First, Salvini goes into the European Parliament to disrupt proceedings and further undermine Angela Merkel’s powerbase. Second, he and Di Maio take that success back to Rome and use that to engage real EU reform of the financial system.

Italy’s Matteo Salvini is riding high right now. Having weathered a couple of cheap legal moves to derail his assault on the European Parliament this May, Salvini is working to galvanize Euroskepticism across the continent into a viable political force.

He’s got his work cut out for himself.

But, he has at least two major allies. Marine Le Pen of the National Rally in France and Viktor Orban, the leader of Hungary. Salvini and Le Pen met last week to announce they would be campaigning together for the European elections as well as a major summit in Milan soon.

This is only the beginning, however.

I’ve been saying for over a year now that Salvini needs to be the person who lays the foundation for a wholesale revolt against the European Union and Italy’s participation in the euro.

His Lega party have skyrocketed in the polls, reversing the dynamic between it and coalition partner Five Star Movement. It’s a coalition that is of the kind which frightens the political establishment in Europe because it isn’t formed on the traditional left-right false divide.

It is a populist one united on the common cause of overthrowing the corrupt, corporatist system which most western governments are fronts for.

And since coming to power last year there have been multiple attempts to drive wedges between these supposedly strange bedfellows. All of them have failed. And part of the reason for that has been the surging popularity of Lega and Salvini.

Having survived to this point and scared the EU a few times with Trump-like ‘big asks’ on the budget and immigration reform, Salvini and his partner in populism Luigi Di Maio are looking towards the EP elections as a first major test of their government.

And being able to bring together groups from all over Europe to agree on a common platform to challenge the French/German axis of power would put them in a good position in the second half of 2019 to push things farther, especially as it pertains to Italy’s insane fiscal situation.

I realized early on that Salvini was two things. He was both a radical who was also methodical. He’s not flaming out in a blaze of glory here. He’s building his case against the EU slowly, allowing history to come to him.

He’s stayed far away from the Brexit debacle, even though he knows he has the power to stop the betrayal of the vote and force the divorce. But rather than do that it’s better to let the process play itself out and reveal the ugly truth of it all while he takes notes and reloads for the next attack on the EU.

If Euroskeptics outperform the current polling which has them at around 30-32% of the seats and Salvini can rally them under one banner to become the biggest party in the EP, then that would send the right kind of message back home to Italy.

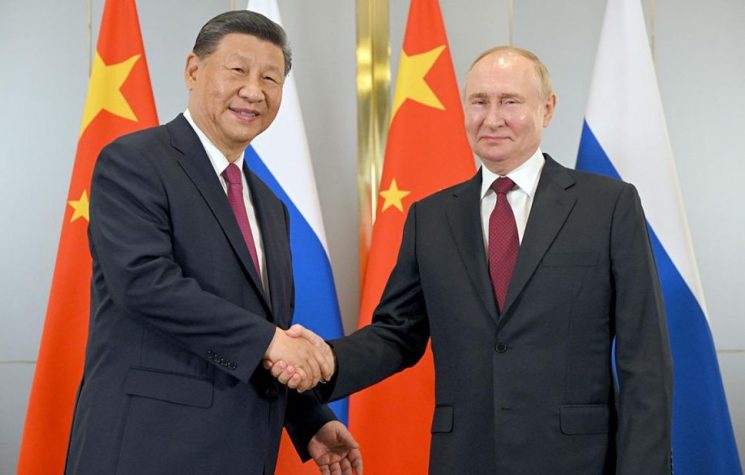

There is something big brewing between Salvini and Di Maio. First, they sign up with China’s Belt and Road Initiative, whose second major summit is later this month. This angered both Trump and Angela Merkel.

All in a day’s work.

But the bigger news, in my mind, is the Italian parliament is pushing to repatriate the nation’s gold reserves from the Bank of Italy. Two laws are under consideration:

One law would instruct the central bank’s owners, most of them private banks, to sell their shares to the Italian Treasury at prices from the 1930s.

The other law would declare the Italian people to be the owners of the Bank of Italy’s reserve of 2451.8 metric tons of gold, worth around $102 billion at current prices.

The Bank of Italy is mostly owed by Italian commercial banks who are now both insolvent and at risk of EU banking rules. This puts them at risk of seeing depositors bailed-in and the banks forcibly restructured overnight by the European Central Bank.

Don’t believe me? Go back and look at what happened to Banco Popular of Spain in 2017. It was sold off to Santander for $1 after the ECB declared it non-viable. It wiped out the shareholders over a weekend and life went on as if nothing had happened.

But it did happen and that did nothing to reassure investors that there is even a hope in hell of getting your investment back out of a European bank if that’s how the ECB can act. In some ways, why do you think it’s going to be so difficult for Deutsche Bank to raise the necessary capital ($6 to $10 billion) to merge with equally-insolvent Commerzbank?

If you had a choice between Deutsche and J.P. Morgan Chase at this point what would you do? US banking system may be corrupt but it isn’t stupid enough to toss aside the one thing that ensures safe-haven foreign capital flows, that investors come first.

I may not like Chase, but I’m putting my money on it over Deutsche any day of the week and especially not on a Sunday evening while Mario Draghi is on the scene.

If those Italian banks are dealt with similarly by the ECB as Banco Popular we could easily see their ownership transferred to their creditors and, by extension, the ownership of the Bank of Italy right along with it.

Talk about undermining national sovereignty!

And what’s the only thing of value on the Bank of Italy’s balance sheet? The gold.

Salvini and Di Maio’s government urging the Bank of Italy to sell the gold back to the government at 1930’s prices is a way to ensure that Italy’s gold reserves stay unencumbered and available to back any new version of the lira if things get to that point.

Like Brexit negotiations the nuclear option, clean divorce, must be a credible threat, i.e. a No-Deal Brexit and unilateral withdrawal from the euro.

This threat by the Italians has been simmering for a while and every time it comes up the talking points from the regime press are the same. It threatens the independence of the central bank. The gold could be sold to pay for populist spending programs. Blah blah blah.

No, the real threat is with the Italian gold owned by the Italian people the Italian government could start all over again with a new currency.

And that is what this is all about.

So, first, Salvini goes into the European Parliament with a solid voting bloc to disrupt proceedings and further undermine Angela Merkel’s powerbase. Second, he and Di Maio take that success back to Rome and use that to engage real EU reform of the financial system.

And if they don’t get what they want, if Merkel holds fast to her policy of Germany strip-mining of Europe via austerity, then they go on the offensive with 2410 tonnes of gold in their back pocket. This will be an easy sell as the European economy implodes further.

It’s not like Germany is in a position to drive a strong bargain with its economy rapidly plunging towards recession.

Any small shock at this point will cause a massive run on European assets. We’ve just seen a enormous move into safe-haven assets in the past month.

The European bond markets are ripe for a sharp reversal on any catalyst.

To pull all off their ‘revolution’ in the EP, however, Salvini and Le Pen will likely have to play nice with Poland on Russia, not pushing for sanctions relief just yet. To unite Euroskeptics over the next seven weeks will be difficult. But, Salvini has shown flexibility to this point with his own coalition.

What makes you think he’s not capable of bringing Poland on side?