Continuing our analysis of U.S. Arctic strategies, we must ask ourselves what they have in store for the near future, over the next 10-15 years.

Join us on Telegram![]() , Twitter

, Twitter![]() , and VK

, and VK![]() .

.

Contact us: info@strategic-culture.su

The exclusive zones option

Continuing our analysis of U.S. Arctic strategies, we must ask ourselves what they have in store for the near future, over the next 10-15 years.

Between 2025 and 2034, the Central Arctic Ocean (CAO) is likely to experience temporary ice melt during the month of September on some occasions. However, access to the area will not yet be stable or predictable from year to year. Such climatic and geophysical variability will make it difficult to develop economic activities that require continuity or regular access. As a result, initiatives that do not depend on constant access will be able to continue, while others will remain marginal or in the experimental phase.

Tourism is one of the sectors most likely to experience moderate growth. It is plausible that the number of cruises in areas belonging to the Exclusive Economic Zones (EEZs) of the Arctic states will increase, thanks to both the sustained pace of shipbuilding and the growing demand for polar tourism experiences. However, tourist navigation in the CAO in the strict sense will remain a rare and elite phenomenon, as it requires ice-reinforced ships and seasonal predictability that is ill-suited to mass tourism models.

Scientific activities, on the other hand, are expected to continue regularly and perhaps intensify. Efforts will focus primarily on mapping the CAO seabed—also in view of the future laying of submarine cables—and studying the fish ecosystem, in anticipation of a possible revision of the CAO Fisheries Agreement (CAOFA). Research may also include environmental impact assessments of potential economic activities, such as deep-sea mining. However, such operations are likely to take place further south, within the EEZs of Arctic states, rather than in the heart of the CAO.

Among the most plausible infrastructure projects during this period is the laying of a transpolar submarine cable, such as the Polar Connect project. This initiative responds to a growing need for redundancy in global telecommunications networks and the technical advantage of reduced data latency over shorter routes. Despite the high costs of construction and maintenance, interest in this type of infrastructure is likely to grow.

The severely limited accessibility of the CAO during this decade will discourage any activity that can be carried out more easily and at lower cost near the coast. This applies to the exploration and exploitation of oil and gas resources, mining operations, and the development of offshore wind farms. Similarly, the transport of goods through the CAO will not be economically viable, given the lack of supporting infrastructure, the high risks for crews, and the lack of market incentives.

Due to the limited commercial presence, there is no expectation of a need for constant surveillance or military presence in the area. Exercises and patrol activities will continue to take place mainly in the EEZs of Arctic states, as demonstrations of defensive capability or as strategic signaling tools.

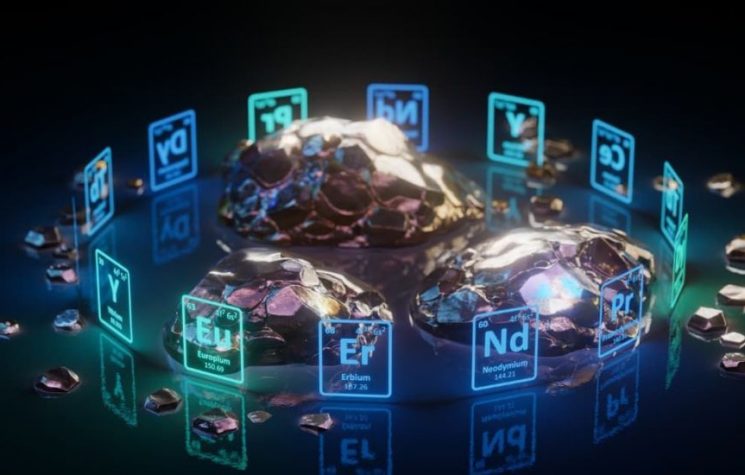

During this period, the International Seabed Authority (ISA) is also expected to issue regulations concerning deep-sea mining in high seas areas. If these rules prove to be particularly restrictive, there will be increased interest from Arctic states that have already submitted claims to the Commission on the Limits of the Continental Shelf (CLCS), as these extensive areas of the seabed, not subject to ISA jurisdiction, would remain potentially exploitable. This could fuel tensions between countries whose claims overlap—particularly Canada, Denmark, and Russia—especially in ocean ridge areas, which are believed to be rich in minerals.

New fishing opportunities

Between 2035 and 2049, accessibility to the Central Arctic Ocean will gradually improve, with ice-free windows potentially extending to less than one month per year. This development will pave the way for a limited expansion of activities that do not require long preparation times or a prolonged presence in the same area. Among these, fishing is the most likely activity to be viable at this stage.

After 2037, the CAO Fisheries Agreement (CAOFA) will be automatically renewed every five years, unless one of the parties objects. The possibility of non-renewal will depend on the urgency of the signatory states to find new fish resources, as well as on the state of scientific knowledge regarding the species present, the size of the stocks, and the sustainability of catches. Any objections to the five-year renewal could come mainly from the Asian signatories and the European Union, which had already supported the idea of a shorter moratorium than the 16 years initially agreed during the negotiation phase. In this case, the states concerned would have to notify their opposition at least six months before the expiry of the period of validity, or in any case during the last meeting of the parties before the end of the ban.

This means that, as early as 2036, the countries involved could begin to prepare strategies for opening up fishing in the CAO, as well as to initiate preliminary discussions on a future regional fisheries management organization (RFMO). However, the actual establishment of such an organization would require several years of negotiations before an operational agreement could be reached.

Some nations already have long-range fishing fleets capable, at least in theory, of operating in the CAO when it is seasonally accessible. These include China, Japan, South Korea, Taiwan, and the countries of the European Union. China, in particular, is the world’s largest consumer of fish products, but has now depleted most of the stocks in its coastal waters. As a result, it has gradually expanded the activities of its deep-sea fishing fleet, now the largest in the world, to all oceans. Although part of China’s fishing is legal and regulated, a significant portion remains illegal or unreported.

The Five-Year Plan for National Fisheries Development published by Beijing in 2022 set new targets for the expansion of the sector by 2025, with the aim of increasing its sustainability through advanced technological tools, such as artificial intelligence applied to aquaculture and total allowable catch calculation systems. The enormous scale of China’s fishing industry and the steady growth in domestic consumption make it likely that the country will be interested in future access to Arctic fishery resources, should these become economically exploitable and logistically accessible.

Despite this, at this early stage, scientific knowledge of the CAO ecosystems will remain extremely limited. Access to ice-free areas will only be possible for short periods of time—no more than a few weeks—which will limit fishing opportunities to countries with not only deep-sea fleets but also ice-reinforced vessels. It is therefore more realistic to expect episodes of ‘incursion fishing’: opportunistic expeditions that venture into the CAO only when navigation conditions allow and where temporarily marketable stocks can be identified. Even such limited activities would require the discovery of species of high commercial value or, alternatively, large quantities of species of lesser value that would make the expedition economically justifiable.

However, given the current lack of ecological knowledge, it is possible that the CAO does not host stocks of economic interest, either for biological reasons (presence of inedible or unpalatable species) or because of the modest size of fish populations. In the absence of scientific evidence of economic and environmental sustainability, the fishing moratorium would probably be extended for another five years.

A further element of uncertainty stems from the possible use of the Treaty on Biodiversity in Areas Beyond National Jurisdiction (BBNJ), signed in 2023, as a legal basis for requiring the total closure of the CAO to all economic activity. This treaty allows for the designation of high seas areas as marine protected areas. Any application of the BBNJ to the CAO would result in a ban not only on fishing, but also on energy extraction, mining, shipping, and tourism. However, this scenario seems unlikely, as neither Russia nor the United States are signatories to the BBNJ, while the non-Arctic countries that have signed the CAOFA are unlikely to accept a permanent closure after having secured a negotiating role with a view to future commercial opening. Furthermore, the closure of the CAO would lead to an increase in traffic along the Northern Sea Route (NSR), which would have geopolitical implications that not all states would consider advantageous, especially in relation to Russia.

During the same period, there could be some experimental freight crossings along the Transpolar Sea Route (TSR) during the months of September. However, the vast majority of commercial traffic will continue to prefer traditional routes through Suez and Panama, while Arctic transport will remain concentrated along the NSR, mainly for the transport of Russian gas and minerals to Asian markets. Any shipments of minerals or hydrocarbons will follow established routes, such as those connecting the Canadian Mary River mineral deposits to international ports.

By this stage, ships will also have to comply with the ban on the use of heavy fuel oil (HFO) adopted by the International Maritime Organization (IMO) in 2021, which will come into full effect by 2029. This fuel, widely used in containerized transport, is highly polluting and contributes to ice melt through the emission of black carbon. The IMO has also set targets for climate neutrality in maritime transport by 2050 and for the adoption of low- or zero-emission fuels by 2030, thus imposing a structural transition in the shipping sector and port infrastructure, including those that may arise at TSR terminals.

In the meantime, exploration and prospecting activities in the CAO are expected to continue or intensify in view of future mining projects, provided that ISA regulations do not prohibit their execution. Increased international competition for critical minerals could accelerate these efforts, prompting state and private actors to invest in identifying and mapping Arctic resources.

Finally, during this period, several states—including the United States, Russia, China, Finland, and Sweden—will have new icebreakers at their disposal, thereby enhancing their presence and intervention capabilities in the Arctic. The United States will have three Polar Security Cutters in service, while Canada will add new Arctic patrol vessels. Denmark and Norway, in turn, will continue their plans to acquire frigates and patrol boats reinforced for polar conditions. This strengthening of the fleets will allow for a more constant and visible presence in the CAO. At the same time, even a modest increase in fishing or merchant traffic will lead to a strengthening of maritime surveillance and control activities, including inspections and checks on compliance with international agreements.