Why one has to be very fanatical not to understand how the U.S. is a brutally expensive burden for European citizens.

Contact us: info@strategic-culture.su

At a time when the Commission and von der Leyen are trying to find new answers to yet another gas crisis in the European Union, which, in the middle of winter, is once again testing the entire strategy of energy transition from Russian gas to what the European CEO calls “diversification” of supplies, all the accusations that Europe has been led to commit energy suicide are returning to the media, with many of the blame, wrongly in my opinion, falling on the “green transition”.

Let’s be clear, this is not about the “green transition” and its validity, a transition which, on a continent without enough fossil resources or nuclear power stations, is fully justified. What is at stake is the destruction of the main pillars on which the energy security of European nations is, and was, based. The green transition is included, as we shall see.

And it is precisely this destruction that is at the root of the current European gas crisis, the U.S.’s ability to create it, and everything that will follow. First, it was a security crisis caused by NATO — which knew that the Russian Federation would oppose its expansion. In connection with the European Union, the role of NATO is dealt with extensively in declassified CIA documentation.

Although the current gas crisis is the result of desperate tactics on the part of the U.S., at a time when its relative external decadence — internally the decadence is absolute — is forcing it to cannibalize Europe, Canada, Japan, and other vassals, it has only been possible because there is a power structure in Europe at the service of the U.S. However, this tactic contradicts the investment made by the U.S. at the time of the Cold War, which created space, together with the social and democratic pressure that existed at the time and originated from powerful trade unions and class political parties, for the construction of a welfare state that the North American peoples themselves never enjoyed, except Canada. And this is one of the biggest contradictions — and perhaps obstacles — in the U.S.’s instrumentalization of the EU.

This gas crisis has also undergone phases. In the first phase, the actions against Russian gas were almost exclusively against natural gas via pipeline. The fact is that until the 14th package of sanctions, little had been done against the supply of LNG. The 14th package of sanctions inaugurated the second phase of the attack, which consisted of creating conditions to prevent the expansion of European investments in Russian LNG. I predict that this will not change under Trump and let’s see if the European nations that are starting to buy cheap Russian LNG gas will comply with those sanctions, since, for the moment, the U.S. isn’t able to comply with all the EU LNG needs.

The fact is that with the round of sanctions following the “special military operation”, the U.S. has curbed the supply of natural gas to Germany, mainly by forcing Germany to replace natural gas via pipeline with LNG supplies. To curb the massive use of Russian LNG, which is cheaper because it is closer, because of discounts and lower extraction costs, sanctions were imposed on Russian banks, excluding them from SWIFT, banning the use of the SPFS (Russian financial messaging system) and creating obstacles to long-term negotiations with the Russian Federation. The result? The countries that were already buying LNG from Russia continued to do so, more or less in the same quantity, or acceptable quantities, benefiting from the long-term contracts they had already signed (France, Spain, Belgium and the Netherlands), but Scholz’s Germany switched from natural gas via Nord Stream to American LNG and other sources. This was a major attack on Germany and its economy, and one of the expected consequences of the operation. The truth is that Russian LNG that is coming to the EU is mostly bought by the countries that used to buy it in the past and less by new contracts and new clients.

Also to curb the purchase of Russian LNG, individually and through long-term contracts, the von der Leyen Commission created a system of aggregated gas purchases, to manage the purchase and reserves collectively, taking advantage of the larger scale and the resulting negotiating advantages — in theory, of course. Incidentally, the countries that have signed up for this aggregated purchase and storage are obliged to respect a minimum reserve of gas purchased in this way, amounting to 15% of total reserves. It seems to me that by combining this requirement with the fact that Ursula von der Leyen has been promoting U.S. LNG, the aim is to guarantee a minimum, predictable supply of LNG from Uncle Sam.

Ursula von der Leyen even blatantly lied, saying that American LNG is cheaper, when it is known that the Russian Federation currently makes huge discounts on gas and oil and that, even if it didn’t, long-term contracting meant cheaper gas. In addition, LNG imports other costs that are not associated with gas via pipeline (transportation, insurance, storage, transfer), and, taking these costs into account, Russia is closer than the U.S. The fact is that, while before 2019, the EU was buying a residual amount of LNG from the U.S., by the end of 2023, the U.S. was already supplying around half of the LNG bought and meeting half of Europe’s needs.

However, as the installed capacity for buying, transhipping, and storing American LNG increased, at the same time as purchases of Russian LNG were recovering, the Druzhba episode arose, which had, in my opinion, at least two objectives: an increase in gas prices in Europe and a consequent need in the increase in U.S. supplies. The U.S. wins both ways.

This issue is so important to the U.S. that it is a Think Thank in the U.S. (the Institute for Energy Economics and Financial Analysis) that has the best data, even used by the von der Leyen commission itself, accurately monitoring the natural gas and LNG purchased by the EU from… the Russian Federation! It should be noted that, in this regard, the strategy used by von der Leyen to justify the use of U.S. LNG and do without Russian gas was not based solely on security issues. European doctrine on the need to “diversify” supply sources is widespread. There’s nothing wrong with that, if weren’t a fallacy.

Today, “diversification” is the motto. Why? Because the U.S. can’t sell all the LNG the EU needs. However, according to the aforementioned IEEFA report, the U.S. has infrastructures under construction throughout the EU which, when completed in 2030, will correspond to an increase in supply capacity of 100% more than today and 76% more than the aggregate European demand for gas on that date. You don’t have to be very clever to predict what will happen: If today American LNG supplies about 50% of needs, by then the U.S. will be able to supply 100%, considering current consumption! And that would lead us to what I expect to be the third phase of the U.S. LNG coup d’etat.

In my opinion, several scenarios could happen: the “diversification” discourse will gradually give way, or through a new crisis, to a discourse on the benefits of “exclusivity” of supply to the U.S.; the U.S., knowing the level of political cooptation it enjoys in the EU, will get the EU to pay more, justifying this higher price with greater security and trust in the supplier. Moreover, even at the market price, as the EU’s transition to LNG pushes up the cost of this commodity, the U.S. will always be able to count on high profits from this operation. “Democratic” and “human rights-respecting” gas has to be more expensive, right? Even if it comes from fracking, a practice banned in Europe.

Another question remains about the EU’s energy future. Given current consumption, the U.S. will be able to meet all the EU’s supply needs by 2030. In addition, gas consumption is falling in the European Union, and by 2030 consumption is expected to be half of what it is today. If by then, the U.S. has doubled its current supply capacity, where will the LNG sold go?

One can tell me that the EU will resell it, but it will be difficult for several reasons: LNG from other sources is cheaper; LNG from other sources has lower extraction costs than American shale; countries will move towards the green transition, reducing LNG consumption, which will further lower the price; Turkey will be a major hub for gas by pipeline, which is cheaper and less polluting.

That’s why I’m wondering about the future of the green energy transition in the EU and how it will or won’t progress, and about the role of the so-called “far right” in a possible setback in the use of renewable energies. And knowing that the U.S. and the EU want to heavily tax Chinese photovoltaic panels, which are much cheaper and responsible for the exponential increase in the use of solar energy… What a great way for the U.S. to delay Europe’s transition to renewable energies because of the need for greater investment in times of need.

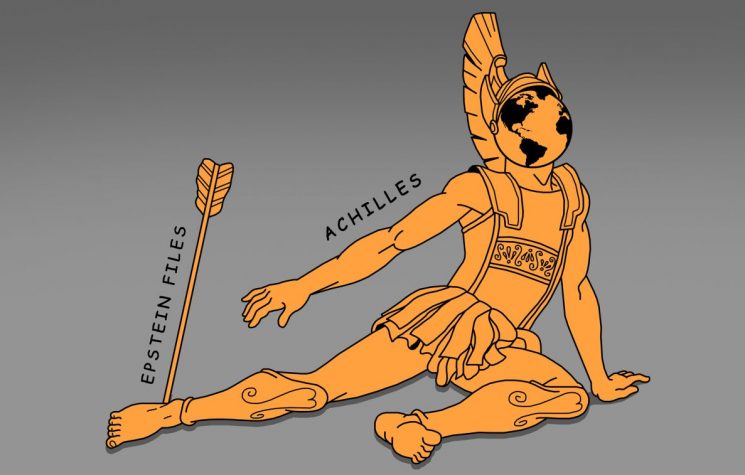

That’s why one has to be very fanatical not to understand how the U.S. is a brutally expensive burden for European citizens. Peace in the NATO-Russian Federation war in Ukraine will only be possible in this light if all international tension is maintained because it is this tension, this permanent security crisis that feeds the coffers of the U.S. LNG industry. The war in Ukraine is, you could say, a gas-fuelled war!