We are yet to see whether it will be a hard landing or a soft landing by the end of 2023.

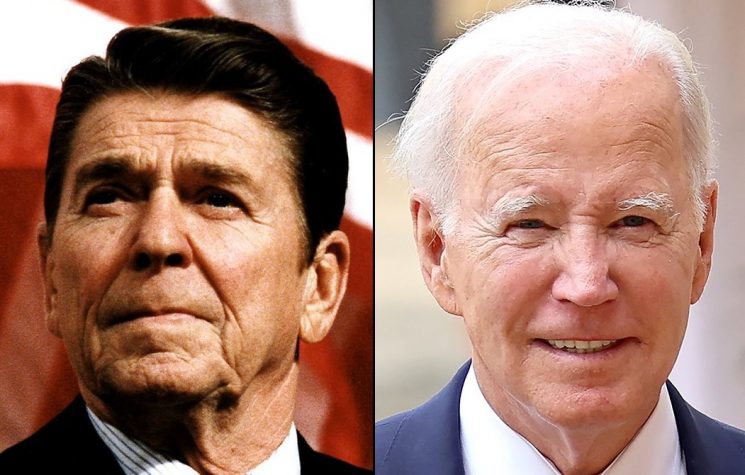

Biden’s administration has shamelessly pumped thousands of billions of dollars into the state financial system for less than two years announcing even a brand new ‘New Deal’ and new financial incentives. One wonders if these measures make any sense and if they get any support from ordinary Americans? How do the money printing and continual and excessive borrowing reflect onto the U.S. economy, and does it have any effect on global inflation the way it is forecasted by Nouriel Roubini, an economics professor at NYU Stern, nicknamed “Dr. Doom” who is warning us that the mother of all crises is looming?

Time will tell whether these measures make any sense or not. They seem not to for the time being. Biden’s administration spent about 1,900 billion dollars to offset the effects of COVID pandemic and then 400 billion dollars for the unpayable student loans, them being a major financial issue in the U.S. economy. Student loans total at about 600 billion dollars and the growing trend is that there is an ever-increasing number of unpayable student loans. Meanwhile, 400 billion dollars have been invested to stimulate the climate change-related Green Agenda. Furthermore, the Biden administration has been announcing a brand-new New Deal, which would cost 4700 billion dollars but there does not seem to be any effect afterwards. Each plan is followed by a new one, which tends to be more prohibitively expensive, which in fact boils down to merely fulfilling the vacuous pre-election pledges for Biden’s voters rather than actual genuinely effective plans.

All this looks rather like caving in to his voters to win them over in this way rather than genuine problem solving of the accumulated U.S. economic problems. This could cause more problems for all of us because the U.S. economy is the biggest economy in the world. All the things happening within the USA, which may seem meaningless and do not make any sense may be due to the butterfly effect, leaving earth shattering global consequences i.e., it can make a detrimental impact on global inflation, growth stagnation and turbulence globally.

Excessive money printing and continual borrowing have been evident since 2008, which has had negative impact and the numbers they are dealing with are of staggering proportions. The U.S. deficit is 1,800 billion dollars which is nominally equivalent to the gross domestic product of Russia. Biden’s plan to print and pump 4000 billion dollars to salvage the U.S. economy is the same as the nominal gross domestic product of Germany. In November 2022 they encountered a mere miscalculation of tax returns and balance sheets of tens of billion dollars, which is the equivalent of the nominal national product of a country as small as, say, Bulgaria. Dr Doom warns the global economy faces a stagflationary debt crisis. Reckless borrowing has amplified the risks of stubborn inflation and economic stagnation, Dr Doom says. He also predicts an imminent U.S. recession and more pressure on stocks and bonds.

Overall, the estimates are that it is now as much as 350% indebtedness compared to the production and services in the USA. This sort of thing never happened in peacetime. One might wonder whether we are still living in peacetime or is it already the age of wartime economy. All manner of hybrid wars are ongoing to try and remedy these major flaws and failures or at least to direct it accordingly. Proportions of public spending and reckless borrowing have changed from what they used to be only two decades ago. That indicates that money is rapidly losing value which cannot seem to end soon. Biden administration policy extravaganza came home to roost this year as inflation soared to nearly 8 per cent.

This new phenomenon of global inflation is the new buzzword among the Wall Street money moguls et al. Are we all victims of global inflation and what might its consequences be? Inflation is almost palpable to an unaided eye by simply comparing the prices on a regular daily basis. This trend started even before COVID pandemic and now it very much seems to be a lame excuse by those economists defending the position of the Deep State who tend to be avid advocates of both medical and financial COVID measures put in place so far. U.S. Federal Bank tends to claim that everything is the result of COVID pandemic and then the Ukraine war

The mother of all crises would have happened regardless of these two possibly related crises. These only exacerbated the hardships and with these energy prices now we might be up against even higher inflation in 2023 and from the looks of things the forecasts are rather bleak. Inflation that was initially considered transitory seemingly became ‘entrenched’ parallel to the war trenches in Ukraine.

The famous and infamous Dr Doom, who was dubbed so because of his doom and gloom financial forecasts, announced the mother of all crises recently. Roubini did forecast the crisis in 2008, which got him to leap into stardom overnight. He has kept predicting new crises since 2008. Some U.S. economists cynically claim that if you want to solve a minor crisis you can do that by creating a bigger one. These gloom and doom forecasts by Dr Doom have not yet come to fruition completely because minor crises have been papered over by the bigger ones. However, now he is not the only one to warn of this, but a few reputed experts claim the same. The inflation is caused by high debts and slow growth in the Collective West, and this is only the beginning of the looming mother of all crises due to the Rise of China and the Global South as well. We are yet to see whether it will be a hard landing or a soft landing by the end of 2023.