David STOCKMAN

You can call it the bleep-hole moment (per the Fox "family channel") or the shit-hole moment (per the rest of the MSM), but what you can't call yesterday's contretemps in the White House is evidence that sentient adults are in charge of the Imperial City.

And, no, we are not getting down on the Donald for using a swear word—nor are we trying to out race-card Don Lemon as to the obvious implications of the President's crude phraseology.

Indeed, even prior to yesterday's outburst it was hard to deny that Trump is a semi-literate bully and that he never got (read) the memo on racial comity and respect. But we actually happen to think that the Donald's potty-talk eruption resulted not from some dark place in his mind and heart, but from sheer frustration as the intractability of the immigration issue closes in on him.

What we mean is that neither party has its cards face up on the matter—-which goes way beyond the potential deportation of the 800,000 dreamers, chain migration, the diversity lottery and the Wall. Underneath it all there is a brutal, raging political struggle for dominance which is almost existential in import.

To wit, the sundry Dem caucuses want more immigrants, and the browner the better, because it's their only route to electoral dominance. By contrast, the hard core GOP immigrant-thumpers are desperately attempting to hang-on to Red State rule in the face of the forbidding demographic math of the white population—and the fact that not many Norwegians want to come to America anyway.

It would not be too far-fetched to say that the partisan battle for office is morphing into a racial-ethnic war.

Fox host Laura Ingraham is both exceedingly articulate and thoughtful on many issues, but on immigration she is a screecher. So her diatribe with respect to Thursday's doings goes right to the heart of the matter:

“Number two, Democrats favor granting citizenship to illegal aliens because they believe it is the absolute key to achieving a super-majority, just like the one they currently have in California. They want that in every key battleground state. So, there’s so much more at stake than just the future of the DREAMers. This deal could decide the fate of the country.

We happen to agree with her, but for a vastly different reason. To wit, the immigration issue threatens to destroy the Republican party—either because it terminally rips it apart or because the nativist immigrant-thumpers completely prevail and thereby marginalize the GOP electorally.

Yes, there is nothing in the constitution or American history that requires a politically healthy GOP or even a Republican party at all. Unfortunately, however, there is nothing in the constitution which requires fiscal rectitude, either. Yet that's exactly where Laura Ingraham's "fate of the country" comes in.

Washington is drifting rapidly into a hellacious fiscal calamity and the only thin reed of resistance is the once and former party of fiscal rectitude. If it does not get its act together and screw-up some courage and focus on the matter soon, the nation's budgetary doomsday machine will become unstoppable—-with the national debt soaring to $40 trillion and 140% of GDP within the next decade.

Moreover, this isn't just a risk; it's a near certainty based on the built-in budgetary math and the sheer auto-pilot nature of its driving forces. For instance, the income entitlements including social security, disability, SSI, food stamps, family assistance, the earned income credit, government pensions and veterans benefits cost $1.5 trillion in the year just ended, but in the absence of Congressional action will automatically soar to $2.4 trillion by 2027.

The tab for the giant open-ended medical entitlements—Medicare, Medicaid, CHIP and ObamaCare—is racing upwards even more rapidly: at nearly 7% per year. Consequently, last year's spending of$1.2 trillion on these programs will become $2.2 trillion by the end of the current 10-year budget window.

These big numbers are bad enough in the telling, but their place in the structure of the Federal budget is what screams out calamity ahead. To wit, last year outlays for the combined income and medical entitlements amounted to just under 14% of GDP, but if Congress were to go AWOL for the next tens years, they would automatically absorb 18% of GDP by 2027.

And that's where the rubber would meet the road. Owing to the Christmas Eve tax cut special, the revenue base will drop by $280 billion in the year just ahead (FY 2019), bringing Uncle Sam's take down to just $3.4 trillion or 16.5% of GDP—-the lowest level since the eve of the Korean War.

In other words, what is now in place owing to the folly of the GOP tax cut and 30 years of bipartisan fiscal can-kicking, is a revenue base that is not even large enough to pay for the big entitlements.

And, of course, that omits entirely the roughly $2.7 trillion that current GOP policy would require by 2027 for national security, roads, education, agriculture, space, small business, medical research, rivers and harbors, courts and prisons, the Census Bureau, the Washington monument etc.—and what will be nearly $1.0 trillion per year of interest on the national debt by then.

To be sure, they have this sheer absurdity—-$2.7 trillion of non-entitlement expense and zero revenue to pay for it—papered over with a motely array of budgetary gimmicks. These cause projected revenue to rise back to just over 18% of GDP by 2027, but this is overwhelmingly fake revenue. Even then, it's still is not enough to pay for the vast reaches of government outside of the entitlements summarized above.

For instance, the individual tax cuts, which will allegedly go to 90% of taxpayers and which are being ballyhooed by the White House as showing up in revised withholding tables by February, will cost $189 billion in the first full year (FY 2019).

But thanks to the disappearing ink in which they were written (i.e. the 2025 "sunset") that number swings to a $32 billion tax increase by 2027. Of course, that's never going to happen: The GOP tax-writers have already baldly confessed that the sunset is just a gimmick to avoid the fiscal discipline required by the budget rules. The only thing they haven't confessed is on the eve of which up-coming election will they vote to cancel the sunset, thereby saving 140 million individual tax filers from what would otherwise be upwards of a quarter-trillion per year tax increase.

And the same goes for the $50 billion per year or so of so-called "tax extenders". This refers to expiring tax breaks for wind, solar and biofuels–along with affordable housing, community development, Hollywood expensing rules, NASCAR motor sports, rum producers, tuna canneries, short-line railroads and countless more.

The game here has been going on for decades: These measures get continuously reenacted just a few years at a time to make the outyear revenue baseline look healthier. But on the eve of expiration they are invariably given another short-term reprieve. That is, Lucy jerks away the revenue football, leaving Uncle Sam to borrow the difference.

Below we provide new data on the fast collapsing fiscal outlook, but suffice here to say that CBO's latest 10-year baseline deficit of $10.2 trillion has already been hiked to just under $12 trillionowing to the tax cut. And when you add in the impact of blowing the sequester caps for defense and non-defense by $120 billion per year (as is now clearly intended by both parties) on a permanent basis and also remove the phony sunsets, fake out-year spending cuts and tax extenders from the projections, the projected red ink soars to a cummulative $15 trillion over the decade ahead.

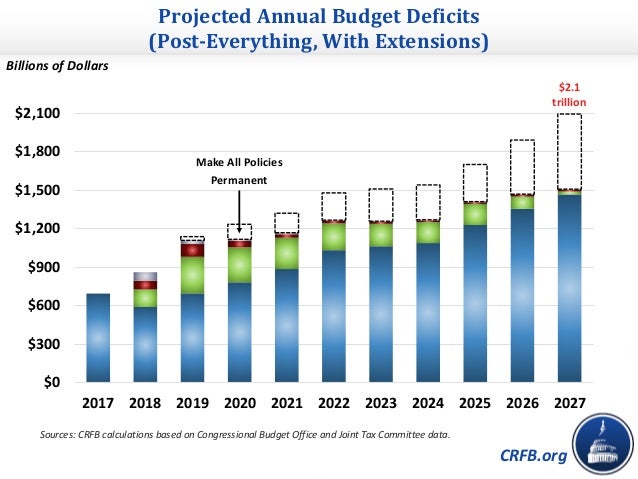

The chart below was developed by the Committee for a Responsible Budget, of which your editor is a charter member, and if anything it errs on the conservative side. The blue section of the deficit bars is the current CBO baseline, the green area adds the impact of the GOP tax cut, and the dotted boxes reflect spending increases already made or promised (defense, disaster aid, border control, veterans, ObamaCare bailout subsidies) and the various budget gimmick which are used to hide the out-year deficits.

The above projection of $15 trillion of cumulative red ink is the very opposite of the Wall Street earnings hockey sticks. The latter are based on a series of economic and financial miracles which never happen. By contrast, the above is an absolute baked-in-the cake price-out of what can't be stopped—-without an aggressive and determined return by the GOP to its roots in the old-time fiscal religion.

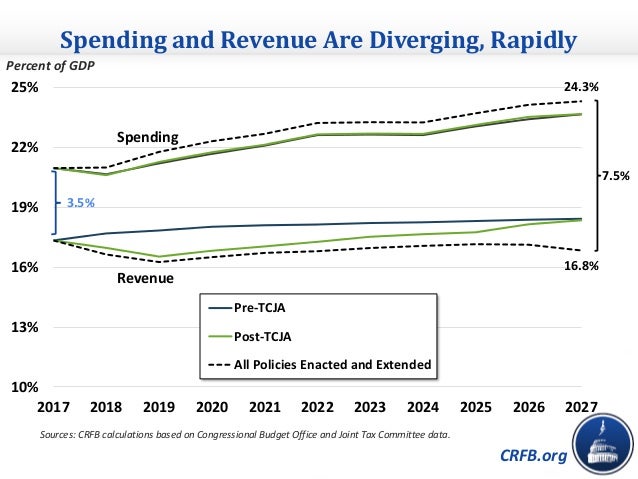

Even absent the fracturing impact and complete distraction of the current right-wing anti-immigration crusade, the task of fiscal stabilization would be herculean, as dramatized by the graph below.

When you factor in the Donald's massive defense spending increase, the rest of the GOP/bipartisan spending agenda (but not including the promised big infrastructure initiative) and the guaranteed explosion of interest outlays, Federal spending will hit 24.3% of GDP by 2027.

The debt service element needs to be thoroughly understood because without a radical swing toward fiscal austerity, interest expense is virtually guaranteed to rise from $269 billion in the year just completed (FY 2017) to $1 trillion by 2027. That's mainly because the FY 2017 number was a phony artifact of decades of Fed financial repression and the massive expansion of the Fed's balance sheet under QE.

As a result, the weighted average cost of interest on the Federal debt was well under 2.0% and the Fed paid $80 billion to the US Treasury as an off-setting "profit" on its money printing scheme. That is, its $4.4 trillion of liabilities cost virtually nothing because they were plucked out of thin air by the Fed's printing press and were then used to purchase a like amount of income earning UST debt and GSE securities.

But here's the thing. By virtue of its pivot to QT the Fed will be selling upwards of $2 trillion of its earning asset trove over the next several years—-even as interest rates and bond yields steadily rise. In the puzzle palace of government and central bank book-keeping, however, the implicit mark-to-market losses on the Fed's shrinking pile of assets will be charged to expense, meaning that its profits will virtually disappear and its payment to the treasury will head toward zero.

That's especially the case because at the same time, its primary tool to raise the federal funds rate is known as IOER and involves paying interest to banks on excess reserves. That doubled last year to$30 billion and will continue to rise steadily, thereby further eroding the Fed's so-called "profit".

Yet at the same time the Fed's phony profit sharing payment is disappearing, the blended rate on Uncle Sam's rapidly expanding debt balances will also soar. The CBO, for instance assumes the 1.5%average rate during FY 2017 will reach 3.2% by 2027 in very slow increments. But that surely understates both the speed and level of the coming increase—–once the world's $100 trillion bond bubble collapses in the face of global QT.

So the truth of the matter is that interest expense on Washington's exploding debt—-as shown above where annual deficits hit $1.1 trillion in the year ahead and $2.1 trillion by 2027—could end up far more than $1 trillion annually and also raise the total spending take to 25% of GDP or more.

And that's what makes the GOP's asinine tax bill—–a temporary break for the folks and a permanent 21% corporate rate which will generate trillions of stock buybacks, dividends and other financial engineering maneuvers that benefit primarily the top 1% and 10%——such a fiscal horror show. When you strip out the gimmicks, the policy amounts to a permanent revenue take of just 16.8% of GDP.

In a word, these clowns have just completed the drawing-and-quartering of the nation's fiscal accounts.

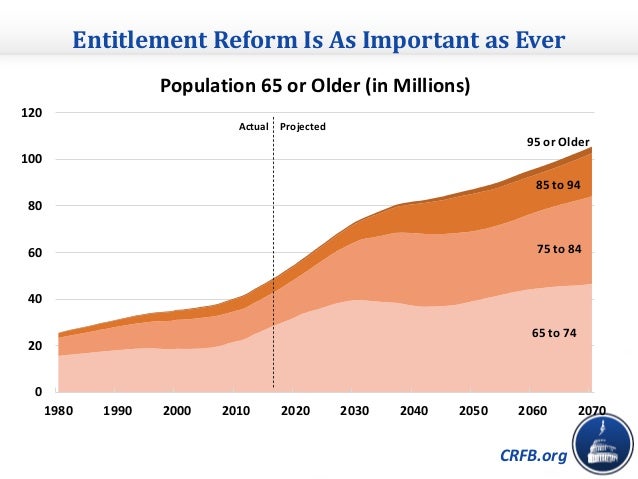

In fact, the stunning irresponsibility of it couldn't be more apparent when you recall that the 18% of GDP cost of the entitlements outlined above is overwhelmingly driven by old people—-including a substantial share of Medicaid costs which go to poor retirees and nursing home beneficiaries. Yet the baby-boom retirement bow wave is just getting started.

As shown below, there are presently about 50 million people 65 and over, but after 2030 that number will go parabolic reaching 105 million eventually. So if the plan is to end the 2020s with $2 trillion plus annual deficits as shown above, it doesn't take much imagination to see where the fiscal accounts will go when the shaded area in the graph below vectors sharply to the upper right after 2030.

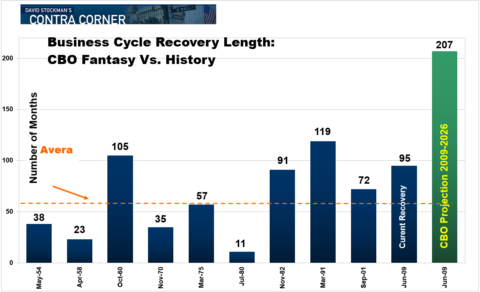

But even that's not all. The deficit chart above adopts the current CBO economic forecast which assumes recessions have been abolished from the face of the earth and that the already faltering US recovery at 103 months will just keep on trucking to a ripe old age of 207 months in 2027.

The risible fantasy of that assumption is evident in the chart below. In the face of soaring public debts, $67 trillion of total public and private debt and an epochal pivot to QT by the Fed and other central banks, there is not a snowballs chance in the hot place of the green bar (below) ever materializing.

As it is, the CBO forecast embedded in the graph assumes average annual nominal GDP growth—–and that's what drives revenues and the deficit, not "real" GDP—that is 33% higher than during the last ten years (2006-2016). Accordingly, the cumulative nominal GDP underlying the post-tax bill revenue and deficit projection above is $237 trillion.

A big number, that. But also a vulnerable one. Just factor in an average recession somewhere along the line during the 10-year window and a resulting nominal GDP growth rate equal to the actual rate for the last decade (which benefited from massive Fed QE versus the pending era of QT).

In the world of big numbers that results in about $14 trillion less GDP over the period and about $2.5 trillion less revenue (at the 18% take rate). Throw in additional debt service and interim recession spending for unemployment insurance and other safety nets and you get $20 trillion of cumulative deficits over the period.

Needless to say, that would bring the national debt to $40 trillion and 140% of GDP just in the nick of time. That is, just before the peak baby-boom retirement wave of the 2030s lays total waste to the nation's fiscal accounts.

At the end of the day, there is only one way out of the impending fiscal catastrophe. Namely, a revival of the old-time fiscal religion within the GOP, and a Paul-on-the-road-to-Damascus conversion among Republicans on the matter of immigration.

That is to say, America does not need Walls; it actually needs tens of millions of younger and working age immigrants who can function as tax mules to carry the burden of 105 million baby-boomer and retirees.

There is virtually no other way out of the giant fiscal trap that is now closing in on the Imperial City—even as going that route is also the only way to save America's constitutional democracy.

What the GOP immigrant bashers fail to recall is that America was not based on a tribe, a folk, a people or a nation. It was a melting pot of diverse peoples who came here seeking the freedom to go their own way as guaranteed by the constitution and to pursue the opportunity to prosper as offered by free market capitalism. And it worked without any borders at all.

The truth of the matter is that in the present day and age people come here "illegally" (since we now have legal quotas that didn't exist prior to 1925) to either: (1) sell or distribute illegal drugs; or (2) find jobs and a better standard of living for their families.

On Monday we will eviscerate the immigrants-bashing claims of the GOP right-wing and the Donald and show this proposition to be true: Namely, if you want to get rid of item #1—then end the War on Drugs and turn-over the drug distribution business to Phillip Morris, the teamsters union truck drivers and the rest of the law-abiding machinery we use to distribute everything else.

At the same time, recognize that item #2 is an economic positive and an unavoidable necessity.

Indeed, its the only way to prevent America from becoming the fiscal bleep(shit)-hole described above.