Doomsday prophesising of how China’s days are numbered and that it is in the midst of an economic collapse could not be any further from reality.

Doomsday prophesising of how China’s days are numbered and that it is in the midst of an economic collapse could not be any further from reality.

The reasons for the spread of this sort of gossip is to keep up the belief (and thus investment) in the idea that the United States is secure in its alpha dog global status and that the world is better off siding with said alpha in its escalating and reckless, not to mention unnecessary, economic and geopolitical war against Russia and China. It is to intimidate any country foolish enough to throw too many of its eggs into the Russia-China basket with the thought that they will be left hanging in the wind once China collapses from the international stranglehold on its economy, which is touted as inevitable.

It is to convince the American people, that the further sacrifices they are about to make in their livelihood and standard of living will be worth it, perhaps to even go so far as to proclaim that this will be the necessary “new normal” all for the cause of world security, of course.

The reality of the situation which should be plain for everyone to see at this point, is that the United States’ sanctions and banning of various types of trade with Russia and China, meant to cripple their economies, is doing more damage to the world markets than anything else, including that of Europe and the United States.

These sanctions have brought the world into a very predictable energy and food crisis to which European and American citizens are told they must suffer through in the name of western security. A crisis which is gutting essential infrastructure required to sustain developed countries. A crisis from which there is no quick return to a first world living standard for its citizenry.

It was thought that such manoeuvres would cripple the Russian economy and cause internal unrest demanding for the removal of President Putin. Instead we see the Russian rouble stronger than it has ever been in large part due to the competent leadership of Sergei Glazyev (see his speech on Sanctions and Sovereignty) who is in the process of organising a “new economic order…[which] will involve a creation of a new digital payment currency founded through an international agreement based on principles of transparency, fairness, goodwill, and efficiency” as he explained in an interview with Pepe Escobar for The Cradle.

In other words, the world’s new monetary system, underpinned by a digital currency, will be backed by a basket of new foreign currencies and natural resources. And it will liberate the Global South from both western debt and IMF-induced austerity. What this means is that with this new system, the economic sovereignty of a nation will be protected; that a country rich in resources will finally be in a position to use the profits of these resources to strengthen their currencies and build infrastructure essential for any first world nation rather than be forcefully reduced to an indebted raw resource producer and nothing more as enforced by the policies of the IMF over the past several decades.

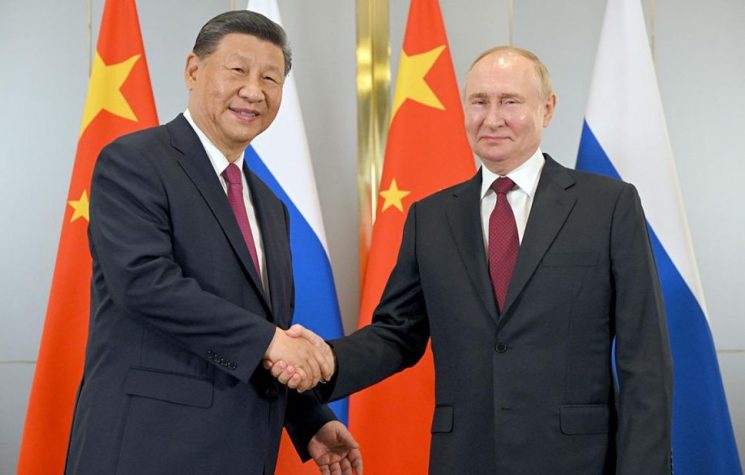

Russia’s economy did not tank, and the alliance between Russia and China has only grown stronger. And despite attempts to isolate their markets, trade opportunities remain ample and in high demand while the United States and Europe who refuse to participate in these markets are pushing themselves further into a corner.

Instead of reassessing its position, the U.S., which clearly did not expect such an outcome, has instead decided to escalate this economic war with China, which will create further hardship for the world markets, in the middle of a very serious semiconductor backlog.

Semiconductors/chips are an essential component for any smart device, including automobiles and smart phones. They are essential in the production of AI, quantum computing, and microelectronics.

Semiconductors are also essential for advanced weapons systems, including hypersonic missiles.

Interestingly, the United States has shot itself in its own kneecap in the middle of a race for military supremacy since the crisis of the semiconductor/chips backlog (triggered by the United States), which has heavily hit the consumer market especially the automobile industry, has also hit the United States’ ability to churn out advanced weapons systems in mass quantity.

In December 2020, SMIC along with other Chinese firms were put on a U.S. blacklist for exports called the Entity List. This was an attempt to prevent SMIC, China’s largest and most sophisticated semiconductor producer, from importing the necessary material and equipment to manufacture 14nm and 20nm semiconductors/chips, which also ended up cutting off the world markets from China, the main supplier of these chips.

TSMC (Taiwan) and Samsung (South Korea) are the present titans in the cutting-edge semiconductor industry (that is 7nm and 5nm chips), however, China’s SMIC was the largest supplier of 20nm+ chips which are essential for the consumer market. When China was taken out of this market it created a bottleneck since TSMC and Samsung, who do not specialise in bulk manufacturing of lower grade chips, were already way above capacity. This created a massive global bottleneck in semiconductor/chip production. [East Asia is manufacturing about 75% of the chips in the world.]

Ironically, the United States would have had an easier time amping up production in their advanced weapons systems if they had left China as the main global supplier of 20nm chips.

Over the past month or so the U.S. State Department has been busy setting up weapon sales with countries such as Japan ($293 million deal, principally with Raytheon Technologies for 150 air-to-air missiles that can be loaded on F-35 fighters), Singapore ($630 million deal for laser-guided bombs and other munitions), Australia ($235 million deal with Lockheed Martin for 80 air-to-surface missiles), South Korea ($130 million for 31 lightweight torpedoes to use with MH-60R helicopters for anti-submarine warfare) and Germany (with a potential sale of over 35 F-35 fighters).

These are orders that presently are unable to be fulfilled by these companies in the short-term due to the semiconductor backlog of 1-2 years or more.

The United States is attempting to increase its onshore manufacturing capabilities so that it can control much more of the supply chain within its domestic market, rather than the present reality, which is that there are several countries dispersed throughout the world who are the specialised leaders of one of the approximately 50 steps, requiring high standard specialisation, in manufacturing cutting edge semiconductors.

The specialising process for all the components required for leading chip manufacturing is so costly (in the hundreds of billions) and precise that it is estimated that it would take at least 4-6 years or more to master each area of specialisation.

“If you want a resilient [self-sufficient] chip supply chain, you not only need chip plants, you also need a whole string of suppliers from critical chemicals and precision components all coming along,” said an executive at Japan’s Daikin, reported by NIKKEI Asia. “Building a semiconductor plant takes several years, but building chemical plants will take even longer given the extensive environmental assessments and regulations for handling chemicals.” (Refer here for a short video on how semiconductors are made).

Presently, no country comes even close to this capability. Later on in this paper I will explain why if any country is to reach resilience, that is self-sufficiency in this market, it will be China not the United States.

Is China too far behind to catch up?

There has been a lot of persistence, perhaps in the belief that if one repeats something out loud enough times it will come true, that China is too far behind to be a contender in the semiconductor race. Since the U.S. ban on China purchasing certain essential materials for chip manufacturing in December 2020, in just the past year, China has experienced a 33% semiconductor growth output.

According to Bloomberg, China’s chip industry is the fastest growing anywhere else in the world, including the world leaders TSMC and Samsung, owning 19 out of the world’s 20 fastest growing chip industry firms over the past four quarters.

SMIC and Hua Hong Semiconductor Ltd., the biggest contract chip makers, have kept their Shanghai-based plants operating at almost full capacity even as the worst Covid-19 outbreak since 2020 paralyzed factories and logistics across China, while other leading semiconductor industries, such as TSMC and Samsung, have been operating at 60% capacity or lower (due to the backlog in essential materials). SMIC recently reported a 67% surge in quarterly sales, outpacing far larger rivals GlobalFoundries Inc. and TSMC.

Despite the United States having already pushed the Netherlands to ban ASML Holding NV from selling China EUV technology (considered essential for manufacturing cutting edge semiconductors), at the time of writing this, it is now attempting to put further pressure on the Netherlands to ban even DUV systems (which predate EUV and are generations behind cutting edge lithography technology) to China in the U.S.’ desperate attempt to remove or at least contain China as a competitor. The U.S. has also attempted to put pressure on Japan’s Nikon (the only other DUV manufacturer at 5% market share) as well.

However, Dutch Prime Minister Mark Rutte said this past June he is against reconsidering trade relations with China and called for the EU to develop its own policies toward Beijing. China is the Netherlands’ third-biggest trade partner after Germany and Belgium. ASML opposes a ban on sales of DUV lithography equipment to Chinese customers because it is already a mature technology.

I suspect this sort of response will become the new normal for the United States if they continue along this line of thinking that everyone, and not just the U.S., should also be ready to shoot themselves in the kneecap or worse, in service of a self-sabotaing idea of U.S. hegemony.

You have to admit, it is a hard story to sell when China is increasingly one of the top trading partners of the majority of countries, while the U.S. seems to only ask that countries be willing to do frequent bloodlettings and be the first to poke their heads up from the trenches in reckless military posturing, all in service to the Anglo-American empire, who has consistently shown that they have not a care in the world for the future state of such countries.

And it gets much worse for American aspirations for global military supremacy…

China’s SMIC has had the capability of manufacturing 7nm chips since 2021, thought to be equivalent to Taiwan’s TSMC’s N7 (7nm chip) in yield optimization. [TSMC is capable of 5nm chip production and is expected to achieve 3nm chip production by the end of this year]. This puts China in the lead of the United States’ Intel, which has yet to achieve manufacturing capability of 7nm chips and hopes to reach capability by the end of 2022 or early 2023.

[Note: Presently, TSMC is banned from selling semiconductors to Huawei that have been made with U.S. technology. Huawei up until that point was the biggest client of TSMC.]

TSMC had already filed lawsuits in U.S. courts against SMIC for products made with TSMC trade secrets in 2003 and 2006, the latter which ended with a settlement. This was a rather controversial manoeuvre on the part of TSMC since the United States is not neutral ground and stands to benefit greatly by crippling what is now China’s no. 1 semiconductor producer. However, TSMC did decide to make a settlement with SMIC rather than attempting to go for the full jugular. Interestingly one of the terms of settlement was the transfer over of about 10% of SMIC’s stocks to TSMC.

There are no signs yet that TSMC is seeking another lawsuit against SMIC, however, even if they were successful, it were likely that China would be prevented from trading with unfriendly countries in 7nm chips but would continue its production and application within China and its trade to friendly countries. The U.S. is increasingly in no position to enforce anything further than this.

With the advent of SMIC’s N+1 and N+2 (7nm chips), China is now 4-6 years behind the leaders (TSMC, Samsung) in cutting edge semiconductor capability. HiSilicon and Huawei together will no doubt accomplish much with N+2 and are capable of massive output.

This is very big news.

Funny how western press seems to be rather silent on this massive breakthrough for China which has propelled it ever close to the front of the race. Instead, we seem to be told, with ever more vigor, that China’s economy is in the midst of a collapse…

China has accomplished what almost everyone thought to be actually impossible. Namely, it was thought an extremely difficult if not impossible task to produce 7nm chips with high yield optimization without EUV technology (to which China has been banned from using after the U.S. pressured the government of the Netherlands). China has also been banned from other thought-to-be key components and yet, have either found a way to bypass the requirement of such things or have successfully specialised in their production on their own.

In January 2022, legendary TSMC R&D Director Dr. Burn Lin mentioned in an interview that SMIC can even fabricate N5 equivalent chips with only multi-patterning no EUV necessary. (TSMC had also become quite good at making cutting edge semiconductors before the EUV technology had come out).

Thus, those simply accusing China of just “copying” TSMC N7 have no comprehension that to actually successfully manufacture TSMC N7 yield optimization level chips is akin to successfully building the Star Trek Enterprise and all its features with 60% of the parts and using technology thought to be about 20 years behind the requirement to build such a thing. You can understand why almost everyone thought this was an impossibility for China.

Instead of accusing China of merely copying, her critics should in fact acknowledge this impressive achievement for what it is. China is increasingly finding itself in the lead of the U.S., despite being the only country banned from full participation in this market.

How the U.S. was the first to use the “Copy EXACTLY! Technology Transfer Method”

Before I go on to discuss where is the U.S. positioned in the semiconductor race, I thought it necessary to review a very important piece of history that everyone, but especially Americans, should know about in relation to their criticism of China.

In the 1980s Japan was the kingpin in cutting edge semiconductors production. This was especially the case relating to a specific type of memory chip DRAM.

Japan’s product was not only superior to that of what the United States was producing but it was also much cheaper, due to Japan’s investment in automation tools and processes. This resulted in much lower defect rates and higher yields.

It was also because Americans were dependent on NMOS for their DRAM technologies, whereas the Japanese had decided to go the more difficult and risky route with CMOS, that is, more expensive and harder to pull off. Rapid advances in lithography technology made the cost of CMOS far lower and became the industry standard.

American chipmakers were now the owners of outdated, expensive technology. And Japan became the kingpin of the semiconductor world.

In 1985 there was a recession in the computer market, with the microcomputer market seeing an 8% decline. This decline had massive reverberations down the supply chain. Prices collapsed by 60%.

Intel, DRAM pioneer, experienced the biggest crash in orders in over ten years, resulting in their exiting of the DRAM industry entirely. Leading U.S. semiconductor industries saw 14-17% decline in revenues. By 1986, the American DRAM industry had dropped from fourteen producers in 1970 to just three.

Complaints from certain quarters in the United States began criticizing Japan for “predatory” and “unfair” trade practices despite the recession in 1985 being a demand problem and not a competition problem. These complaints were primarily:

- That the Japanese were dumping semiconductors into the U.S. market at below fair market value.

- The Japanese were not providing foreign chip makers sufficient access to its domestic market

However, Japan’s semiconductor presence in the U.S. did not harm all American markets, IBM and AT&T greatly benefitted from these lower prices for DRAM.

Discussions began about implementing trade barriers, which would in turn make America an even more expensive place to make things, accelerating the electronic assembly off-shoring trend already underway.

In June 1985, Micron filed an anti-dumping complaint against Japanese exporters of 64K DRAM. Intel, AMD and National Semiconductor soon followed, doing the same for the EPROM market.

The Reagan Administration had filed a complaint of their own over 256K DRAM (64K DRAM was released by Japan in 1982 and 256K DRAM was released by Japan in 1984).

President Reagan, who was supposed to be all about free markets, in the spring of 1986 forced the U.S.-Japan Semiconductor Agreement with METI (Ministry of Economy, Trade and Industry in Japan).

Part of the conditionalities of this agreement were that the American semiconductor share in the Japanese market be increased to a target of 20-30% in five years, that every Japanese firm stop its “dumping” into the American market and the Americans wanted a separate monitoring body to help enforce all of this.

Many Japanese companies felt that their government had caved and had betrayed them. They had hoped for a simple fine. It was thought incredible, and rightly so, that their company trade data now needed to be submitted to a third party in order to be reviewed and judged in accordance to the demands of an American market competitor.

Not only this, but these Japanese companies were being asked to trade with American companies, regardless of whether the American product was the most superior or best priced from its competitors, to meet this U.S. demand for a 20-30% Japanese market share.

No surprise here, the Japanese companies refused to do this and METI had no way of forcing them to do so.

President Reagan responded by imposing a 100% tariff on $300 million worth of Japanese goods in April 1987. Combined with the 1985 Plaza Agreement which revalued the Japanese Yen the U.S.-Japan Semiconductor Agreement gave the U.S. memory market the extra boost it needed.

Of course, that boost was akin to pushing Japan’s head underwater for several minutes while a race was underway, however, rather embarrassingly, Japan would still maintain a lead.

The U.S. was in no position to beat the Japanese in its domination of the semiconductor industry. There was no choice but to…copy Japanese technology, in the name of American supremacy that is.

It appears no country has the right to earn its way to the top other than the U.S. in a world we are told benefits the smartest, most innovative and fastest growing industries. Apparently everyone at the end of the day works for a global boss, who reserves the right to determine your company’s fate and the rules are changed accordingly to what suits this global boss’ needs case by case, the world markets be damned.

Intel would be the first to implement vast copying of Japanese semiconductor technology in order to stay in the competition. Craig Barrett CEO (1998-2005) and Chairman (1968-2009) of Intel was the first to implement “Copy EXACTLY! Technology Transfer Method.” I think the title gives you a good enough idea of what that entails.

Again, if we have learned anything from the generous lessons bestowed on us by the great arbiter, the United States, it is to “Do as I Say, Not as I Do.”

Apparently copying is only an infringement on patents when other countries do it. I guess this is sort of similar to the American lesson that biological research facilities only turn into dangerous bio labs threatening world security when in the possession of the Russians, when in the possession of the Americans it is simply called biological research and entomology (the study of insects).

Yields at American fabs (semiconductor fabrication plant, also know as foundry), improved by 60% in 1986 to 84% in 1991. Over the same time the Japanese had gone from 75% in 1986 to 93% in 1991, decreasing the gap by 6% in the span of five years between the two competitors.

In 1984 the U.S. passed the National Cooperative Research Act, which among other things allowed for the revising of laws to permit partnerships between national research institutes and private companies and that these private companies could attain the exclusive rights of the generated research for five years or even longer.

This initiative was to partially mimic what the Japanese had done in terms of collaboration between companies and R&D, however, whatever came out of such partnerships were owned by the Japanese government. In the case of the United States, publicly funded research was to be the property of private companies who could choose to use whatever they learned from such research for their sole benefit or to even bury it if it was thought to be not “profitable” in accordance with their aims, whatever that might be.

In 1987, fourteen American semiconductor companies along with DARPA joined together to found SEMATECH. SEMATECH became the facilitator of relationships within the American semiconductor industry. DARPA stands for Defense Advanced Research Projects Agency. DARPA is a research and development agency of the United States Department of Defense responsible for the development of emerging technologies for use by the military.

Notice in the above graphic that SEMATECH also has influence over TSMC and Samsung. Source: SEMATECH.

In case the chilling reality of this has not fully sunk in, what the formation of SEMATECH along with the National Cooperative Research Act meant, was that the U.S. Department of Defense was the sole proprietor of R&D research in practically ALL fields of science and engineering. In other words, the U.S. Department of Defense would be the sole conduit at the core deciding where funding goes, which projects should be prioritised and downgraded, and which projects should be killed in their cradle never to be talked about again with threat on your life.

For those who take issue in all advancement of technology because they are fearful that we are heading towards such dystopic visions as Terminator, the Matrix, or Bladerunner, this is not because this is what humans “naturally” do, it is not even fair nor accurate to say that this is what all countries will inevitably do. It is namely what a country will do if the military industrial complex is its sole reason for existing on this Earth. And it will feed this monster at the cost of the welfare and livelihood of its actual people, as we see so clearly occurring specifically within the United States.

And yes, this is specifically striking in the United States, especially since the 2007-2008 financial crisis, to which the U.S. has yet to do anything differently in terms of how it runs its finances, despite countless Americans losing their homes and more while the big banks have been repeatedly bailed out with taxpayer money.

Today, the U.S. continues to spend hundreds of billions of dollars on its military industrial complex and leaves the ever-growing poverty, suicide and drug abuse unaddressed while it loudly blares its woke priorities as to how to speak in such a way that no person could possibly be emotionally offended and in the process render anything you have to say entirely irrelevant.

People should wake up and realise that they are not mad because of this or that label, it is because your future was stolen from you, and it was done by the hand of your very own government.

Your oppression in situated in your lack of opportunity, in your lack of real choice for a better future. In today’s western world you are free to choose whatever avatar you like but you are not free to make any changes to the status quo that is governed by the military industrial complex, which keeps the American people in ever-increasing poverty and destroys entire nations. What sort of freedom is that?

This is the reason why no decent scientist can hope to accomplish great benefits for their society with any research they conduct in the United States. It is all about business at the end of the day, and there is no bigger business than the military business in the United States, except perhaps “biological research” which is drawing a close second, and technically speaking figures into the military business…

Note that in the case of China in the above graph, this is an estimate.

In the case of China what we see is the very opposite to what is occurring in the United States. As the World Bank and BBC attest, surprise surprise, China is doing what they say they are doing in addressing poverty levels, you can read about it on the BBC news site. According to the World Bank, which draws a higher poverty line for upper-middle income countries, to reflect the economic conditions, China is now considered an upper-middle-income country according to the World Bank.

Therefore, China is able to not only compete with the American arms race (in self-defence to the clear war escalation), but it is also able to compete in other areas of more useful endeavours as well as raising its own people out of poverty.

China is not subservient to a military industrial complex and using the lazy logic that if it happened to the U.S. it will happen to China, is to not only disregard what is actually going on in China today but it is also to disregard the cultural orientation of its country and its people.

Now back to our story.

Intel, which would exit out of DRAM in 1985 would turn their focus on logic chips, which they are now a world leader in.

In 1991, the Japanese real estate bubble burst. The real estate bubble had inflated due to the Yen’s appreciation, triggered by the 1985 Plaza Accord.

In 1983 Samsung received a technology transfer from Micron (the company that launched the complaint suit against Japan that started this whole thing off) for 64K DRAM.

To the credit of Samsung, they utilised this technology transfer to maximum use and along with LG and Hyundai were able to produce the 4M DRAM, with their product hitting the market just 6 months after the Japanese.

Micron was one of the few American DRAM producers to have survived the 80s and had made adjustments making production very cheap for their lower-end DRAM chips.

While Samsung was beginning to compete for the lead in cutting edge DRAM technology with the Japanese, Micron in a pincer move flooded the Japanese markets with half-a-generation behind DRAM chips at a cost of $4 when Japan was selling them at $6.

Japan’s semiconductor market was hit from the top by Samsung with their high-end products and at the bottom by Micron with their low-end products, known as the Micron Shock. The Micron Shock set into motion the fall of the Japanese semiconductor manufacturing industry.

128M DRAM prices collapsed by 50% in a single year. Fujitsu exited the DRAM market in 1998. Japanese companies Hitachi and NEC merged their operations together to create Elpida in 1999. They later took over Mitsubishi’s DRAM division in 2002. Elpida was later acquired by none other than….Micron Technology.

Japan’s semiconductor industry is still strong but they are much smaller players in the world market and no longer have a capability of developing cutting edge semiconductors. Companies such as TSMC, Samsung, SMIC, and Intel are much further in the lead. (for more on this story to which I largely drew from refer to Asianometry).

Today, the United States has reopened its arms to Japan in what is promised to be a loving embrace this time around, Japan will open an R&D center for next-generation 2nm chips by year-end under a partnership with the U.S., part of their efforts to establish secure chip supply chains amid tensions around industry leader Taiwan.

Perhaps Japan truly believes it will really be different this time around.

Is the U.S. too far behind to catch up?

Intel was scheduled to have its 7nm chips in production by 2021, instead one year later, Intel has yet to develop the capability of 7nm chip production which they hope to achieve by the end of 2022 or early 2023.

However, despite China having figured this all out in 2021, we are still supposed to believe that China is hopelessly behind the U.S. in the semiconductor race. Back in July 2021, Intel is still making big announcements of their comeback, now moved back to the year 2025…

2025 is something that is almost lightyears away in the semiconductor R&D. Who knows what TSMC, Samsung and SMIC will have achieved by then, there may even be a new form of technology to replace the entire present way of doing things. Perhaps the U.S. is used to making these predictions assuming everyone else will remain stationary? Someone should tell them and their investors that this is no longer 1985.

With this set back in mind that things tend not to run on schedule in the semiconductor business, is it a feasible prospect of the United States to increase its onshore manufacturing capabilities so that it can control much more of the supply chain within its domestic market?

The short answer is no. But don’t take it from me, take it from Morris Chang, an elder statesman of the semiconductor industry who founded and formerly chaired TSMC, who put this smack of reality most bluntly in remarks addressed to the U.S. as reported by NIKKEI Asia:

“If you want to re-establish a complete semiconductor supply chain in the U.S., you will not find it as a possible task,” he said at an industry forum last year. “Even after you spend hundreds of billions of dollars, you will still find the supply chain to be incomplete, and you will find that it will be very high cost, much higher cost than what you currently have.”

Despite these words of advice, amidst what I think can be fairly called an economic recession if not depression, the United States has just recently passed the $52 billion CHIPS Act, with $39 billion planned to be spent domestically, to namely benefit, you guessed it, the military industrial complex.

U.S. Commerce Secretary Gina Raimondo warned in a recent interview with CNBC while the CHIPS Act was being considered by Congress:

“If you allow yourself to think about a scenario where the United States no longer had access to the chips currently being made in Taiwan, it’s a scary scenario…It’s a deep and immediate recession. It’s an inability to protect ourselves by making military equipment. We need to make this in America.”

Notice the only concern she names by name? The military industrial complex. At some point Americans need to ask themselves, what is the point of all of this military equipment if the American people’s livelihood is not economically secure, in violation to the promise of freedom from want as one of the four core American freedoms. How is the American government providing the American people security if they do not even have enough food to eat and have no homes to live in but increasingly ghettofied communities living like an ant colony. Or Elon Musk’s ridiculous house box. They are literally selling boxes for homes as if this is some sort of luxury product.

Why is it ok for Americans to increasingly have no access to the most basic of basic needs while hundreds of billions of dollars are poured into Department of Defense Frankenstein projects?

In case you haven’t noticed, the Cold War has been going on for 76 years now. When has the military industrial complex ever been justified and not in fact based on conscious lies? President Eisenhower departed his office actually acknowledging that he left a monster growing in the basement and had no idea how to get rid of it in his farewell address:

“In the councils of government, we must guard against the acquisition of unwarranted influence, whether sought or unsought, by the military-industrial complex… The potential for the disastrous rise of misplaced power exists, and will persist.”

Honestly, he might as well have gotten into a helicopter and left the country waving like Nixon did while the Americans all stared dumbstruck. But somehow we largely regard that speech as if it were something respectable. Let us call a spade for what it is. And what happened to the next President who was elected to address the matter? His brains were splattered onto the pavement in broad daylight on live television.

Anyway, I digress, back to the matter of American supremacy…

The U.S. is confident that it can once again unleash its jungle roar of supremacy with the help of TSMC. TSMC is scheduled to building fabs (semiconductor fabrication plants) in the U.S. and Japan.

Intel doesn’t expect its new fabs in Ohio to begin production until 2025. Intel is also building two new factories in Arizona expected to go online in 2024. That’s when TSMC and Samsung also plan to open new fabs in Texas and Arizona, respectively. What this means is essentially that they have agreed to share some of their trade secrets with the U.S.

This is likely not being done voluntarily, without some very scary threats.

As NIKKEI Asia reported Taiwan’s government is keenly aware that if TSMC were to move production sites it could weaken the island’s security position, analysts say. For many analysts, those factories and their role in the global economy act as an insurance policy for the island.

“The Taiwanese government will definitely hope TSMC keeps its most cutting-edge factories all in Taiwan,” said Su Tzu-yun, director of the Institute for National Defense Security Research in Taipei. “That could make Taiwan a safer place. No one would want to damage TSMC’s advanced chip production capacities, which are the hearts of many electronic devices…We don’t think the tension and competition between the U.S. and China will end any time soon…As a crucial supplier, TSMC may still face a tough issue later – choosing sides.”

TSMC is thus stuck in a very tight spot right now. What Taipei should also understand is that Taiwan is expendable to the United States, but it is not expendable to China. Rather, Taiwan is actually essential for China’s security. Taiwan needs to realise that words are words but actions are another thing. Independence for Taiwan is not a reality. It is not an economic reality. And it is not a political reality (not to mention cultural reality).

The United States will not stop until Taiwan becomes its own military base (added to the list of South Korea and Japan) and becomes an upholder to U.S. hegemony in the area, which pretty much runs counter to every country’s interest in South-East Asia. Or Taiwan can return to China and receive protection from America’s war mongering. China will do this one way or another, that is, defend their land against a U.S. invasion, but it would be nice if Taiwan had its head together if such a stand-off were to occur.

In case you have not been informed, Taiwan is internationally recognised, including by the United States as part of China. China has enough missiles to defend Taiwan without any issue. For more on China’s military capability refer to ex-Marine Brian Berletic’s New Atlas.

Thus, though Intel has high ambitions to somehow be in the lead in 2025 despite only being thrown scraps from the alley presently, the elephant in the room here is that the U.S. seems to have lost any ability to actually be an innovator in the field. The only thing keeping them in the game right now as a leading cutting edge semiconductor manufacturer is their use of intimidation and threat of force.

The writing is on the wall, as Russia and China gain in economic and military supremacy, South Korea and Taiwan will be free to conduct their business as they choose and not be obligated to constantly give the U.S. favors under uncomfortably tense situations threatening the very sovereignty of these companies let alone countries.

Another rather large factor to the U.S.’ miscalculation in their strive for supremacy is the matter of a little mineral called Fluorite.

Fluoropolymers are a key material for semiconductor production. Fluoropolymers are processed from fluorspar, also known as fluorite, a mineral of which China controls nearly 60% of the global production output, according to data from market research company IndexBox. China has long identified fluorspar as a strategic resource and back in the late 1990s limited exports due to its importance to industries from agriculture, electronics and pharmaceuticals to aviation, space and defense.

In a supply chain review paper published by the White House in 2021, the U.S. flagged the risks of critical materials subject to foreign domination and identified fluorspar as one in a list of “shortfall strategic and critical materials.”

Source: NIKKEI Asia

An independent commission established by Congress recently concluded: “If a potential adversary bests the United States in semiconductors over the long term or suddenly cuts off U.S. access to cutting-edge chips entirely, it could gain the upper hand in every domain of warfare.”

The Centre for Strategic and International Studies (CSIS) reports “China’s leaders have set a goal to build a ‘fully modern’ military by 2027 based on ‘informatization,’ ‘intelligentization,’ and ‘mechanization,’ investing heavily in technical areas which support such an approach, such as AI, quantum computing, hypersonics, and microelectronics.”

As the chair and vice chair of the National Security Commission on Artificial Intelligence (NSCAI) put it in 2021, “We do not want to overstate the precariousness of our position, but given that the vast majority of cutting-edge chips are produced at a single plant separated by just 110 miles of water from our principal strategic competitor, we must re-evaluate the meaning of supply chain resilience and security.”

U.S. dependency on Taiwanese production of chips for defense systems extends beyond AI. TSMC makes semiconductors used in F-35 fighters and a wide range of “military-grade” devices used by the U.S. Department of Defense (DOD).

Interestingly, the CSIS report acknowledges that advances in semiconductor technology are primarily driven by the development of devices for commercial use.

Which is what China is exactly focusing on right now. Recall China was the number one world supplier of semiconductors for commercial use with 75% of all semiconductor production coming out of East Asia.

What China has done in fact is, to quote Pascal Coppens, set up an ecosystem in Shenzhen that will allow for top industrial focus on all levels of the semiconductor production line for commercial use, while SMIC, HUAWEI, and HiSilicon focus on the cutting edge semiconductor technology. As Pascal Coppens makes the point, China’s semiconductor ecosystem is in fact a form of decentralization, while the United States is approaching the semiconductor race from an approach of centralization (around the military industrial complex).

TSMC is bottlenecked due to the reasons already discussed above. TSMC is operating at around 60% capacity and to achieve 80% capacity would be considered an incredible achievement. China has the ability to correct the semiconductor shortage that is bankrupting western companies right now, including the automobile industry. And 90% of the chips needed to make the smart world will have to come from China. Recall, TSMC owns 10% of SMIC stocks, if SMIC is able to meet these demands, TSMC stands to benefit greatly, much above what they are capable of producing as output.

And everyone knows, there is no greater romance than a forbidden romance.