the Hill.

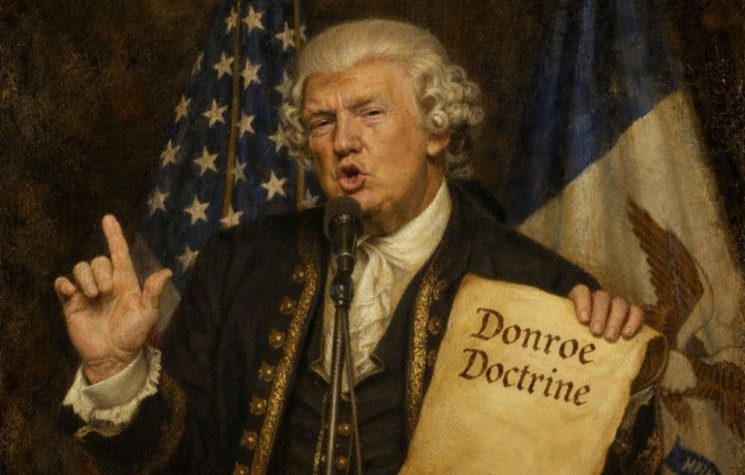

Qiao Liang is a former People’s Liberation Army Air Force major general that became famous in 1999 with the book “Unrestricted Warfare” co-authored with his colleague Wang Xiangsui. Western media immediately presented the study as the herald of a new kind of war waged by China against America. The authors tackled the concept of asymmetrical war against a stronger enemy, foreshadowing future events like the attack of 9-11. A few years ago, Qiao wrote a new book, “The Arc of Empire”, translated now into Italian for the first time outside China. The study is edited by retired Italian lieutenant general Fabio Mini, Commander of the NATO-led KFOR in Kosovo from 2002 to 2003. Mini also introduced in Italy “Unrestricted Warfare”, his Italian foreword is now translated in the last Chinese edition. Qiao’s new work is a study of the American superpower. It explains its incredible success and the reasons for its unavoidable decline. According to Qiao, the United States has overcome the colonialist imperial logic of the 19th century British Empire by adopting a revolutionary system of economic domination, which has reached its peak with the end of Bretton Woods agreements in 1971. The power of the dollar as a universal currency supports the first financial empire in history. The Pilgrims Fathers’ City upon a Hill loved by Reagan, the image of American exceptionalism is, in reality, The Mint upon the Hill. With this “colonial financial economy”, American wealth is paid for by the rest of the world. Qiao writes that Pentagon’s “endless wars” are designed to ensure “that not only do dollars flow smoothly out of the country but also that capital moving around the world returns to the United States”. We have asked general Mini to introduce Qiao’s conception of the U.S. Empire and its decline.

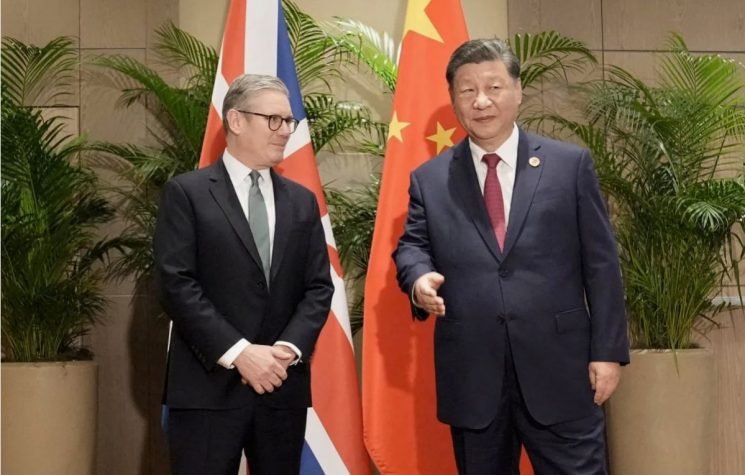

During a video conference in early December, Chinese President Xi Jinping and Russian President Vladimir Putin stressed the need “of accelerating efforts to form an independent financial infrastructure for servicing trading operations between Russia and China”. Do you think this is the beginning of the end of the dollar system?

I don’t rule it out. Considering that Qiao Liang wrote the book in 2015, he must be credited with great foresight and political influence. The two leaders are concretely interested in ending the hegemony of the dollar. As Qiao says, the dollar’s waning may mark the beginning of the end of U.S. economic and geopolitical hegemony. However, this does not mean that the attempt will succeed. The Americans could threaten or implement retaliation, not necessarily only commercially. For now, the common intention of Putin and Xi is to bypass the dollar’s brokerage in their bilateral trade only. But China and Russia rely heavily on exports, and their currencies credibility is not so strong. Despite U.S. threats and penalties imposed on its commerce, China is not in a hurry. It aims to pursue an international agreement that recognises at least two other currencies as reference for trade in addition to the dollar: euro and yuan. Russia is in a different situation: it realises that the U.S. counters any attempt to safeguard its sovereignty and regional interests. Therefore, it suffers a triple penalty: two in the economic field and one in the political field. The export resources are depleted in quantity and price (due to demand contraction). Its imports are penalised by prices (increasing due to the lower supply) and payments in dollars. The third, and most important, is the political penalty: submitting to external blackmail causes a loss of credibility and influence. Russia has had to bite the U.S.-NATO bullet in continental Europe for years now. Detachment from the dollar has become a question of political survival for Moscow. However, Russia knows that this measure is necessary but not sufficient. The country faces a U.S.-NATO offensive made of provocations, erosion of territories, border destabilisation and support to internal subversion that requires to be managed on the level of security and military power. While China believes it has time to act on the economic and financial level, Russia must demonstrate that it can oppose serious provocations also militarily. The different Russian and Chinese attitudes find a concordance of territorial, economic and geopolitical interests in Central Asia, the energy sector and military-industrial cooperation. The EU might be the balancing power in this situation, even for Russia and China. The euro could become the new equivalent currency in the world. But currently, the Union’s internal political weakness, its subservience to the Americans and the permanent delegation of its security to NATO are making this scenario impossible.

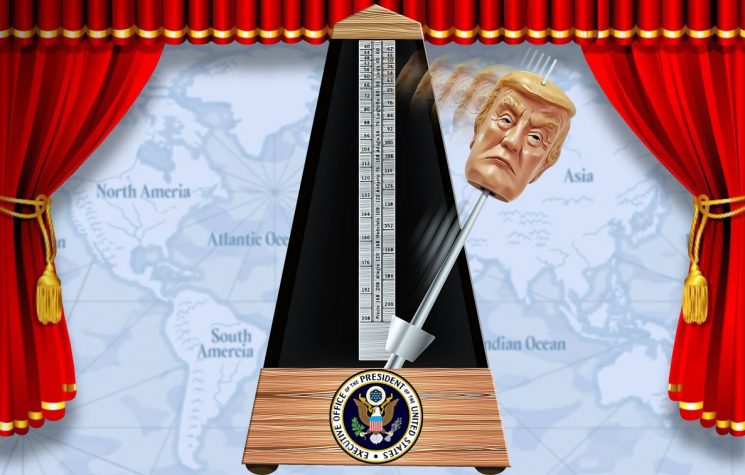

The return of industries moved abroad, first evoked by President Obama, appears structurally impossible. Qiao sees it as another aspect of American decay. Even if U.S. experiences new recoveries, they will be “jobless”. Technological innovation and finance have reached “their energetic limit”; there will only be a decline from now on. Is it a realistic judgment?

It seems reasonable to me, especially for the period in which it was formulated. Today it would perhaps be revisited but not completely rejected. The U.S. is experiencing one crisis after another, yet it is not holding back ambition or adventurism. Indeed, much of manufacturing is lost forever, but IT and technology dominance is still strong, and the financial dominance is huge. The U.S. trade deficit has two aspects: it favours the Chinese and, at the same time, induces Washington to contain China. The manufacturing deficit can be balanced by exports of technologies and the energy sector. Since the American stranglehold on Russia and its resources began, the United States has multiplied gas exports to Europe. The observation that any economic recovery will be “jobless” is correct to those who think of work and employment as tools for growth and prosperity. Almost the entire world agrees. But the U.S. is an exception in this as well. They have long abandoned the idea of giving work to increase production and have never said that the wealth should be better distributed. On the contrary, the concentration of wealth in a few hands facilitates its control and use. They have long replaced employment benefits with those of exploitation and speculation. Work is now a social safety net, just like the layoff funds. Few people’s wealth and success are illusorily experienced as collective goods that the whole country should be proud of.

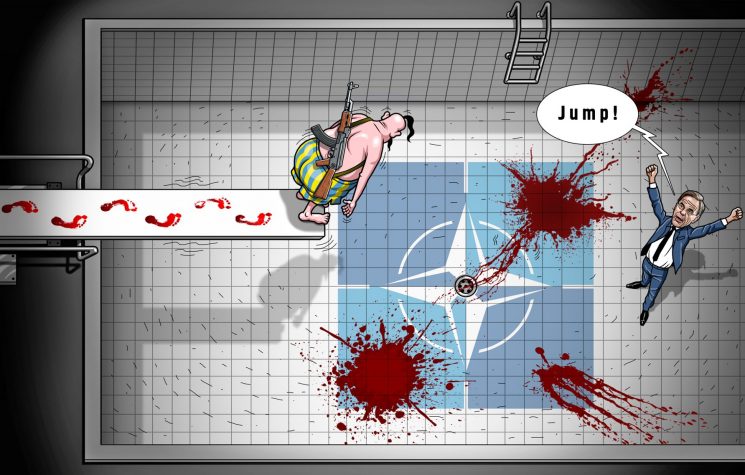

One of the most surprising thesis in the book is that Washington is more interested in destroying the euro’s Europe than China. From the NATO war on Yugoslavia in the aftermath of the birth of the European currency in 1991 to today’s confrontation with Moscow in Ukraine, Washington is simultaneously pursuing the goal of encircling Russia and damaging the EU with the help of the Europeans themselves. The prospect of an economic relationship between Russia and Europe, naturally favoured by geopolitics, is thus destroyed. Is this a conspiracy theory?

No, it is a theorem proven by the facts. In the wake of Trump’s tariffs offensive against Europe, some European analysts claimed that the Union was an Americans’ idea. Hence the U.S. cannot want its destruction. It is a historical falsehood and a clumsy attempt to reassure Europeans when doubts are growing about the loyalty of their bigger ally. The idea of supporting the formation of a kind of European Union came to the Americans when they decided to launch the Marshall Plan’s aid program after WWII. It was a purpose of convenience: they needed a united counterpart to manage the aid. Furthermore, the fear that the USSR would take control of Europe was the reason for the initial support for the European Union. Washington made sure to stop any European initiative that wasn’t to its benefit. The contrast remained all along with the Cold War but under the radar. It was clear when the NATO blockade transformed the possible Soviet threat of nuclear retaliation against the U.S. in a nuclear and conventional war in Europe. After the implosion of the USSR, the contrast increased when NATO assumed the double task of expanding to the East and preventing Europe from acquiring an autonomous defence capability. NATO’s ploy was the Partnership for Peace program (PFP), which offered non-NATO countries the possibility of military cooperation. For a few years, Russia, an observer inside NATO, followed the program with suspicion. Countries formerly part of the Warsaw Pact entered into the Alliance, while others were offered to be part of the EU as a first step towards admission. On the other side of the border, Moscow found new Europeans that opposed Russia and strictly followed the anti-Russian U.S. directives even to the detriment of the rest of the Union. For the last ten years, the U.S. has prevented any European autonomy. Above all, they averted the possibility that the euro could challenge the dollar. For this reason, America will not miss any opportunity to force Europe to cut both political and economic relations with Moscow and Beijing. Such manoeuvres are forcing Russia and China to increase their military power to shift the confrontation to the geopolitical and strategic level, where military deterrence may contain the economic threat.

Italy has a strong dependence on Washington and hosts U.S. atomic weapons on its territory. Now an American fund wants to buy TIM’s network, the most important telecommunications company in the country. It seems an excellent example of the looting of the family jewels that, according to Qiao, the Dollar’s Empire cyclically carries out at the expense of the rest of the world. Is it so?

He is right in saying that the dollar sucks up the wealth produced by people’s sweat in exchange for a piece of bread. He argues that the dollar does not fluctuate only concerning the economic or geopolitical situation but follows a cyclical pattern that affects the economy and geopolitics. This Qiao’s brilliant insight is now a phenomenon verified by Japanese and Chinese researchers. These studies have found that the dollar index varies downward for thirty-two months and upward for an equivalent period. The first interval begins with large amounts of money entering the financial market. It causes interest rates to fall, greater access to credit and increased productivity by those in the world who have taken advantage of the liquidity. So the wealth increases, and there are significant “economic booms”. But this wealth cannot be left in the hands of the beneficiaries. So it begins the interval in which the dollar must return to the U.S. The monetary flow decreases, interest rates increase, American securities become profitable, and new investments flow to U.S. companies. The “dollar cycle” is completed in 65 months, during which the U.S. profits both from the “roller coaster” imposed on global finance and from speculation based on the return of capital. But we should have no illusions, the appropriation of other people’s wealth is not an exclusive feature of the American dollar. Large Chinese corporations are following closely behind or perhaps have already surpassed U.S. multinationals in hoarding the resources and labour of others. But, even accepting Qiao Liang’s proposal to establish a global regime based on three reference currencies: dollar, euro and yuan, the economic pillage would not be reduced or eliminated. So the real nature of the problem is not the currency but who guarantees its convertibility and stability. According to Qiao Liang and many others, providing these guarantees for the dollar is a country that lives beyond its capabilities, does not allow competition, exercises political absolutism. To maintain its lifestyle, the U.S. has no qualms in prevaricating, preventing the development of others, waging war against everyone, enemies and friends, allies and opponents. Qiao identifies in the dollar’s hegemony the key to dismantling this power with the means of finance and the potential of the Internet. The Chinese general is stunned by how the U.S. exercises its global hegemony: convincing the world that the threatening and warmongering countries are Russia and China and not them.