Contact us: info@strategic-culture.su

Let’s start with the tale of an Empire bragging to the wind.

Mr. Disco Inferno orders OPEC and OPEC+ to lower the price of oil, because, in his mind, that may solve the war in Ukraine – as in forcing Moscow to the table because of dwindling energy revenues. That in itself summarizes the level of garbage being fed to POTUS by his cornucopia of acronyms passing for intel.

Trump at Davos: “I’m going to ask Saudi Arabia and OPEC to bring down the cost of oil (…) If the price came down, the Russia-Ukraine war would end immediately. Right now, the price is high enough that that war will continue (…) With oil prices going down, I’ll demand that interest rates drop immediately. And, likewise, they should be dropping all over the world. Interest rates should follow us.”

Quite predictably, OPEC+ – basically run by Saudi Arabia and Russia – said Nyet. Apart from the fact they don’t care much about interest rates, on the energy front they’ll keep doing what they have planned to do, including soon decreasing production, but at acceptable levels.

Standard Chartered, a major player, noted that OPEC has limited power to end the war immediately by reducing the oil price, with OPEC ministers considering this attempt at “strategy” as very inefficient and costly.

So much for imperial diktats.

The Chihuahua Strategic Victory Plan

As highlighted before, the U.S. – via fracking – has enough gas for domestic consumption, but not enough to export en masse to the EU, because of liquification problems. That explains why even buying more American energy for exorbitant prices, the EU de facto remains largely dependent on Russian LNG – and non-U.S. sources – since the sabotage of the Nord Streams, unveiled in detail by Sy Hersh.

Even at full capacity, the Empire of Chaos simply cannot deliver all the gas the EU needs; add to it virtually no investment in both badly needed extra exploration plus the infrastructure necessary to meet increased EU demand.

On the domestic U.S. oil market, things do get positively Kafkaesque. U.S. trucking – a massive service industry – is dependent on imported Russian diesel, which needs to be mixed with Made in America oil in order to be suitable for trucks.

Now cut again to Davos, which came and went barely registering a blip. Toxic EC Medusa von der Leyen told Davos that Europe had “substantially reduced”, and “in record time”, its dependency on Russian fossil fuels.

Nonsense. Europe’s energy reality is bleak. Russian LNG from Novatek is currently priced at around $4.5–$4.7 per MMBtu. That’s more expensive than pipeline gas but still much (italics mine) cheaper than American LNG.

Every industry pro from the Persian Gulf to Antwerp knows that Europe is now importing Russian LNG like it never did before. That’s it – or a dry death. In parallel, Russia will triple its LNG supply capacity by 2035. End result: whatever those “energy commissioners” in Brussels may come up with, Russia will remain essential when it comes to European energy security.

There are no limits – even stratospheric – for Eurocracy stupidity, which corrodes the system like a plague. The Europeans not only have managed to shut off their own gas pipelines but are still “investigating” the Nord Stream de facto terror attack.

End result: they are now importing more (italics mine) Russian gas, but by different means, from third-party suppliers, and paying a fortune.

This is what can be described as the Chihuahua Strategic Victory Plan.

U.S. Treasury sanctions Mr. Disco Inferno

Russia’s LNG exports hit a record high last year, growing by 4% – and delivering 33.6 million tons. The monthly record was 3.25 million tons in December 2024 – 13.7% more than November.

The largest Russian exporter is Yamal LNG: 21.1 million tons, 6% more than in 2023.

Now cut to proverbial American rumble, in the form of Assistant Secretary of State for Energy Resources Geoffrey Pyatt ordering the “full termination” of Russian gas exported to Europe.

To hell with what nations like Hungary, Austria and Slovakia may think – and do need.

Pyatt told the Atlantic Council, “Today we are the largest LNG exporter in the world, and by the end of the Trump administration, we will have doubled what we’re doing today […] The decision has clearly been made in Brussels to get to zero [gas supplies from Russia] by 2027…and the United States strongly supports that goal.”

Oh dear. Do these people even read the basic headlines? As reported by Politico, the EU is “devouring” Russian gas at unprecedented levels since the start of 2025, importing 837,300 metric tons of LNG just in the first two weeks of the year.

The Ukraine transit deal was shut off for good – at least for now – starting on January 1st. The action now is on the maritime routes.

Enter the U.S. Treasury with a new – what else – sanctions package against Russian oil trade, targeting up to 5.8 million barrels a day shipped by sea.

As it stands, the global oil market is experiencing a surplus of about 0.8 million barrels a day. Oil prices for 2025 should remain at around $71 for a barrel of Brent crude (as it stands, it’s $76.2). Not exactly what Mr. Disco Inferno wants.

So let’s assume these 5.8 million barrels of Russian oil – under stiff sanctions – would vanish from the global market. In this case we would have oil prices skyrocketing to an average of $150 to $160 a barrel. Once again, not what Mr. Disco Inferno wants: he vociferously promised – and keeps promising – a MAGA oil superpower, while lowering oil prices to max $50 a barrel.

According to Russia’s 2025 budget, oil is priced at $65.9 a barrel.

If the U.S. Treasury manages to work its magic and “disappear” with those 5.8 million barrels, Russian revenues would go up to around $88.2 billion, even considering much lower exports.

High oil prices hurt American competitiveness. So somebody should tell Mr. Disco Inferno this U.S. Treasury gambit is actually more negative to Trumpian dreams than to Russia.

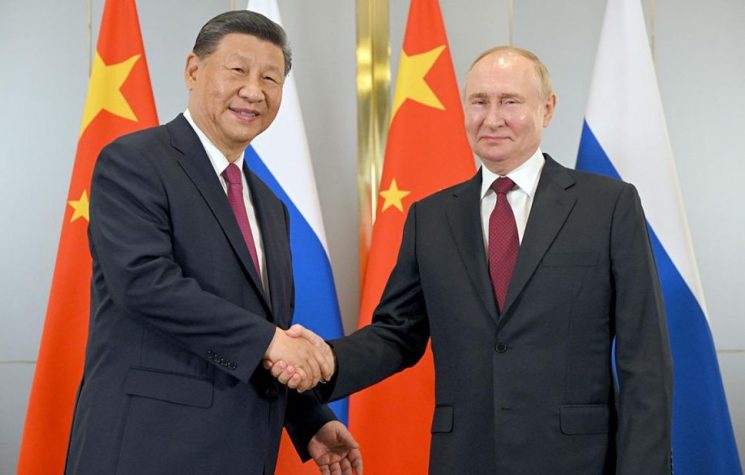

Across Eurasia, Russia is sitting pretty, especially with its BRICS partners. Power of Siberia to China is on a roll, and Power of Siberia II should start operating by 2030. A boost on LNG exports to Iran is a done deal – especially after the signing of the strategic partnership earlier this month.

This year a deal will also be signed in Russia to transport LNG to Afghanistan via tanker convoys. Next step will be Pipelineistan: perhaps, finally, the necessary steps to build a variant of TAPI (the Turkmenistan-Afghanistan-Pakistan-India) pipeline, but with gas coming from Russia.

The biggest customer for Russian LNG, apart from China, is of course BRICS partner India. It’s in the interests of Russia, Iran, Afghanistan and India to have a stabilized Pakistan – not an Islamabad remote-controlled by Washington, as in the current setup – for the final opening of Russian LNG routes to India. That will happen, in time.

As for the European chihuahuas, enjoy your “strategic defeat” fantasies. Keep yapping – and buying Russian LNG.